Buffett’s bet: can a tracker trounce the hedgies?

There’s no sense in handing 1%-2% plus fees to fund managers when a cheap tracker gets results, says Stephen Connolly.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

There's no sense in handing 1%-2% plus fees to fund managers when a cheap tracker gets results, says Stephen Connolly.

Nearly a decade ago, Warren Buffett, one of the world's most successful investors, made a $500,000 bet with a hedge-fund manager a bet that now looks certain to pay off. Buffett wagered that, over ten years, a cheap, no-frills S&P 500 index tracker (ie, one that aims to match the performance of the main US equity index see page ten) would beat the average performance of five funds of hedge funds (so in effect, 100 or so underlying funds) picked by asset manager Protg Partners. With less than a year to go, the market has trounced the fund managers a valuable reminder that, over the long run, most professional money managers charge healthy fees for rotten results.

At first glance, the bet doesn't seem to make sense. Hedge funds boast of their ability to beat the market. Managers are marketed as investment geniuses, masterfully exploiting markets for clients. If they cannot beat a simple index tracker, then how on earth do they manage to attract huge sums of money and earn such high fees from sophisticated, well-advised investors such as the super-wealthy and large investment funds?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Perhaps investors really do believe that higher fees equate to better results. Perhaps there is an attraction to playing alongside fellow sophisticated investors in funds that are not accessible to all. Perhaps sophisticated investors do look down their noses at no-frills trackers that are available to anyone. But whatever the reason, it must be rooted in investors' psychology, because judging by the bottom line, real-money-in-your-pocket results, it's the cheap, no-frills investors who typically have the last laugh.

A sure thing

Buffett and Protg's ten-year bet has just one year to go, as Buffett pointed out in the investment letter that accompanies the latest results from his investment vehicle Berkshire Hathaway. So far the index fund he chose a Vanguard S&P 500 tracker has delivered an annualised return of 7.1% a year, while the hedge funds chipped in just 2.2% (all figures are after fees). That 7.1% market return is nothing special it sits pretty much plum in the middle of the 6%-8% a year range, typical of developed-market equities over the long run. This makes the relatively weak performance of the hedge-fund managers even less impressive.

Even the best performer of the five funds of hedge funds failed to beat the market, returning 62.8% in total over the period, compared with 85.4% for the index fund. What's more, they're paid well for this failure. According to Buffett, the managers are charging upwards of 3% a year and that's before adding "performance" fees on top. The tracker, meanwhile, charges an all-in fee of just 0.05%. In other words, even if the hedge funds were keeping up, they would need to generate 2.95% a year more than the market, just to get the same result as the tracker fund, after fees. Achieving that on a consistent long-term basis is extremely difficult for any active manager not just for hedge funds.

For example, last year index provider S&P Dow Jones Indices found that almost every active equity fund in Europe investing in global, US and emerging markets underperformed its benchmark over ten years. Funds sold in the UK turned in mixed performances over shorter periods, but again all UK fund categories lagged over ten years. In short, most managers can't beat the market in the long run. They might have a good year or even a few, but eventually most melt. In turn, that means the average investor using actively managed funds for long- or even medium-term investing is likely to underperform and pay handsomely for it.

Many of these funds are also used by private banks and wealth managers or family offices in their client discretionary portfolios. Given the poor performance of most such funds, why don't the wealth managers just use trackers, cutting their clients' costs? One reason is that discretionary managers are conflicted they fear that clients will object to paying big fees simply to have their manager add to a tracker each year. They are more comfortable selling the idea that they can find the best active managers for clients. Yet in reality, most private banks and wealth managers are just adding another performance-limiting layer of costs, on top of the fees charged by the underlying active funds. Even those discretionary managers who do use trackers are often ludicrously overpriced.

An expensive ticket to Wimbledon

It's not for nothing that bankers call discretionary management their "annuity business" charm and schmooze to keep clients sweet and the money keeps rolling in. And if investors are happy to pay high long-term costs in return for a chaperoned trip to Wimbledon, the Chelsea flower show or a dreary investment conference once a year, that's fine. But while those high fees might pay for the odd day out, they're unlikely to deliver market-beating returns.

You'd be far better off paying just 0.2%-0.3% a year to invest in a tracker fund. Even a saving of 1.5% a year soon adds up. Say you have 25 years to go until you retire: on a £1m portfolio, assuming growth of 7% a year, that's just under £950,000 saved on what would end up being £5m-plus of investments. If that cash was sitting on the table, you wouldn't let someone take it away bit by bit, for no return every year. Of course, there are some rare active managers with enviable long-term records. But as a private investor, you can easily add these to a core portfolio built around trackers, and still keep your costs down and your ultimate wealth up.

Investing alongside Buffett himself by buying Berkshire Hathaway would cost less than a standard private-bank discretionary offering. So too would investing with Lord Rothschild (via the RIT Capital Partners investment trust); the Cayzer family's investment team (Caledonia Investments); Terry Smith (Fundsmith); Neil Woodford (Patient Capital Trust and others); and Nick Train (Lindsell Train or Finsbury Growth & Income). All of these strong long-term performers charge 1% a year or even less.

With that calibre of expertise readily available to bolt on to a core portfolio of cheap trackers, why would anyone pay a nobody in a private bank or wealth manager's "investment management team" upwards of 1%-2% a year of their wealth (on top of the fees paid for the underlying funds) for lacklustre long-term performance? Buffett one of the greatest stockmarket investors of our times, with an exceptionally consistent track record over 50 years certainly doesn't think you should. By putting his money where his mouth is and betting on a cheap tracker versus expensive hedge funds, Buffett has once again tried to hammer home his point. If you don't already do so, you should take his advice.

Stephen Connolly is managing director of consultancy Plain Money. He has worked in banking and asset management for over 25 years.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Canada will be a winner in this new era of deglobalisation and populism

Canada will be a winner in this new era of deglobalisation and populismGreg Eckel, portfolio manager at Canadian General Investments, selects three Canadian stocks

-

The Stella Show is still on the road – can Stella Li keep it that way?

The Stella Show is still on the road – can Stella Li keep it that way?Stella Li is the globe-trotting ambassador for Chinese electric-car company BYD, which has grown into a world leader. Can she keep the motor running?

-

US inflation brings no respite for markets

US inflation brings no respite for marketsNews As US inflation hit a 40-year high, the benchmark S&P 500 stockmarket index slid into a bear market, down more than 20% since its 3 January high.

-

Central banks change their tune on inflation

Central banks change their tune on inflationNews With prices rising at 7.9% in the US and 6.2% in the UK, and global commodity prices surging, central banks around the world are being forced into inflation-fighting mode.

-

Interest rates might rise faster than expected – what does that mean for your money?

Interest rates might rise faster than expected – what does that mean for your money?Analysis The idea that the US Federal Reserve could raise interest rates much earlier than anticipated has upset the markets. John Stepek explains why, and what it means for you.

-

How to pay for the pandemic

How to pay for the pandemicOpinion Covid-19 has proved extremely expensive. It’s time to consider fresh sources of government revenue, says Edward Chancellor

-

Quiz of the week 21-27 November

Quiz of the week 21-27 NovemberFeatures Test your recollection of the events of the last seven days with MoneyWeek's quiz of the week.

-

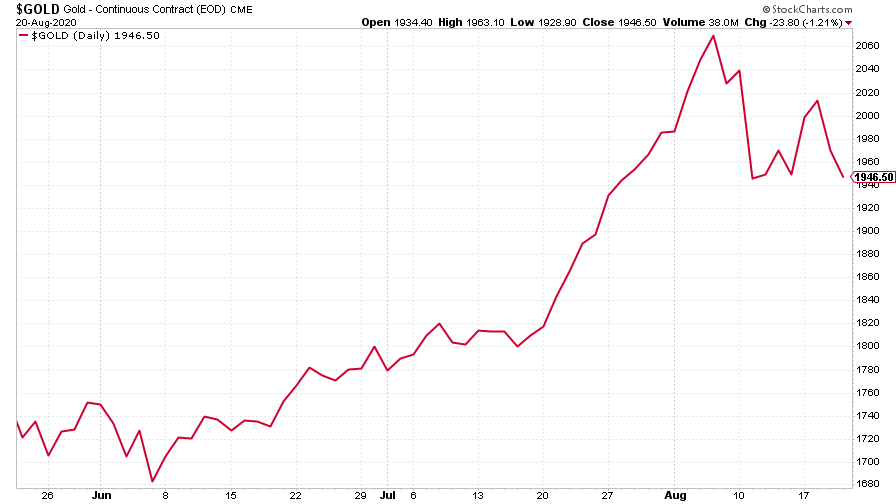

The charts that matter: gold dips after Buffett buys in

The charts that matter: gold dips after Buffett buys inCharts Warren Buffett bought into gold's bull market just as the price slipped again. Here's how the charts that matter most to the global economy reacted.