Zero-coupon perpetual bonds: this April Fool is no joke

When the US Treasury considered zero-coupon perpetual bonds years ago, it was greeted as a joke. Not now, says Edward Chancellor.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

About ten years ago I wrote an article recommending that the US Treasury should issue zero-coupon perpetual bonds (bonds that would pay no interest and would never be redeemed) to reduce debt-service costs. This comment was published in The Wall Street Journal on 1 April 2006. A couple of readers wrote in complaining that a zero-coupon perpetual would have no value. I politely pointed out to them the date of publication. At the time, it seemed like a good joke. But much has happened since then, and monetary policy wonks are, in effect, seriously discussing the idea.

Ben Bernanke, the former chairman of the Federal Reserve, has suggested that the Bank of Japan, which has bought up close to half the outstanding Japanese government debt, should convert its bond holdings into zero-coupon perpetuals. The difference between a central bank owning zero-coupon perpetuals and conventional bonds is that the former cannot be sold to withdraw excess liquidity from the banking system.

That means the Bank of Japan would lose a key tool in controlling inflation. As inflation expectations rose, Japan's decades-long battle against deflation would be over. There are further benefits to this proposal. In one fell swoop, Japan's massive debt overhang would disappear. As the government's debt service costs dried up, Tokyo would be able to fund massive public works, such as high-speed train lines and defence spending. The clear losers would be Japanese households holding cash and other nominal yen assets, who would see the real value of their savings evaporate as inflation took off.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, in his forthcoming book, The Curse of Cash, economist Kenneth Rogoff proposes abolishing the dollar bill which, being an irredeemable non-interest bearing liability of the US Treasury, is technically a zero-coupon perpetual. This may sound strange. The $100 note costs a little over ten cents to manufacture. Roughly half of the $1.4trn of US dollar bills outstanding are held abroad. That represents hundreds of billions of dollars of pure profit for the federal government.

Yet getting rid of cash would prevent people from hoarding cash, and thus allow central bankers to push interest rates even deeper into negative territory. "The whole premise," writes Rogoff, "of (significant) negative rates is to turbocharge the economy out of a deflationary recession."

A cashless world with negative interest rates would look very different. Beggars would have to be provided with debit card readers (as is already the case in progressive Sweden). Cheques would lie around uncashed. People would hurry to file their taxes early and even overpay them. There would be no restraints on investment.

Of course, there are some minor drawbacks. The poor and disadvantaged, many of whom lack bank accounts, would have to be coerced into entering the world of electronic payments. Many of them would lose their livelihoods as much of the semi-licit underground economy disappeared. The government would have knowledge of every transaction in a person's life, from the child's first purchase of sweets onwards. A brave new world indeed.

Even in this era of unorthodox monetary policy and unprecedented state snooping, Rogoff's proposal to abolish cash probably won't fly. However, Bernanke's plans have a depressing inevitability. What's more, they'll probably work. Revolutionary France created inflation and wiped out its national debt by issuing vast amounts of assignats, an earlier type of zero-coupon bond. Ten years ago, the notion that this type of finance would make a comeback was laughable. Today, it's no joke.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

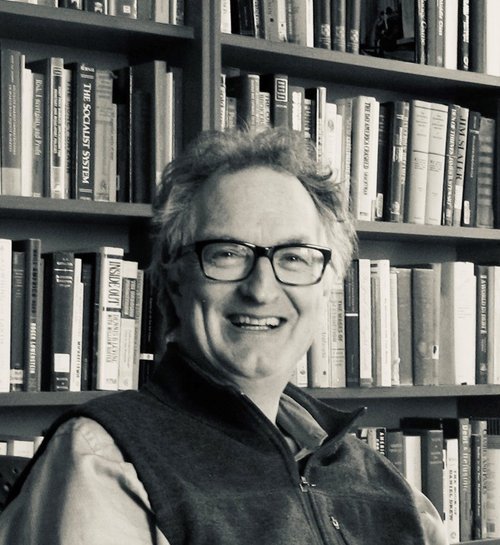

Edward specialises in business and finance and he regularly contributes to the MoneyWeek regarding the global economy during the pre, during and post-pandemic, plus he reports on the global stock market on occasion.

Edward has written for many reputable publications such as The New York Times, Financial Times, The Wall Street Journal, Yahoo, The Spectator and he is currently a columnist for Reuters Breakingviews. He is also a financial historian and investment strategist with a first-class honours degree from Trinity College, Cambridge.

Edward received a George Polk Award in 2008 for financial reporting for his article “Ponzi Nation” in Institutional Investor magazine. He is also a book writer, his latest book being The Price of Time, which was longlisted for the FT 2022 Business Book of the Year.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

'Governments are launching an assault on the independence of central banks'

'Governments are launching an assault on the independence of central banks'Opinion Say goodbye to the era of central bank orthodoxy and hello to the new era of central bank dependency, says Jeremy McKeown

-

Do we need central banks, or is it time to privatise money?

Do we need central banks, or is it time to privatise money?Analysis Free banking is one alternative to central banks, but would switching to a radical new system be worth the risk?

-

Will turmoil in the Middle East trigger inflation?

Will turmoil in the Middle East trigger inflation?The risk of an escalating Middle East crisis continues to rise. Markets appear to be dismissing the prospect. Here's how investors can protect themselves.

-

Federal Reserve cuts US interest rates for the first time in more than four years

Federal Reserve cuts US interest rates for the first time in more than four yearsPolicymakers at the US central bank also suggested rates would be cut further before the year is out

-

The Bank of England can’t afford to hike interest rates again

The Bank of England can’t afford to hike interest rates againWith inflation falling, the cost of borrowing rising and the economy heading into an election year, the Bank of England can’t afford to increase interest rates again.