Why gold really is your best defence

Gold is still scorned by many investors. But they're missing the point of owning gold. With inflation rising and government debts out of control, it's not something you should be without, says Merryn Somerset Webb.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

I wrote a few mild criticisms of Warren Buffett last week. It didn't go too badly on the hate mail front but I didn't get away with it entirely, either.

One reader wrote in to say that I will "never have the class of Warren Buffett". That is true, of course, although if class is Cherry Coke and turning a blind eye to potentially dodgy stock dealing, I'm not altogether sure I want his class.

I'm also comforting myself with the knowledge that I have one thing that Buffett doesn't have: gold. His most famous quote on this makes it clear that he just doesn't fancy it much. Gold, he says, "gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head."

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Would they? I suspect that as long as the Martian grasped the concept of money, he/she/it wouldn't be doing any scratching at all. Let's not forget that the gold price has gone from $260 an ounce to not far off $1,500 in a decade.

Still, if you remain in the Buffett camp on this one, I'd recommend two books. The first is Bill Bonner's Dice Have No Memory (you can read the introduction here).

Bonner has a string of bestsellers to his name. He is also the proprietor of MoneyWeek, and the man who got me into gold with his newsletter The Daily Reckoning back in 2001. This book is a collection of his writings, taking us from then to now.

See also

In 2002, with gold at $305, he told us to buy "not because we know something... but because we don't... we do not know how long the world will continue to accept dollars in exchange for goods and services. Nor do we know how long American consumers can continue to spend money that they don't have. Nor when real estate markets will turn down, ending the illusion of additional wealth caused by rising prices. But, in a world of so many unanswered questions, gold the world's only proven long-term store of value seems the perfect thing to own." The answer to most of Bonner's questions on timing turned out to be 2007/2008.

Bonner, like me, is a great believer in the idea that nothing brings on inflation (and so reduces the value of a currency) like an out of control deficit. Governments, says Bonner, "yield to emergency like dieters to devil's food", printing money to pay their bills and ignoring the long-term consequences.

That can really only end one way. How? For that we turn to John Mauldin's Endgame. It's a big title, but Mauldin had a pretty good record of crisis commenting and now sees us as being in Act II of the 'great debt supercycle' the one where the bankruptcies and defaults (which for politeness' sake we will call restructuring) will not be of households and companies but of governments. Something to think about as Ireland's debt is downgraded to just above junk, Iceland votes not to pay the UK back lost savers' money and a consensus grows that the US national debt has stepped over the line from containable to nuts. Some kind of US default no longer seems impossible.

So how will it all happen? "Companies and households typically deal with excessive debt by defaulting; countries overwhelmingly deal with excessive debt by inflating it away." They make money worth less so that their debts are easier to repay. High inflation is almost always caused by "public budget deficits that are financed by money creation".

Sound familiar? It should particularly in the UK, where we are one of the "likeliest candidates" around for hyperinflation. Why? Because we have a whopping deficit and because we have created a huge dose of new money via quantitative easing, which we have mainly used to buy our own government debt: we monetised almost our entire deficit in 2009.

With most investments, the idea is to look at the income generated and to figure out its net present value. It is straightforward, if not exactly easy. But gold is a different matter. You don't measure the rise in income from it. You measure the fall in trust around it. And as Gillian Tett, the US managing editor of the Financial Times, likes to say, if there is a bear market in anything at the moment it is in trust, in finance thanks to the crisis and in governments thanks to the money printing.

Jim Grant of Grant's Interest Rate Observer sums it up pretty well: "To me, the gold price takes the form of a very uncomplicated formula, and all you have to do is divide one by 'n'. And 'n', I'm glad you ask, 'n' is the world's trust in the institution of paper money and in the capacity of people like Ben Bernanke to manage it. So the smaller the 'n', the bigger the price."

That, of course, is why gold keeps on hitting new highs. "We already own a lot of gold," said Bonner. But, given the state of the world's currencies, "I feel like I want to buy more of it."

This article was first published in the Financial Times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

BrewDog investors have lost everything - are there better ways to back small firms?

BrewDog investors have lost everything - are there better ways to back small firms?The collapse of BrewDog has called into question how useful crowdfunding is as an investing strategy and whether there are better ways to profit from small firms and start-ups

-

One million more pensioners set to pay income tax in 2031 – how to lower your bill

One million more pensioners set to pay income tax in 2031 – how to lower your billHundreds of thousands of pensioners will be dragged into paying income tax due to an ongoing freeze to tax bands, forecasts suggest

-

The Stella Show is still on the road – can Stella Li keep it that way?

The Stella Show is still on the road – can Stella Li keep it that way?Stella Li is the globe-trotting ambassador for Chinese electric-car company BYD, which has grown into a world leader. Can she keep the motor running?

-

How to pay for the pandemic

How to pay for the pandemicOpinion Covid-19 has proved extremely expensive. It’s time to consider fresh sources of government revenue, says Edward Chancellor

-

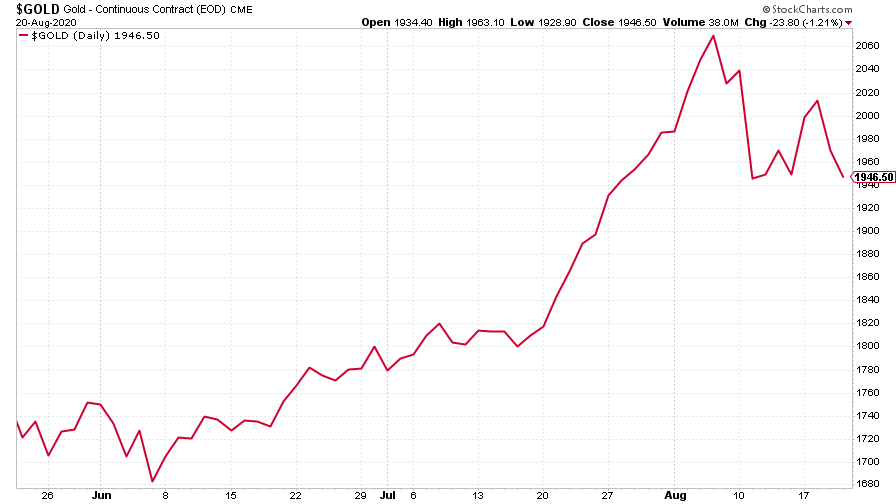

The charts that matter: gold dips after Buffett buys in

The charts that matter: gold dips after Buffett buys inCharts Warren Buffett bought into gold's bull market just as the price slipped again. Here's how the charts that matter most to the global economy reacted.

-

The world’s greatest investors: Philip Carret

The world’s greatest investors: Philip CarretFeatures Philip Carret was a value investor, buying stocks in obscure companies that he felt were undervalued, aiming to at least double his investment.

-

Buffett’s bet: can a tracker trounce the hedgies?

Buffett’s bet: can a tracker trounce the hedgies?Features There’s no sense in handing 1%-2% plus fees to fund managers when a cheap tracker gets results, says Stephen Connolly.