Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

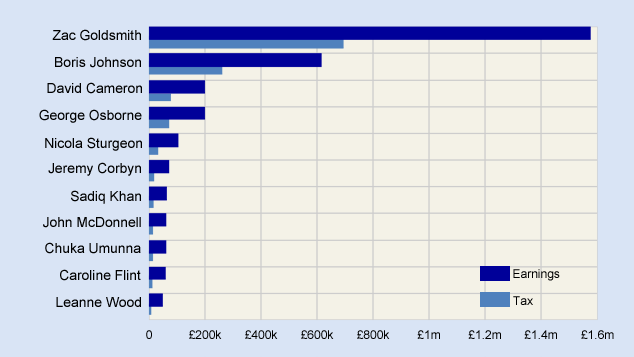

In the wake of the Panama Papers expos, and the news that David Cameron's father operated an offshore trust in which Mr Cameron used to own shares, the country's most high-profile politicians have been falling over themselves to demonstrate just how clean they are, and trumpet the exact amount of tax they contribute to the nation's coffers.

In truth, there are very few surprises. It would take an extremely dense (or particularly brazen) politician to squirrel money away in offshore tax havens, given the expenses scandal of a few years ago and the occasional celebrity being vilified in the press. Perhaps there will be the odd backbencher who hopes to remain under the radar. Perhaps not.

So here are the country's top earners, and what they paid:

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The devil is in the tax returns

The current London mayor, Boris Johnson, comes in a distant second. His mayoral salary of £129,000 (net of pension contributions) is boosted by income from his writing. He earned over £266,000 for his column in the Daily Telegraph, and received over £224,000 in book royalties, bringing his total taxable income to £612,583. On that, he paid tax of £276,505, a rate of 42%.

Next comes the PM. David Cameron's taxable salary as prime minister is £140,522. Add to that £3,000 in savings interest and his 50% share of renting out his house (almost £47,000), and he earned £200,307, with a tax bill of £75,899, or 39%.

George Osborne earned £120,526 as chancellor of the Exchequer, topped up with £33,500 rental income and £44,000 dividend income from the family wallpaper business, for a total of £198,738. Tax was £72,210, or 36%.

Scotland's first minister, Nicola Sturgeon, doesn't take everything she is entitled to. If she took her full salary, she would be the highest paid politician in the UK. But instead, she limits herself to £104,000, on which she pays tax of £32,517, a rate of 31%.

And the ever frugalJeremy Corbyn managed to subsist on his meagre MP's pay, supplemented by just £1,850 of extra income, to bring a total of £72,645 on which he paid tax of £18,912 (26%). But poor old Jeremy couldn't get his tax return in on time, and so suffered a £100 penalty.

The average UK worker, by contrast to all of the above, earns just £26,000, on which income tax of £3,202 would be due.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

The true price of paradise

The true price of paradiseFeatures The so-called Paradise Papers have highlighted the use of far-flung remnants of the British Empire as tax havens. The bargain tax rates are looking increasingly costly, says Simon Wilson.

-

We’ll all pay a price for these leaks

We’ll all pay a price for these leaksOpinion Leaks such as the Paradise Papers reveal something very worrying, says Matthew Lynn. And it's not about those who have been caught up in the scandal.

-

Don't chase the super-rich for tax, just simplify the system

Don't chase the super-rich for tax, just simplify the systemFeatures It might seem fair for HMRC to chase the super-rich. But if the tax system were simpler, they might be less inclined to go looking for loopholes.

-

The big government threat to big corporations – and small states

The big government threat to big corporations – and small statesFeatures Apple's potential €13bn tax bill should sound a warning to investors, says John Stepek. Governments have finally worked out how to raid big multinationals' balance sheets.

-

Time to duck: ‘government by headline’ is back

Time to duck: ‘government by headline’ is backFeatures David Cameron's dilemma over the Panama Papers is a symptom of our flawed tax regime. But it's what we're stuck with, says John Stepek. And it's going to get worse.

-

Tax dodge scandal claims first scalp in Iceland's prime minister

Tax dodge scandal claims first scalp in Iceland's prime ministerFeatures Icelandic prime minister Sigmundur Gunnlaugsson has been the biggest casualty so far of the Panama Papers scandal, says Matthew Partridge.