Profit from mining’s malaise

As mining flounders, it’s tempting to grab bargains – but with a mergers spree in the offing, snap up predators to bag the best gains. Alex Williams looks at the sector and picks the best stocks to buy now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The outlook for the mining industry could hardly be murkier. BHP Billiton and Rio Tinto, the giants of the sector, have both dropped by more than a third since the beginning of 2015, while trading giant Glencore has plunged with the price of copper, falling 85% since listing in London's biggest initial public offering in mid-2011. Anglo American, founded in 1917, has fared no better, overtaking Glencore as the worst-performing company in the FTSE 100 in 2015. Chief executive Mark Cutifani announced a "radical" restructuring last week, closing nearly two thirds of its operations and laying off 85,000 mine workers, enough to fill Wembley stadium.No-one, it seems, has been spared.

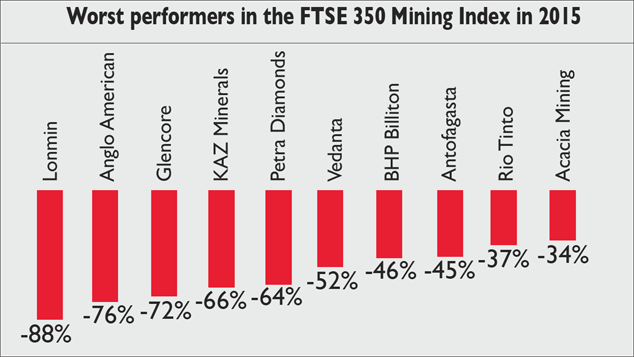

And for investors, the damage has been all too real. The FTSE 350 mining index has fallen by 75% since early 2011, continually hitting new lows (the chart in the box below of the top ten decliners in the FTSE 350 mining index shows just how badly the sector has suffered). Those hoping to catch the bottom have so far been disappointed every time. Entering 2016, the heavy losses raise the question: is now the time for contrarians to be jumping into mining stocks and hauling bargains out of the rubble? Or is the industry now little more than an outdated relic of China's bygone boom?

The billion-tonne question

China, unavoidably, is the swing factor in the mining business. According to the World Economic Forum, the country consumes 40%-60% of all the world's metal, from copper to nickel and zinc. Meanwhile, its smokestack steel mills are the world's biggest buyers of both coal and iron ore. But much like Japan in the 1980s, China's period of peak industrial investment appears to have passed, threatening to leave commodity markets chronically oversupplied.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Mining bosses have a vested interest in talking up China's growth rate, but even they have relaxed their tone. BHP Billiton recently stepped back from its long-held forecast that Chinese steel production will rise through one billion tonnes per annum by 2030, compared to around 820 million tonnes today. Rio Tinto has stuck to the prediction, but its former chief economist, David Humphreys, admitted last month that China's steel sector has been massively overbuilt. "There's about 300 million tonnes of surplus capacity in China," Humphreys told Bloomberg."It needs to be eradicated."

China itself is even more bearish. The country's Iron & Steel Association says the steel industry is already contracting, while Shanghai Baosteel, China's largest state-owned steel mill, says it expects the sector to shrink by 20%. The extent of oversupply in both steel and iron ore is "much more serious than anyone pictured it", according to Li Xinchuang, the president of China's main metal planning body, who expects prices to remain depressed for at least another year."You can't find any bright spots."

With the demand side of the equation looking gloomy, the supply side will be forced to rebalance. Firms running higher-cost mines have already begun to fail. BC Iron, one of the few new producers to break into Australia's iron-ore oligopoly in recent years, shut its only mine on Friday. American copper miner Freeport has also cut back unprofitable production under shareholder pressure this year, while Anglo is downsizing from 55 operations to 20, with closures most heavily focused on platinum and coal. Morgans analyst Tom Sartor describes Anglo's move as "the most aggressive intention to cut capacity we've seen in this commodity cycle to date".

Mine closures, however, have only just begun in earnest. Until now, as metal prices have floundered, companies have upped production in an aggressive attempt to offset lower earnings. The net effect has been that, despite a bearish backdrop, production is still rising. Rio Tinto, for example, has lifted its iron-ore output from Western Australia from 184 million tonnes to 330 million tonnes in the last four years, even as prices have buckled. Having peaked in 2011 at $190 per tonne, iron ore tumbled below $40 a tonne at ports in China last week.

Glencore and BHP Billiton have followed much the same strategy in coal and iron ore, in what analysts describe as a "race to the bottom". For the industry as a whole, it is undoubtedly value-destructive, akin to a supermarket price war. Volume growth, for example, added $1.4bn to Rio's earnings last year, which was more than offset by a $4bn fall in pricing. Even so, it is hard to see any of the major producers pulling back their tonnage, to release pressure on prices, until their competitors have first failed. Anglo American is not just being crushed by China it is being crushed by its peers.

The clock is ticking for miners

China's slowdown, coupled with the output battle being waged by the mega-miners, suggests mining stocks could sink deeper. Fortunately, however, Jeremy Wrathall of investment bank Investec, has devised a mining clock that tellsus exactly where we are in the cycle.

Like a map of the London Underground, it is a stylised version of the industry's ups and downs, telling investors what comes next. Demand might be unpredictable, but there's a reason why the clock works: it's because mining companies always react to rising prices in the same way, issuing shares to buy rivals and shipping in debt to build new operations.

And like supertankers, because mines take years to plan and build, ballooning production inevitably catches the tail end of a boom, making the bust that much deeper. As such, there is nothing new about the pain the industry is suffering now; on the contrary, it is almost boringly predictable.

So where are we now? According to Wrathall's clock, 12 o'clock marks the high point for metal prices and the industry, encapsulated by the bullish assumptions of Anglo American's Minas-Rio mine on the coast of Brazil. Anglo bought the iron-ore deposit in 2008 from a Brazilian businessman for $6.7bn, shortly before the collapse of Lehman Brothers. Construction costs then ballooned from $1.5bn to $9bn, while the construction timetable slipped by more than five years. By the time Anglo finally brought Minas-Rio into production late last year, iron ore was already below $80 per tonne. The mine looks destined to be "lossmaking into perpetuity", according to number-crunchers at Barclays.

As a result, unless prices quickly tick higher in 2016, its closure looks almost certain. The mine's total cost of more than $15bn, meanwhile, dwarfs Anglo's current market capitalisation, which has dwindled to £4.1bn ($6.2bn). In short, Minas-Rio was "the high-water mark" of Anglo's mistakes, says Wrathall. "It was a series of strategic errors, the collective madness of the super cycle, where everyone got it wrong."

A massive price shock

The price shock that has followed the peak has sent the mining industry into cost-cutting overdrive. Companies have largely achieved this through scale, squeezing ever-more tonnage through the same cost base. Rio Tinto's output expansion in Australia means it is leading the pack. The company can currently produce iron ore for as little as $28 per tonne, but by jacking up production further that figure could fall as far as $11 per tonne by 2017, according to estimates by Deutsche Bank. Brazil's iron-ore giant Vale is similarly targeting production costs of $13 per tonne by 2018, a bearish indicator for prices, if production costs are seen as a price floor.

The cost-cutting phase of Wrathall's clock (one o'clock to two o'clock) has brought us to the current phase of dividend cuts and write-downs, as miners adjust to lower prices. Glencore, for example, has announced more than $9bn of write-downs since buying Xstrata in 2012 and in September it scrapped its dividend. Anglo followed suit last week, while BHP is widely expected to cut its dividend in 2016. The payout cost the company $6.5bn last year, enough to tip it towards an increase in net debt.

That all sounds pretty miserable.

But the next phase four o'clock is when the mining market is due to get exciting. Companies struggling to compete in the volume race will feel sharper pain. Glencore, platinum miner Lonmin, and silver group Hochschild Mining all announced emergency equity issues in 2015, but such rights issues have not yet become a hallmark of the current downturn. Anglo American is the prime candidate. Even after its latest round of closures, at these prices the group is still burning around $1.7bn a year, according to HSBC, edging its net debt ever higher.

Four years into the downturn, however, managements that have made it this far relatively unscathed will start to feel boisterous, as they come to be seen as the cycle's winners. They will be given the green light by shareholders to embark on mergers and acquisitions (M&A), picking off rivals' assets at distressed valuations. It will be a chance to dine out on the misfortune of their peers. Mining M&A has fallen in value for four consecutive years now, from around $155bn in 2011 to $45bn last year, according to accountancy Ernst & Young, while the number of deals has halved. But as prices bear down on companies, dividing the industry into winners and losers, the logic behind an uptick in deal flow becomes increasingly compelling.

Who, then, looks like the leanest and most shark-like predator? Rio Tinto could very well make the fastest move. Despite maintaining its dividend and its share buyback programme, its debtlevels are lower than those of its peers and its margins are currently higher.

"We have the strongest balance sheet of any of the major mining companies," chief executive Sam Walsh boasted earlier this month. "Now is not the time for us to be complacent. Now is the time to take this strength and actually turn it into being a world leader." As for potential targets, copper miner Freeport cancelled its dividend last week in a bid to conserve cash and has fallen by 72% this year, putting its copper assets on the block. Anglo American's copper mines in South America also increasingly look like a palatable target, promising to fatten out Rio into the world's largest mining company, grabbing the title from BHP.

Bottom of the market?

Other deals look increasingly compelling. In the diamond sector, Vancouver-based Lucara, which discovered the biggest gem-quality diamond for than a century at its Karowe mine in Botswana last month, is similarly cashed-up. The firm wants a second mine and London-listed Firestone, which is building the Liqhobong mine in Lesotho, would be a suitable target. If logical deals begin to filter through and are met by a receptive market, others are bound to follow.

But perhaps surprisingly, buying the acquirers rather than the targets looks the more sensible strategy. Not only can the predators pick their time, but with minimal competition, they can also name their price, bulking up on assets as we approach a market bottom. Wrathall's clock suggests the overall mining industry has some way to go before striking six o'clock, the absolute low-point of the cycle, when sentiment cannot get any worse. Rights issues or a high-profile company failure would both mark a worsening of the industry's current condition. The volatility of mining stocks, always tempting in a bull market, may be terrifying on the way down.

But it does have one major advantage: change happens suddenly in the mining industry and assets can move quickly from the weak to the strong. We look at the best ways to take advantage below.

The three stocks to buy now

Rio Tinto (LON: RIO) is paying off debt and has maintained both its dividend and share buyback scheme throughout the downturn. Iron ore, the group's main commodity, looks set for a prolonged downturn and the price could fall further, but Rio is well placed as the industry's lowest-cost producer. Its over-exposure to the metal, which accounted for 72% of its earnings in the first half of the year, also gives it an incentive to raid the market for unloved copper assets; Freeport is the likeliest target.

Champion Iron (ASX: CIA) is led by Australian bulk commodities boss Michael O'Keeffe, who has a deft history when it comes to finding himself on the right side of the mining cycle. Having headed Glencore's operations in Australia, O'Keeffe founded Riversdale Mining, a coal company in Mozambique, which he sold to Rio Tinto for $3.9bn at the top of the coal market in 2011. As executive chairman of Champion Iron, O'Keeffe returned to the mining markets in a big way this month, paying C$10.5m for the Bloom Lake mine in Canada, including its rail assets, which changed hands four years ago for C$4.9bn ($5bn).

Shareholders in Firestone Diamonds (LON: FDI), which is listed on London's junior market, have endured a bumpy road. But the company is now less than 12 months away from production at its Liqhobong diamond mine in Lesotho, which is budgeted to produce more than one million carats per annum for at least 15 years. The company is led by Stuart Brown, the former finance director of diamond giant De Beers, and with new diamond assets scarce, it is likely to be coveted by existing diamond producers, including Vancouver-based Lucara, which is hunting for a second mine.

Tips update

In the issue dated 7 August, we warned that miningstocks were set to go lower, but suggested four companies that were benefiting from the downturn, by expanding their underlying businesses at a cyclical low. In total, our tips are down 11% since then, compared to 40% for the mining sector over the same period. Australian gold miner Northern Star (ASX: NST) has been the best performer of the four, up 33%. Managing director Bill Beament began a buying spree after gold prices slid in 2013 and his conviction is paying off. The company remains a buy.

We also backed Australian coal miner New Hope (ASX: NHC), saying it was positioned to buy new assets. It has in September, the company paid $606m for Rio Tinto's Bengalla coal mine in New South Wales, continuing New Hope's record of buying near the bottom. However, while the company has outperformed the wider sector (down 8%), it is only for those wedded to coal. Sell.

Canadian explorer Altius Minerals (TSE: ALS) is led by CEO Brian Dalton, a hardened contrarian, who has used the downturn to mop up acreage in Michigan and Alberta. The market isgiving Altius minimal credit and shares are down 30% since August, but Altius thinks in decades and remains a buy.

Kaizen Discovery (CVE: KZD), backed by mining buccaneer Robert Friedland, has stuck to its strategy of using its links to Japanese trading houses to finance early-stage copper assets. The stock is down 41%, in line with the wider sector, and it will take time for Kaizen's plans to come to fruition. But for those betting on a cyclical rebound, it's a good small-cap play. Buy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

These 2 stocks are set to soar

These 2 stocks are set to soarTips The returns from these two aluminium and tin stocks could be spectacular when the commodity cycle turns says David J Stevenson.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

The best ways to buy strategic metals

The best ways to buy strategic metalsTips Weaker prices for strategic metals in the alternative-energy sector are an investment opportunity, says David Stevenson. Here, he picks some of the best ways to buy in.

-

A lesson for investors from a ill-fated silver mine

A lesson for investors from a ill-fated silver mineAnalysis Mining methods may have changed since the industry’s early days, but the business hasn’t – digging ore from the ground and selling it at a profit. The trouble is, says Dominic Frisby, the scams haven't changed either.