Why I sold some of my gold when Donald Trump won

After Donald Trump’s election victory, stockmarkets rallied and bonds sold off. That’s perhaps not too surprising. But gold saw a brutal sell-off too. Dominic Frisby explains why he joined in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

From an investment point of view, I must confess I have been wrong-footed by the Donald Trump win.I had a bet on him, so that was a nice win (almost a five-bagger). But the reaction since then that, I did not see coming.

The stockmarket rally I get, but the sell-off in gold I'm more ambivalent about.And that's the focus of today's Money Morning

Why I sold gold when Donald Trump won

The fact that Trump is not in bed with Wall Street, doing highly-paid speeches for Goldman Sachs and all the rest of it, might have led one to think the stockmarkets would react badly to a Trump win, but the fact that they have rallied is not that much a surprise.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Focusing on what Trump has said, his policies increased infrastructure spending, deregulation, lower taxes and so on are actually business-friendly, which is what you would expect from a businessman.

Nor has the sell-off in bonds been such a surprise at least in retrospect. On the one hand, his infrastructure spend will need to be paid for somehow, so that means more debt. On the other hand, he attacked the low-interest policies of his predecessors and of the US Federal Reserve during his campaign.

It's also worth reminding ourselves that the sell-off in bonds actually began in the summer. The decline, which follows Trump's election, is the continuation and acceleration of a trend that was already in place. Such has been the noise about bonds, it may even be that the sell-off is done, at least in the short term.

So what's going on with gold? Given Trump's unpredictability, you might think gold would have reacted more positively than it did. And I do think that you can make the case that the sell-off in bonds is related to the sell-off in gold. If the market is factoring in higher rates, perhaps that is what is motivating sellers.

But last week the selling was just brutal. We saw almost $130 an ounce knocked off the gold price in just three days.

I was one of those selling.

I made quite a nice call on gold a month or so ago, and made some good gains. I didn't want to see those gains turn into losses, so I was taking profits wherever I had them.

I closed my spread bet. I sold some of my more liquid gold stocks.

And then I thought: "I have had a good year in gold stocks, and I don't want to give back the gains I made". So my selling became increasingly aggressive by early on Friday.

At one point, I was even on the verge of selling some of my physical gold.

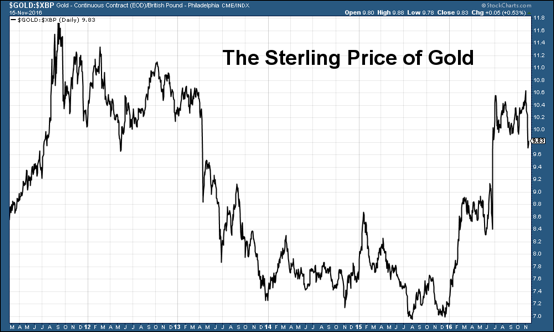

The gold price is reported in dollars, so we tend to think about the dollar price of gold. But, in fact, in the UK we should be thinking about the sterling price of gold. Sterling is what we will use to buy gold, and when we come to sell, sterling is what will receive in exchange, in most cases.

Sterling gold is up over 45% this year. It has broken the £1,000 an ounce barrier for the first time since early 2013. I want to protect the gains that I have made.

I was looking at the chart and thinking: that wants to go back below £900.

Anyway, I didn't. I decided I was being too emotional and walked away. It is better to sell from a position of strength.

Time to wait for the next "buy" signal for gold

From a shorter-term perspective, I have now sold enough and built up a big enough cash position to wait for the next buy signal.

Gold has buckets of support in the $1,200-$1,230 area. It made its March and May lows there earlier in the year. The relative strength index is below 30 meaning it is coming into the "buy" zone. Gold stocks were up 5% yesterday while gold was stable that is often a bullish divergence.

So it's very possible that gold could be making an intermediate-term low in these parts. If I sold everything now and it turned around and rallied, I'd feel like a right bozo.

The fundamental reason I own gold is that it is my hedge against governments. From a political upheaval perspective, 2016 has been the year that keeps on giving. I don't see that changing. For all the volatility, you want a considerable long-term core position.

But this whole episode has been a valuable lesson in how, once you get swayed, it is very easy to get carried away.

I'm now comfortable with my position. From a risk-management point of view, I want to have some physical gold, some cash and some stocks. I have that.

But I want to see clearer signs before I go all in again. I don't have that. Gold and gold stocks are still on a short-term "sell" signal for me.

I'm watching and waiting for my indicators to turn, and then I'll go back in. If that means buying at a slightly higher price than I sold annoying, but so be it. If it means buying at a lower price, all the better.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How should a good Catholic invest? Like the Vatican’s new stock index, it seems

How should a good Catholic invest? Like the Vatican’s new stock index, it seemsThe Vatican Bank has launched its first-ever stock index, championing companies that align with “Catholic principles”. But how well would it perform?

-

The most single-friendly areas to buy a property

The most single-friendly areas to buy a propertyThere can be a single premium when it comes to getting on the property ladder but Zoopla has identified parts of the UK that remain affordable if you aren’t coupled-up

-

Diagnosing cancer more deftly will pay dividends

Diagnosing cancer more deftly will pay dividendsGiven that 50% of Britons will develop cancer during their lifetimes, we need to get better at detecting it, says Matthew Partridge. These firms are leading the technological charge.

-

Protect against inflation with Britannia gold coins and bars

Protect against inflation with Britannia gold coins and barsAdvertisement Feature With UK inflation at a 40-year high and expected to rise even higher, interest in physical gold is surging once again. And The Royal Mint’s Britannia gold coins and bars offer an accessible and affordable way to buy.

-

Commodity prices are taking a breather

Commodity prices are taking a breatherNews Commodity prices have fallen back after spiking early in the year. Iron ore is down 36% from its March peak, while copper has lost 20% since 1 January. And there could be further falls to come.

-

Seoul attempts to close the “Korea discount” for stocks

Seoul attempts to close the “Korea discount” for stocksNews South Korean stocks suffer from the “Korea discount” – with the country still classified as an emerging market, investors are reluctant to pay a premium.

-

Upcoming IPOs in 2022: which companies are planning to list this year?

Upcoming IPOs in 2022: which companies are planning to list this year?News Rupert Hargreaves explains what an IPO is, how public and private companies differ, and picks out some of the more notable companies set to list on the stock exchange this year.

-

Five dividend stocks to beat inflation

Five dividend stocks to beat inflationTips Rupert Hargreaves looks at five stocks to beat inflation that should help protect your wealth

-

Metals prices wobble on slowdown fears

Metals prices wobble on slowdown fearsNews The S&P GSCI index of 24 major raw materials has fallen back 9% since mid-June on growing fears of a recession, and copper has hit a 16-month low after losing 22% since a peak in early March.

-

How to invest in the copper boom

How to invest in the copper boomTips The price of copper has slipped recently. But that’s temporary – the long-term outlook is very bullish, says Dominic Frisby. Here, he explains the best ways to invest in copper.