Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Precious metals

Hang on to your gold

Gold has no yield, which means rising interest rates often mean lower gold prices. No wonder, then, that gold slid by another 7% to a five-year low in November as the US readies for a rate hike. Silver which usually mirrors and amplifies gold's movements fell even further. Keep 5%-10% of your portfolio in gold as insurance against disaster.

Equities

Buy Europe and Japan

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

UK and US shares trod water in November, but the pan-European FTSE Eurofirst 300 index hit a three-month high. A hallmark of the bull run in developed markets since 2009 has been a triumph of liquidity over fundamentals, and in Europe stocks were anticipating further monetary easing from the European Central Bank (ECB).We prefer Europe and Japan to America; both regions boast supportive central banks and reasonable valuations.

As for emerging markets, the MSCI Emerging Markets index remains near a six-year low, hit hard by the rising US dollar and the commodities downturn. GDP growth in emerging markets has slowed for a sixth successive year. However, the worst may be over. Growth should improve as China stabilises, commodities may also have bottomed, and valuations look reasonable emerging markets trade at the biggest discount to developed markets in a decade.

Bonds

Still too expensive

Developed-market bond yields have slipped again in the past few weeks due to fear of deflation in the major economies. The asset class remains very expensive after a 30-year bull run and thusvulnerable to a reversal. Any sign of unexpected inflation would scare investors, while a sell-off could be exacerbated by the dearth of liquidity in the market, as we noted last week. That caveat applies also to corporate bonds, where yield-starved investors have piled in since the financial crisis.

Property

Battered by headwinds

Momentum is draining from the UK residential market. Annual house-price growth slowed to 3.7% in November, notes Nationwide, down from more than 10% last year. Higher stamp duty on second homes and buy-to-let investors are new headwinds, added to the fact that the market remains overvalued compared to history.

Cash

Keep some on hand for bargains

The US Federal Reserve might raise interest rates next week, for the first time in almost a decade, but British savers will have to wait until 2017, hints Bank of England boss Mark Carney. That's bad for savers. But hold cash as "dry powder" to exploit future buying opportunities.

Oil

Lower for even longer

Oil prices slid again in November and are near three-month lows at around $45 a barrel. The fundamentals suggest the "lower for longer" trend will endure. The oil glut shows no sign of shrinking, with developed-world stockpiles at a record high and Saudi Arabia not expected to cut production at today's meeting in Vienna. Next year more Iranian oil could add to supply, while global demand growth has been lacklustre. A sustained rebound looks quite a way off.

Soft commodities

Good bet for the long term

The trade-weighted dollar's rebound to a 12-year high has hit both industrial commodities, notably copper and their agricultural counterparts. Softs are also suffering from rising supply we've seen three years in a row of strong harvests in grain markets, for instance. But over the very long run, softs are likely to rise, given growing populations and limited arable land. Play the theme with farm equipment or fertiliser stocks.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

The end of cheap money hits the markets

The end of cheap money hits the marketsNews Markets have swooned as central banks raise interest rates, leaving the era of cheap money behind.

-

France’s government collapses – could it trigger the next euro crisis?

France’s government collapses – could it trigger the next euro crisis?Briefings France’s government has toppled after losing a vote of no-confidence, plunging the euro zone’s second-largest economy into turmoil. Is this 2012 all over again and should Europe be worried?

-

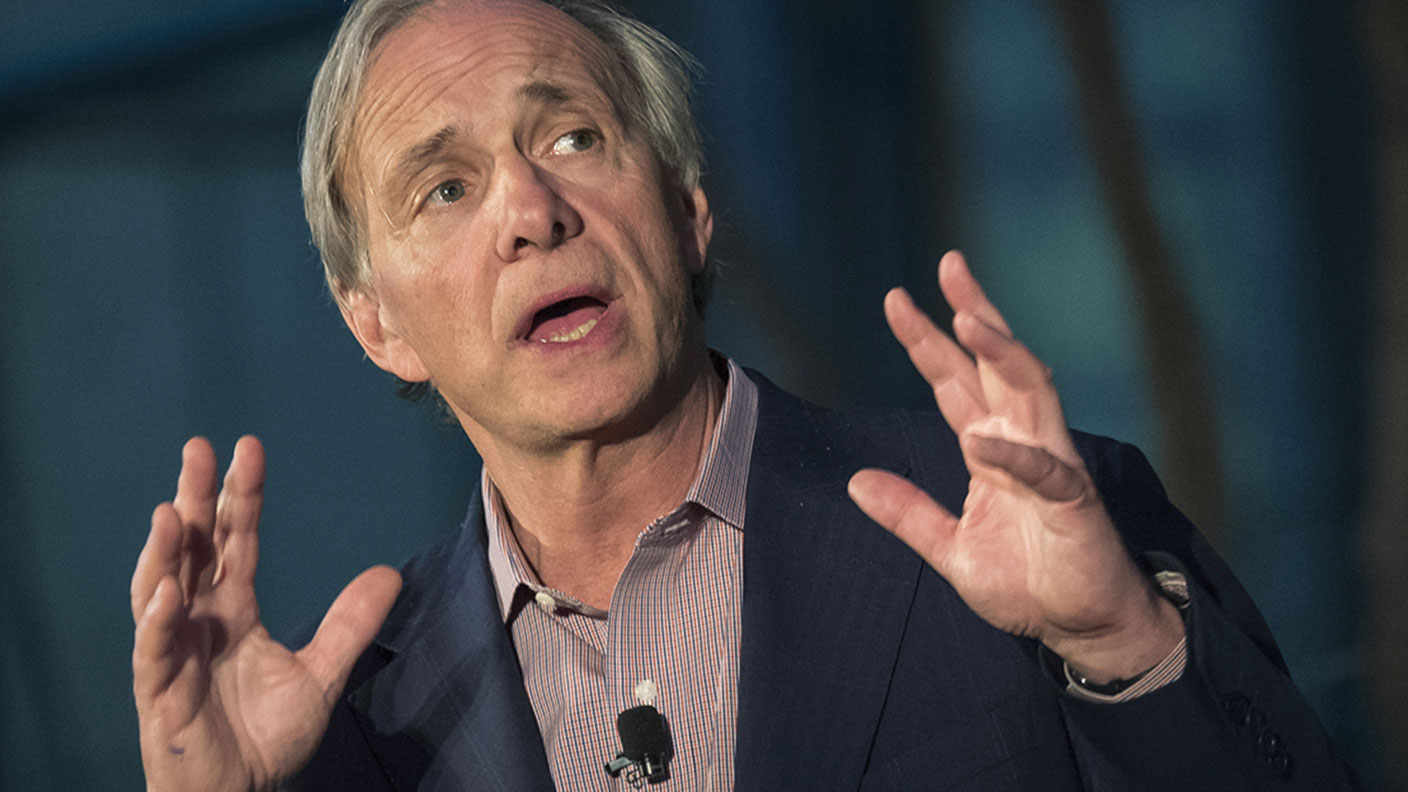

Ray Dalio’s shrewd $10bn bet on the collapse of European stocks

Ray Dalio’s shrewd $10bn bet on the collapse of European stocksOpinion Ray Dalio’s Bridgewater hedge fund is putting its money on a collapse in European stocks. It’s likely to pay off, says Matthew Lynn.

-

French stocks are back in fashion

French stocks are back in fashionNews France’s CAC 40 stockmarket index gained 29% in 2021, making it the world’s best performing major market.

-

Five unexpected events that could shock the markets in 2022

Five unexpected events that could shock the markets in 2022Opinion Forget Covid-19 – it’s the unexpected twists that will rattle markets in 2022, says Matthew Lynn. Here are five possibilities

-

Has Italy’s economy turned the corner?

Has Italy’s economy turned the corner?News Italy’s FTSE MIB stockmarket index has returned 23% so far this year, more than double the FTSE 100’s performance over the same period.

-

Overlooked European stocks are a solid bargain

Overlooked European stocks are a solid bargainNews The lack of speculative exuberance in European stocks compared to US markets bodes well for investors seeking less tech-heavy drama and more deep value.

-

Curiouser and curiouser: 20 years in the markets

Curiouser and curiouser: 20 years in the marketsCover Story Central banks have been interfering with market and economic cycles for two decades, undermining capitalism and storing up huge trouble for the future, says Andrew Van Sickle.