John Bull called the EU vote right

The market turmoil unleashed by the EU vote could help to put the economy on a sounder footing, says Edward Chancellor.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Britain's EU referendum has left the country divided and bitter. Defeated Remainers believe that those who voted Leave are ignorant, and that they will come to regret the material consequences of their decision. Perhaps John Bull has better economic intuitions than he's credited with. The British public ignored shrill warnings from the government and other official bodies and signalled its dissatisfaction with the status quo. The majority embraced uncertainty because they didn't see that they had much to lose. The good news is that the market turmoil unleashed by Brexit could help to put the economy on a sounder footing.

Immigration is a red herring as an explanation for public discontent. When the economy is growing and living standards are rising, migrants are generally welcome. The real problem afflicting the UK is that incomes have stagnated for years. Households are struggling with excess debt. Housing is increasingly unaffordable. And while private wealth is at record levels, the gains have been unequally distributed.

Weak income growth reflects Britain's extraordinarily poor productivity record over recent years. Why has productivity growth faltered? During the era of ultra-low interest rates the UK has morphed into a bubble economy. Bubble economies generate profits (and taxes) from shuffling around pieces of paper, but little by way of genuine productivity growth. They are characterised by inflated asset prices, low savings rates, the misallocation of capital, an overly large financial sector, and often by rising foreign indebtedness. The UK ticks all these boxes. Low rates have pushed up house prices. Since (some of) the public enjoys vast paper wealth, it doesn't save much. The household savings rate, at 4% of GDP, is lower than it has been in more than half a century. Low savings have been accompanied by weak investment.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Near-zero interest rates set an inadequate hurdle for returns on capital. As a result, the bubble economy has sucked resources into sectors with low productivity, such as construction and domestic services, and away from the manufacturing and traded-goods sectors. The financial sector occupies a greater share of the economy than ever before. Total assets of the UK financial system are around 12 times the size of the economy more than twice the level of the US, according to the Bank of England. The spendthrift Brits have become dependent on foreign capital. A string of huge current-account deficits a sign that Britain has been consuming more than it produces has pushed the UK's net foreign liabilities to a record 25% of GDP.

This bubble economy has resulted in disappointing productivity and wage growth. None of this bothers Londoners much they have enjoyed the greatest growth in house prices and their incomes are boosted by the outsized financial sector. But the rest of the UK had less of an interest in maintaining the status quo.

The Brexit vote has been accompanied by a sharp fall in sterling, rising volatility and the downgrading of the UK's credit rating. On the stock exchange, the weak performance of house builders suggests the housing bubble, already threatened by overbuilding in the luxury segment, may be about to burst. The conventional wisdom is that this is unmitigated bad news. However, in the long run these developments should be welcomed. As sterling falls and currency volatility rises, foreigners will become reluctant to fund the current-account deficit. As a result, savings in the UK will have to rise.A cheaper currency means exports become more competitive. In time, resources will be diverted from construction towards the traded-goods sector. A higher cost of capital should improve the allocation of capital. In time, this will allow interest rates to normalise.

As the bubble economy shrinks, Britain will become more productive, paving the way for faster income growth. There will be losers the financial sector will probably shrink, and there may be fewer chances to get rich quick from a career in banking. London house prices will likely fall relative to the rest of the UK. But there's an upside. The City won't deprive other, more productive sectors, of talent. Cheaper houses mean more affordable homes. In the long run, winners will outnumber losers. The UK will end up richer, and disparities of wealth will be less extreme. John Bull probably didn't clearly envisage such an outcome when he marked his ballot paper, but in his bones he may have sensed change was necessary and overdue.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

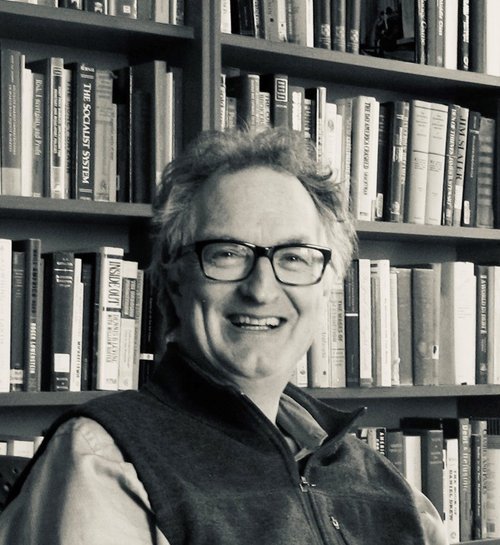

Edward specialises in business and finance and he regularly contributes to the MoneyWeek regarding the global economy during the pre, during and post-pandemic, plus he reports on the global stock market on occasion.

Edward has written for many reputable publications such as The New York Times, Financial Times, The Wall Street Journal, Yahoo, The Spectator and he is currently a columnist for Reuters Breakingviews. He is also a financial historian and investment strategist with a first-class honours degree from Trinity College, Cambridge.

Edward received a George Polk Award in 2008 for financial reporting for his article “Ponzi Nation” in Institutional Investor magazine. He is also a book writer, his latest book being The Price of Time, which was longlisted for the FT 2022 Business Book of the Year.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how