Apple Energy could be the smartphone king's move into solar power

The maker of iPads and iPhones could be moving into the renewable power industry as it registers the company "Apple Energy".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Last year, Apple's revenues were $233.7bn. If it were a country, the company's GDP would be slightly behind Ireland's as the 43rd biggest in the world.

Apple, the world's largest publicly traded company, is one of the few that can legitimately claim to have as much clout as a sovereign state. The corporation can move markets in just the same way as a medium-sized country and sends its ambassadors abroad to negotiate with governments.

Apple's latest move is just as statist. A filing made with the US Federal Energy Regulatory Commission suggests the company may be moving into energy provision a far cry, obviously, from its day-to-day business. It's not yet clear what Apple Energy LLC, newly registered in Delaware, is for, but we'll find out soon enough.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Whatever Apple is planning is set to start on 5 August, just over six weeks from today.Green energy is a major concern for Tim Cook's company. Apple already sources 93% of its energy from renewable sources, much of it generated by Apple-owned projects; 463 Apple stores are run on renewable energy, as are the company's massive data stores, which run on solar power and fuel cells.

Apple's clean energy policy is clearly extensive and it seems to be working. By the look of this filing, the company is generating more energy than it can use. If Apple does indeed move into energy sales, its stock already seen as mind-bogglingly cheap by some could look even more attractive.

I think the Apple Energy filing is interesting for two reasons.

Apple is struggling to grow in a saturated smartphone market (where it hasn't had a functional edge in years), so itsmanagement islooking elsewhere for profits.

Apple grew so rapidly because it effectively created several markets. It may not have invented MP3 players, smartphones or tablets, but it certainly changed them beyond recognition. Now, though, the company lacks headroom. Apple has saturated the markets it opened up.

Like any number of companies before it, the tech giant could start incorporating enterprises that are further and further from its core business. We already know it's probably developing an electric car so a move into energy sales doesn't look unlikely.

Apple won't weaken its brand with this move it won't be selling energy to end users, so the fact that it's "Apple Energy" won't matter. The Apple brand will stay strong (barring a major flop from one of its core products), and the company will monetise energy it's already generating. It's low-hanging fruit.

This is an Apple story but it's also a solar story

Apple's stock has been battered over the last year, falling 30% from its July highs. The company would not be moving into energy now if it wasn't sure about its profitability.

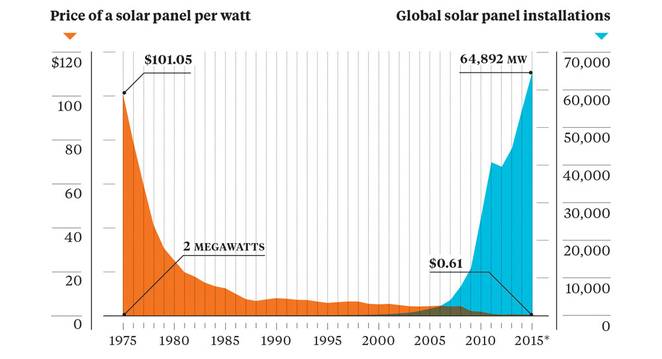

Since the 1980s, solar power has become approximately 10% cheaper each year. It's not a tree-hugger's pipe dream anymore. It's a real, practical way of providing clean energy.

Apple is in a privileged position; it has the financial muscle to provide its own green energy. Not all companies will have that luxury. Solar power is becoming cheaper, but setup costs are still prohibitive for some smaller businesses.

But Apple's move could be a catalyst. If the world's largest company sees solar as a shrewd move, it could rub off on other businesses of any size. The opportunity to make money and reduce emissions is rare but it looks like Apple could be doing just that.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Mischa graduated from New College, Oxford in 2014 with a BA in English Language and Literature. He joined MoneyWeek as an editor in 2014, and has worked on many of MoneyWeek’s financial newsletters. He also writes for MoneyWeek magazine and MoneyWeek.com.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how