Another tough year ahead for equities?

Last year wasn't good for equities. And 2016 has started badly too, with poor Chinese data causing a global slide, and the FTSE 100 having its worst start to a year since 2000. So what's next?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

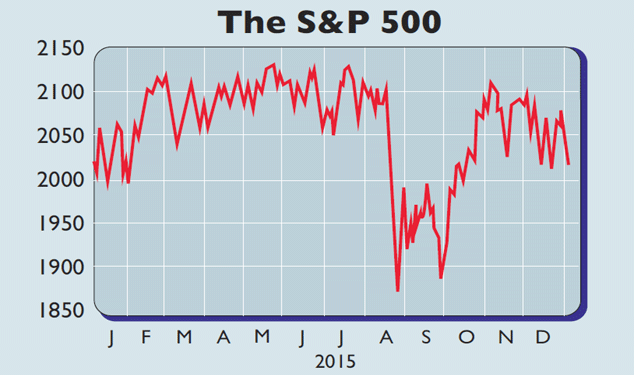

Last year was hardly a stellar one for equity investors. While European and Japanese stocks rose, the S&P 500 finished marginally lower and the commodities-heavy FTSE 100 had its worst year since 2011, losing almost 5%. Emerging-market equities fared three times worse. Then 2016 started in panic mode, with more poor Chinese data causing another global slide. The FTSE 100 lost 2.4% on Monday, its worst start to a year since 2000.

So what next? America tends to set the tone for global markets, and there the fundamentals are discouraging. The US market is being driven forward by just nine stocks, including Facebook, Amazon and Netflix, which gained more than 60% in 2015. Without these, the S&P's performance would have been "terrible", says John Authers in the Financial Times. "Such a narrowing' of the market is a classic symptom" of a long rally coming to an end.

Corporate earnings are expected to stop falling once the impact of lower oil prices drops out of the annual comparison, but profit margins are at historic highs and interest rates are set to rise, so it's hardto see much of a jump from here. Even if rates are cut (normally good news for stocks), this would "imply a sickly economy, which would hit hopes for earnings", says Authers. Valuations are historically stretched, too, signalling poor long-term returns for those buying now.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That said, the US economy looks healthy enough not to slide into recession anytime soon. George Magnus of UBS notes in The Times that the average US economic expansion since 1948 has lasted 58 months, with the three before the crisis lasting 95 months. This one is 80 months old, but the unemployment rate doesn't seem to have troughed yet, so there should still be some mileage in it. Without a recession, huge market falls are unlikely.

Another key issue for markets, as we were reminded this week, is China, where it looks as though growth fears are overdone. But if China does continue to falter, it would be bad for Europe, where the recovery is already weaker than in the US, as it is more exposed to the Middle Kingdom. In this scenario, however, the European Central Bank could well step up the pace of its quantitative easing, or money printing, programme. This brings us back to the recurring theme of the past few years: the best bets remain reasonably priced markets being supported by central bank action: Europe and Japan.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify