Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Asset allocation is at least as important as individual share selection. So where shouldyou be putting your money? Here's our monthly take on the major asset classes.

Sensible insurance

Gold has slipped from late January's six-month high of around $1,300 an ounce.But ongoing jitters over political instability and a possible financial crisis in Europe will keep investors keen on "safe havens".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Disinflation and fear of deflation is likely to hold short-term interest rates down, which tends to be good for gold (as it pays no interest, the opportunity cost of holding it is lower when interest rates are low).

Demand from emerging markets remains healthy central banks bought 461 tonnes last year, up 13% on 2013 and the second-highest annual total since 1971. Russia, eager to diversify away from the dollar, accounted for a third of last year's total. Increasingly wealthy emerging-market consumers also bode well. So hold on to the yellow metal keep 5%-10% of your portfolio in it as insurance.

Set to get even more expensive?

Annual house-price growth slippedfrom a peak of 12% to 7% in 2014.It may tick up again: mortgage approvals rose for the first time in six months in December, while the healthy labour market and recent falls in mortgage rates bode well. But don't chase the market houses are already overvalued as it is, and London prime property is looking wobbly.

Buy the money printers

"Global growth is still too low, too fragile, and too uneven," says Christine Lagarde, head of the International Monetary Fund. Six years after the global financial crisis, the world economy is still hungover. Judging by stockmarkets' performance, however, you'd think the rebound had been unusually strong instead of unusually weak.

US stocks have almost tripled and Europeex-UK has just hit a seven-year high. Quantitative easing money printing has driven the gains, as liquidity leaks into asset markets. As far as developed-market equities are concerned, we think you should stick with the reasonably valued markets where the end of QE is still a long way off. So Europe and Japan remain the best bets; the US is too expensive and QE there is over for now.

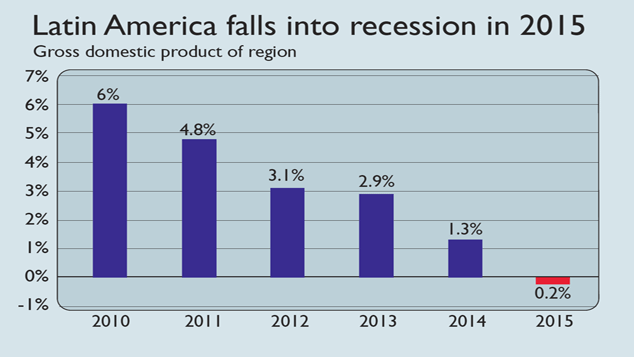

Emerging markets are going through a rough patch, beset by the end of the commodities boom, the Chinese slowdown, structural problems, the tepid global economy and political instability. But beneficiaries of the falling oil price with large domestic markets, which can offset subdued exports, are the best bets here: enter India, the Philippines, and Vietnam. Commodities exporter Brazil, meanwhile, is cheap enough to be worth a look.

The biggest bubble of all

Bonds just keep rising in price, which in turn means that yields keep shrinking some are now even negative. European bonds have been particularly in demand. This is partly due to investors worrying about a possible euro break-up or long-term deflation.

But the main driver seems to be anticipation of European QE, and the hope of selling bonds at a higher price once the money floods in. The bubble in corporate debt continues too. This week the yield on one Nestl bond maturing in October 2016 turned negative.

A perfectly negative storm

Raw-materials prices have hit multi-year lows amid "a perfect storm of negative factors", as Societe Generale's Robin Bhar puts it. China's downturn, which last year saw local steel demand drop by 3.4% (the first fall in 14 years), higher supplies and a stronger dollar are driving the trend.The printed money created by US QE, which finished last autumn, also helped prop up commodities.

Iron ore halved last year and is down 12% in 2015; copper and lead are down by a fifth since July. But we may be at or near the bottom of the metals cycle, as we point out this week in our free daily email Money Morning. Supplies areset to dwindle as production is shut down, while European QE is about torev up. Mining shares also remain reasonably priced.

Agricultural commodities are a solid long-term bet. As the world's population grows, the amount of arable land is dwindling, so over time land and soft commodities will become more valuable. Farm equipment and fertiliser stocks are better plays on the theme than commodities futures, which are extremely volatile.

A long-term switch

Oil prices are up by more than 20% since troughing at around $46 a barrel last month, as we explain in our cover story. American natural gas has slid to a three-year low, thanks to unusually warm winter weather and ample supplies. In the long term, however, more stringent environmental regulations worldwide should encourage households and industries to switch to gas, negating the surplus.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Who will follow Sri Lanka into a debt crisis?

Who will follow Sri Lanka into a debt crisis?News Sri Lanka defaulted on its debt in May as soaring global food prices and a tourism slowdown collided with years of profligate state spending. Which countries could follow?

-

The emerging-markets debt crisis

The emerging-markets debt crisisBriefings Slowing global growth, surging inflation and rising interest rates are squeezing emerging economies harder than most. Are we on the brink of a major catastrophe?

-

Why Vietnam is the star of Southeast Asia

Why Vietnam is the star of Southeast AsiaEditor's letter Emerging markets should be a good source of income in the years ahead, with emerging Asia looking most appealing, and Vietnam the standout performer.

-

Brazil: an attractive long-term bet

Brazil: an attractive long-term betFeatures Despite all the gloom surrounding Latin America, Brazil is an attractive long-term bet for investors prepared to take the risk, says Sarah Moore.

-

When the last bear turns bullish is it time to get out?

Features Famously bearish economist Stephen Roach has suddenly turned bullish on the world economy, as have plenty of others. But what does this mean for your investments?