US interest rates: after the lift-off, the crash?

US interest rates have finally been raised. But years of ultra-loose monetary policy have blown up bubbles all over the place. How long before they burst?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

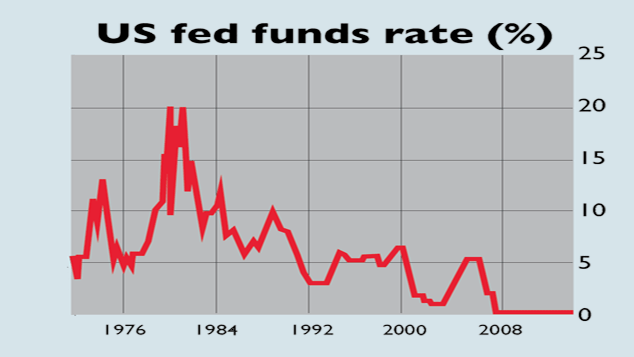

Finally. Ever since the benchmark US short-term interest rate, the federal funds rate, fell to a record low of 0%-0.25% in 2009, the Federal Reserve has "repeatedly made optimistic forecasts about when they would start rising, only to delay the big day again and again", says The Economist. Now we finally have lift-off. Last Wednesday, the US central bank lifted the funds rate by 0.25% to a new range of 0.25%-0.5%. It was the first such rate hike since June 2006.

No tantrum this time

This time, however, liquidity-addicted markets weren't perturbed; indeed, stocks ticked up once the decision was announced. The move had been clearly telegraphed; recent economic data have been positive; and the global-market jitters that had helped persuade the Fed to hold fire in September had subsided, although the turbulence in the credit markets has caused concern. Yellen also placated investors by making it clear that rate rises from here will be very gradual.

Many analysts believed it was high time for the Fed to move. Its mandate is to achieve maximum employment and 2%inflation. Unemployment has slipped to just 5%, below the level at which the Fed last started tightening in 2004. Underlying inflation, which strips out volatile food and energy prices, has already reached an annual rate of 2%.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The big picture, however, is that "America's monetary policy has justgone from being astonishingly loose to ever so slightly less astonishingly loose", says Liam Halligan in The Sunday Telegraph. There's miles to go if we are to return to interest rate levels usually associated with "normality" rather than an emergency.

Early signs of trouble

An unexpected surge in inflation could also cause turbulence and cause interest rates to be hiked much faster than currently expected. The inflationary momentum could come from wage growth. In December the annualised rate of average hourly pay growth hit 2.8%, up from 2.4% in September. And core inflation is already at 2%.

The Fed's serial bubble blowing, then, means that getting rates up significantly without endangering the system is going to be a very tall order. The last time the Fed embarked on a similar exercise was in 1947. Back then, it started raising rates from three-eighths of a percent, where they had been for five years, says The Economist. "This time, the wait for another stint near zero may not be nearly so long."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

The UK regions with the highest proportion of homes above the inheritance tax threshold

The UK regions with the highest proportion of homes above the inheritance tax thresholdHigh house prices are pushing more families into the inheritance tax trap across the country

-

Are money problems driving the mental health crisis? MoneyWeek Talks

Are money problems driving the mental health crisis? MoneyWeek TalksPodcast Clare Francis, savings and investments director at Barclays, speaks about money and mental health, why you should start investing, and how to build long-term financial resilience.