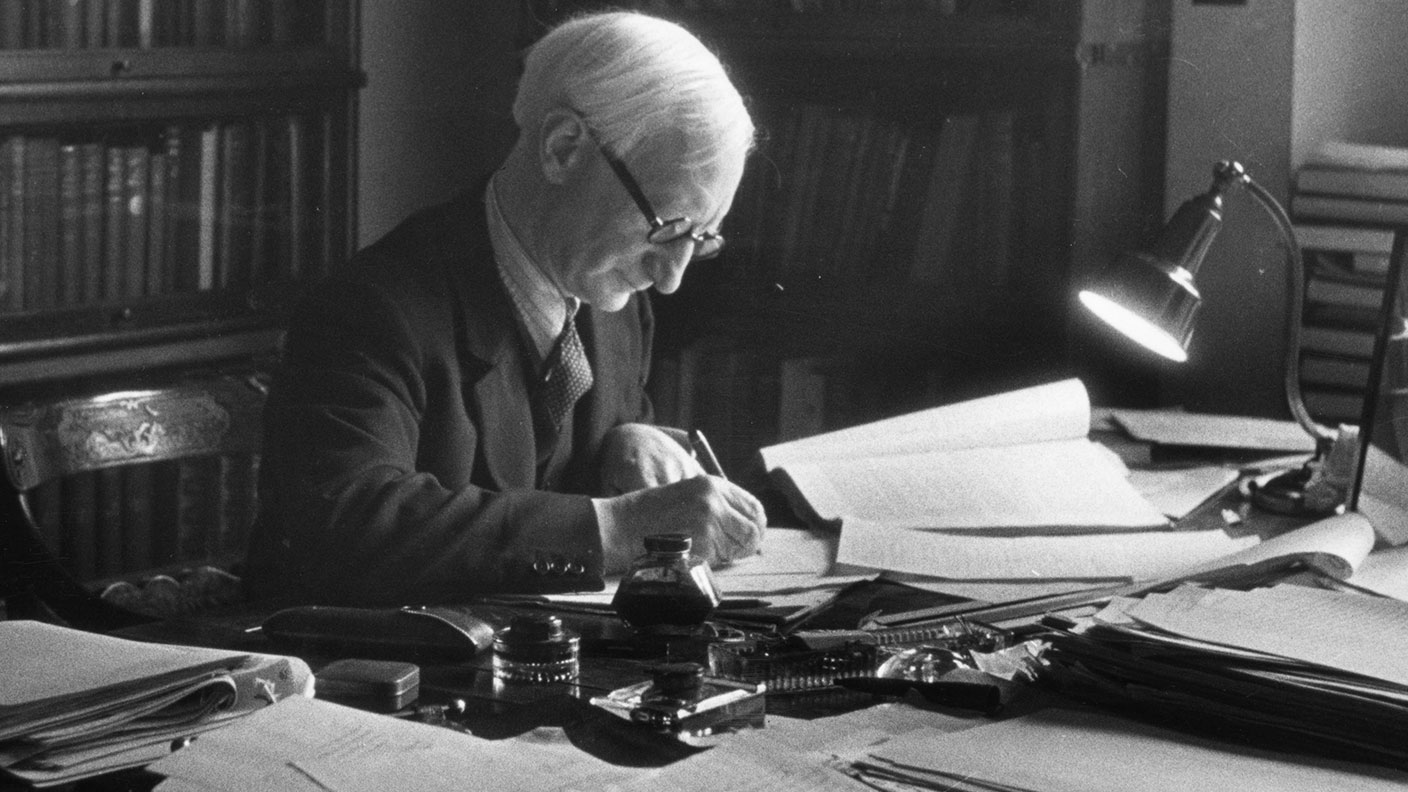

1 December 1942: the Beveridge Report proposes a welfare state for Britain

With the Second World War still raging, the popular Beveridge Report was published on this day in 1942, proposing a welfare state be set up after the war

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

With the Second World War in its third year, Britain turned its thoughts to what life would be like after the war had been won. It was “a revolutionary moment in the world's history”, said respected economist William Beveridge, “a time for revolutions, not patching”. In other words, the time was ripe to build a better society.

The problem, said Beveridge, was that there were five “giants” holding back progress: want, disease, ignorance, squalor and idleness. These could be conquered with “co-operation between the state and the individual”.

In return for a monthly payment, the state had a duty to provide social welfare to those who needed it, but it could not be so much that it would “stifle incentive, opportunity, and responsibility”. That was the central message of Beveridge's report into Social Insurance and Allied Services, published on 1 December 1942.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The Beveridge Report, as it was known, was enthusiastically received by a public that had endured months of wartime privations and misery. It called for a national health service and a welfare system “from the cradle to the grave” that paid out 24 shillings a week for a single person on unemployment benefit (40 shillings for a husband and wife), eight shillings per child in family allowance, and a state pension that guaranteed a minimum standard of living.

None of this was going to come cheap, of course. The prime minister, Winston Churchill, urged restraint and asked the public to prioritise post-war reconstruction. The public responded by voting Churchill out of office in July 1945.

For that year in 1945, the Beveridge Report estimated its recommendations would cost £697m.

Since then, with people living longer and more people retired, welfare costs have soared. Total welfare spending in the UK is forecast to be 10.8% of GDP in 2024-25, with £165.9billion for pensioners, and £35.1billion on housing benefits, according to gov.uk.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

31 August 1957: the Federation of Malaya declares independence from the UK

31 August 1957: the Federation of Malaya declares independence from the UKFeatures On this day in 1957, after ten years of preparation, the Federation of Malaya became an independent nation.

-

13 April 1960: the first satellite navigation system is launched

13 April 1960: the first satellite navigation system is launchedFeatures On this day in 1960, Nasa sent the Transit 1B satellite into orbit to provide positioning for the US Navy’s fleet of Polaris ballistic missile submarines.

-

9 April 1838: National Gallery opens in Trafalgar Square

9 April 1838: National Gallery opens in Trafalgar SquareFeatures On this day in 1838, William Wilkins’ new National Gallery building in Trafalgar Square opened to the public.

-

3 March 1962: British Antarctic Territory is created

Features On this day in 1962, Britain formed the British Antarctic Territory administered from the Falkland Islands.

-

10 March 2000: the dotcom bubble peaks

Features Tech mania fanned by the dawning of the internet age inflated the dotcom bubble to maximum extent, on this day in 2000.

-

9 March 1776: Adam Smith publishes 'The Wealth of Nations'

Features On this day in 1776, Adam Smith, the “father of modern economics”, published his hugely influential book The Wealth of Nations.

-

8 March 1817: the New York Stock Exchange is formed

8 March 1817: the New York Stock Exchange is formedFeatures On this day in 1817, a group of brokers moved out of a New York coffee house to form what would become the biggest stock exchange in the world.

-

7 March 1969: Queen Elizabeth II officially opens the Victoria Line

Features On this day in 1969, Queen Elizabeth II took only her second trip on the tube to officially open the underground’s newest line – the Victoria Line.