What’s next for the US dollar?

A potential peak in industrial metals prices could mean the US dollar is set to go higher. But nothing is certain, says Dominic Frisby. Here’s how he’s playing it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Late last week, I was swiping through the charts of some of the less well-known commodities, looking for attractive technical set-ups.

I ended up shorting Arabica coffee (working well so far), lead and copper (gone against me by a few points).

I was tempted to add zinc, aluminium and iron ore to my roster of shorts, but then decided, with my cautious hat on, that three bets were enough for one day. Nevertheless the charts of all the industrial metals I've just mentioned look a bit dodgy to me.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Broadly speaking, they had a bonanza 2016 (maybe copper's year is better described as "good", but zinc, iron ore, aluminium and lead had a great time).

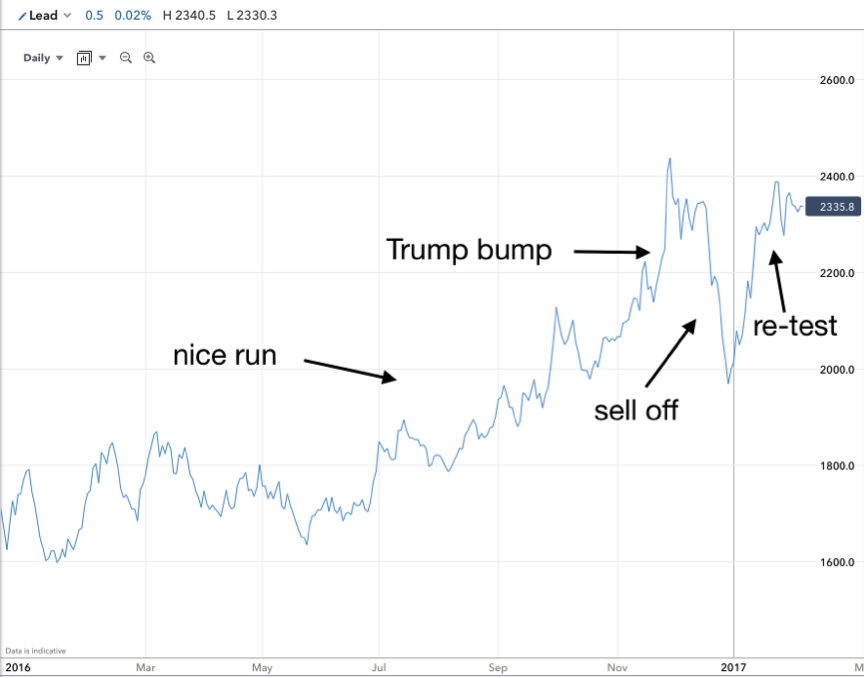

They then got a massive "Trump bump" after the US election, sold off a little in the lead up to Christmas, and in 2017 have had a rebound rally that has taken them back to their post-election highs, where they seem to have run out of steam.

Here, for example, is lead over the past year.

You can see the big run up from last May, the Trump bump in early November, the sell-off in December, followed by the re-test.

What other author gives you the lead price so graphically displayed?

As I looked at those charts, I couldn't help thinking, "industrial metals are making a top here". I can't say that for sure, of course, it's just an obvious place, from a price action point of view, for them to do so. I texted my thoughts to colleague Charlie Morris (editor of The Fleet Street Letter) and got a curt "agree" as a reply.

From there, I started thinking about the implications of a top in industrial metals. There's a lot more to this than the price of a block of lead. If industrial metals are putting in a top, it signifies that another, much more important market is getting set to go higher. That much more important market is the US dollar.

A stronger dollar does not just signify lower metal prices, it signifies deflation, rather than the touted inflation, taking hold again.

It signifies that Donald Trump's plans to revitalise US industry and rebalance its import-export deficit are not going to be such plain sailing. It makes higher US interest rates less likely.

It suggests continued relative weakness in sterling, the euro, and the yen, not to mention gold and silver. It has all sorts of investment, not to mention social and political implications.

So where is the US dollar going?

The signs all point to a weaker dollar

The US dollar index measures the dollar against a basket of major foreign currencies. On the first day of this year it set a 14-year high of 103, since when it's been falling, albeit by only 3%-4%. Hence the recent bump we've been seeing in metals prices, both precious and base.

The futures markets show unusually large volumes of open interest, with the commercials (the "clever ones") on the short side of the trade and the large and small speculators (the "stupid ones") long. In simple terms, too many of the wrong sort of people think the dollar is going to up, so the market needs to correct. It has done to an extent, but sentiment remains excessively bullish.

Similarly, a January survey of global fund managers by Bank of America Merrill Lynch found that 47% of fund managers think that "long dollar" has become the most crowded trade. The second most crowded trade, to put that number into perspective, had just 11% of fund managers voting for it (that was "short bonds").

On top of all that, according to comparisons of purchasing power, the dollar is 20% overvalued against the euro and the pound, and by 30% against the yen.

From a sentiment and valuation point of view, then, the signs are bearish. In other words, my idea that industrial metals have peaked is wrong.

Then again, the dollar could go a lot higher

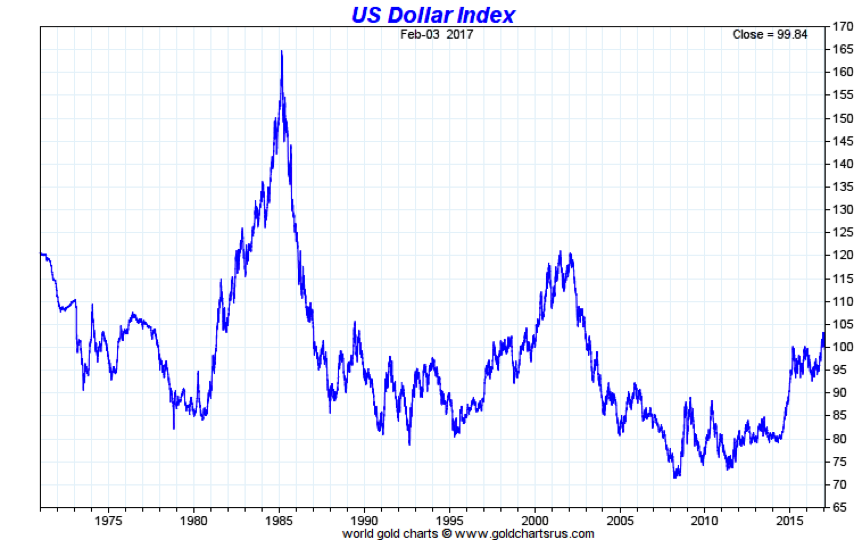

But I want to take a very long-term view for a moment. The chart below shows the US dollar index since 1971.

On a historic basis, the dollar doesn't look that overvalued. If you stripped out the bear market lows of 2008 and 2011 you could easily view its current position as "higher side of the middle of the range".

In 2001-02 it went to 120 20% higher than where we are now.

Many are drawing parallels between Trump and Ronald Reagan. Well, look at what happened to the dollar between 1981 and 1985 in Reagan's first term it went from 90 to 165. In 1985 the US, UK, France, Germany and Japan had to agree the Plaza Accord to manipulate it lower.

Could such a thing happen again? It's not probable, but it's possible. I can envisage a scenario that sees a global rush for US assets that would only be a continuation and an acceleration of what has been going on since about 2012.

One thing's for sure we are in a period of strangeness and it's going to get more strange political unrest, social division, currency wars, trade wars possibly. A rally at least to the highs of the early noughties looks quite possible. I'm not ruling it out.

Trump does seem to be intent on delivering on the statements he made in his campaign, which is in itself unorthodox for a politician. What is more unorthodox is his way of going about things. He constantly seeming to wrong foot his opponents. He is consistent in his unpredictability.

We don't yet know what his relationship with the Federal Reserve is going to be like, which is of great significance to the dollar. And of course his every action seems to be met with resistance of some kind.

The result is this slightly bipolar, unsure market. One minute it's "all going to be ok" buy buy buy! Next it's "Oh my god have you seen what he's just done?" Sell, sell, sell! And buy gold.

Fetch me a one-armed economist

I can envisage a scenario in which Trump gets what he wants, and we get a lower dollar plus inflation. I can also envisage the opposite and see a scenario in which America remains the most attractive place to be in the years ahead and so there is a rush to American assets, whether in its stockmarket or its currency.

I can also envisage a scenario, not unlike now, where we swing between the two. In fact, that's probably the most likely outcome. The dollar might go up or it might go down. Ugh!

How am I playing it, then? I've lightened up a little on my miners, though I'm still long, and I'm keeping my bet against lead and copper. However, my risk is managed. If lead and copper go above their Trump bump highs I'm wrong and I'm out of the trade.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.