The dire record of active managers in mining funds

The performance of the best actively-managed mining funds has been dismal. Alex Williams reveals a better alternative for your money.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

After the latest downward lurch in commodity prices, investors in the mining sector have now endured terrible returns for five years. Thegold price has nearly halved and the FTSE 350 Mining index has dropped by a gruelling 75%, returning investors to where they were more than a decade ago.

There is, however, nothing better than a prolonged bear market to filter out the best fund managers. Using the industry's dire performance as a litmus test, which funds have actually added value the whole point of active management in the last five years? Sadly to say, the short answer is "none". The performance of the best-regarded mining funds available to UK investors has been unwaveringly dismal. The longer answer is "some, a little bit, but not enough to justify the fees".

Uninspiring performance

Over the last five years it has droppedby 70%, a grim performance, butstill better than a 78% drop in its benchmark, the FTSE Gold Mining index. Indeed, according to Citywire it's the top performer of seven funds in its sector. "Investors are very aware that we are going to perform in the direction of the gold price," Hambro has told the Financial Times, "but they expect us to outperform our benchmark."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, the small margin of outperformance is hardly inspiring no one is going to cheer on a 70% loss, after all and is largely attributable to the small amount of cash (currently 2.2%) that the fund holds on the sidelines to manage its relentless flow of redemptions. Its assets under management have plunged from $3.4bn in 2011 to £681m at the end of last month, as the City has turned its back on mining investments.

Lack of conviction

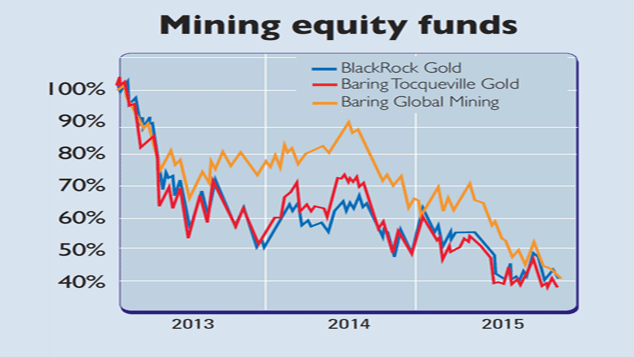

With so many companies in each portfolio, a manager's individual stock selections are heavily diluted and it is hard to see how they can hope to add any value. So it's not that surprising that the performance of each has been near-identical: the three funds mentioned are down 58%, 59% and 62% respectively over the last three years.

One fund with slightly higher conviction though it also has a broader remit is the Baring Global Mining fund, managed by former mining analyst, Clive Burstow. It holds around 30 stocks and is heavily overweight Rio Tinto versus industry leader BHP Billiton.

Burstow, however, has turned 180 degrees on Glencore in recent years and assets under management are just £5m. Its overall performance has, meanwhile, been pretty much identical to the sector's other funds: over three years, it is down 59% and the fund's launch in 2012, at the tail end of China's investment boom, is proof in itself that fund managers have no special insight into the mining cycle.

Better to go passive

The reality is that if you are currently keen to invest in gold miners (and,as Edward Chancellor argued a few weeks ago in MoneyWeek, now doeslook a promising time to do so), but you would rather not take the risk of researching and investing in individual companies, then you would be betteroff finding a cheap passive tracker to avoid paying fees on an active fund.

One such fund is the Market Vectors Gold Miners (LSE: GDX) exchange-traded fund, which tracks the biggest listed gold miners. It's had a similarly rough time over the last five years down around 75% but the expense ratio is around 0.53%, meaning less of your returns will go on fees.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

These 2 stocks are set to soar

These 2 stocks are set to soarTips The returns from these two aluminium and tin stocks could be spectacular when the commodity cycle turns says David J Stevenson.

-

The best ways to buy strategic metals

The best ways to buy strategic metalsTips Weaker prices for strategic metals in the alternative-energy sector are an investment opportunity, says David Stevenson. Here, he picks some of the best ways to buy in.

-

A lesson for investors from a ill-fated silver mine

A lesson for investors from a ill-fated silver mineAnalysis Mining methods may have changed since the industry’s early days, but the business hasn’t – digging ore from the ground and selling it at a profit. The trouble is, says Dominic Frisby, the scams haven't changed either.

-

The natural resources industry is in a tight spot – which is bad news for the rest of us

The natural resources industry is in a tight spot – which is bad news for the rest of usOpinion The natural resources industry is in a bind. We need it to produce more energy and metals, but it has been starved of investment, plagued by supply chain issues, and hobbled by red tape. That’s bad news for everyone, says Dominic Frisby.

-

How to invest in the copper boom

How to invest in the copper boomTips The price of copper has slipped recently. But that’s temporary – the long-term outlook is very bullish, says Dominic Frisby. Here, he explains the best ways to invest in copper.

-

Why investors should consider adding Glencore to their portfolios

Why investors should consider adding Glencore to their portfoliosTips Commodities giant Glencore is well placed to capitalise on rising commodity prices and supply chain disruption, says Rupert Hargreaves. Here’s why you should consider buying Glencore shares.

-

How to invest in the multi-decade boom in industrial metals

How to invest in the multi-decade boom in industrial metalsTips The price of key industrial metals has already begun to rise. The renewable energy transition will take them higher, says David Stevenson. Here's how to profit.

-

Avoid China’s stockmarket – here’s what to invest in instead

Avoid China’s stockmarket – here’s what to invest in insteadOpinion China’s stockmarket is not a good place for investors to be. But you can't just ignore the world's second-largest economy, says Dominic Frisby. Here, he picks an alternative China play.