Brazil: an attractive long-term bet

Despite all the gloom surrounding Latin America, Brazil is an attractive long-term bet for investors prepared to take the risk, says Sarah Moore.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Funds with exposure to Latin America have had a dire few years, with many down by more than 50% since 2011, says Attracta Mooney in the Financial Times. Unsurprisingly, many investors are now heading for the exits. Total assets managed by European-domiciled Latin America funds have fallen by more than 70% in Europe since 2010 (to €7.5bn), with US-domiciled equivalents dropping by 85% to just $1.4bn, according to investment research company Morningstar. What was briefly a fashionable sector is now shrinking: more than a quarter of US and European-based funds specialising in the region have been liquidated since 2010, according to data provider Lipper.

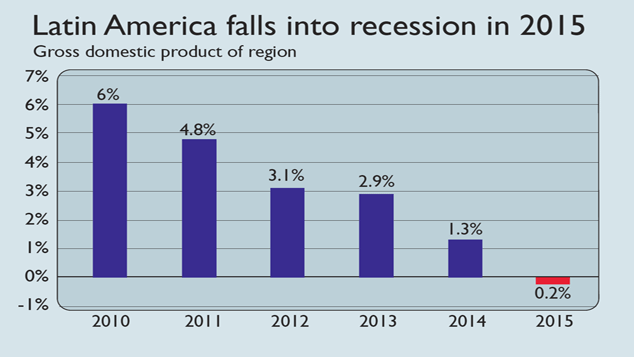

Weak performance throughout Latin America's stockmarkets can be attributed to "the three Cs", writes Patrick Gillespie for CNN Money "China, commodities, and currency". China invested heavily in Latin America's commodities over the last decade, buying iron, copper and food. But China has cut down on infrastructure projects and is directing less cash towards Latin America. Furthermore, the dollar's strong rise has made it "more expensive for Latin Americans to buy imports and, for some companies, more expensiveto pay debt that's in US dollars", says Gillespie. The result is that Latin America officially fell into recession during 2015, shrinking by 0.2% overall, according to IMF data. Five years ago, it was growing at almost 5% per year.

Brazil, Latin America's largest economy, is to blame for much of the downturn. Fears over the weak economy have been exacerbated by a corruption scandal involving its state-controlled oil company, which has entangled a large number of leading politicians and businessmen, and has led to impeachment proceedings against President Dilma Rousseff. Hence the commodity-heavy stockmarket has fallen by almost 40% in sterling terms this year and investors are retreating from Brazil in droves: the country has seen persistent capital outflows since the beginning of 2010.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Given its significance to the region it accounts for more than 40% of regional GDP and more than 45% of the MSCI Latin America index that's holding back all regional funds. "For flows into Latin America funds to pick up, you need to see a performance improvement and that really hinges on Brazil," says Simon Dorricott, senior analyst at Morningstar. "When that will happen is anyone's guess."

But despite the gloom, "there are selected opportunities' in [Brazil] among exporting companies, which have benefited from the depreciation of the real", Claudia Calich, manager of the emerging markets bond fund at M&G, tells Attracta Mooney. And while a wider economic turnaround and a resolution to the political turmoil is likely to be some way in the future, MoneyWeek views Brazil as an attractive long-term betfor those prepared to take the risk.

One way is to invest in the Aberdeen Latin American Equity Fund. This fund has struggled over three years (down 15% per year), but it "remains poised to benefit from rising consumerism across Latin America, with exposure to companies set to benefit from increased spending, such as banks and retail businesses", says Kate Marshall of Hargreaves Lansdown. The fund has an ongoing charge fee of 1.29%.

In the news this week ...

Twenty-six MPs across five UK political parties have urged their pension scheme to divest their funds of fossil-fuel investments, says Madison Marriage in the Financial Times. Caroline Lucas, the Green's party's only MP, put forward a motion in September encouraging trustees of the £500m Parliamentary Contributory Pension Fund to "evaluate the risk of its investments in high-carbon industries" and to "divest from fossil-fuel companies in areas such as coal and oil". The divestment movement is already supported by investors controlling $2.6trn of assets, including French insurance group Axa and Norway's state pension fund.

Fund group Threadneedle Asset Management has been fined £6m by the FCA for failings that left it vulnerable to a $150m fraud attempt, writes Daniel Grote for Citywire. Inadequate security procedures allowed Vladimir Gersamia, a former fund manager at the group who has since been dismissed, to attempt to execute a $150m trade for Argentinian warrants in August 2011, at four times their market value and on behalf of three Threadneedle debt funds that he did not manage. If the deal had been completed, investors in these funds would have faced a £70m loss. The only reason why it failed was that Threadneedle's systems had not traded this type of warrant before. A spokeswoman for the group said that this weakness in its security processes had now been "fully addressed".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sarah was MoneyWeek's investment editor. She graduated from the University of Southampton with a BA in English and History, before going on to complete a graduate diploma in law at the College of Law in Guildford. She joined MoneyWeek in 2014 and writes on funds, personal finance, pensions and property.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Who will follow Sri Lanka into a debt crisis?

Who will follow Sri Lanka into a debt crisis?News Sri Lanka defaulted on its debt in May as soaring global food prices and a tourism slowdown collided with years of profligate state spending. Which countries could follow?

-

The emerging-markets debt crisis

The emerging-markets debt crisisBriefings Slowing global growth, surging inflation and rising interest rates are squeezing emerging economies harder than most. Are we on the brink of a major catastrophe?

-

Make money from the metals mining boom in Latin America

Make money from the metals mining boom in Latin AmericaTips Covid-19 has hit Latin America harder than any other. But the continent's highly competitive mining sector looks poised to profit handsomely over the next few years. James McKeigue explains

-

Why Vietnam is the star of Southeast Asia

Why Vietnam is the star of Southeast AsiaEditor's letter Emerging markets should be a good source of income in the years ahead, with emerging Asia looking most appealing, and Vietnam the standout performer.

-

Latin America’s best markets are in the bargain bin

Latin America’s best markets are in the bargain binTips The Andean Three – Chile, Peru and Colombia – should have little trouble shrugging off the pandemic, says James McKeigue. And their long-term prospects remain excellent.

-

The assets to buy now – February 2015

The assets to buy now – February 2015Features Asset allocation is at least as important as individual share selection. So where should you be putting your money? Here’s February's take on the major asset classes.

-

Protect your wealth from the all-powerful bankers

Tutorials Gold is the best insurance against economic collapse and the misuse of power by central banks. But simply holding gold may not be enough. Bengt Saelensminde explains why it's essential to diversify your gold holdings, and outlines the best ways to do it.

-

How much higher can gold go?

How much higher can gold go?Features With governments and central banks intervening in the currency and bond markets on a daily basis, it's little wonder that jittery investors are being drawn to gold - it's one of the few 'free' markets left. But how much higher can it really go? John Stepek investigates.