Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

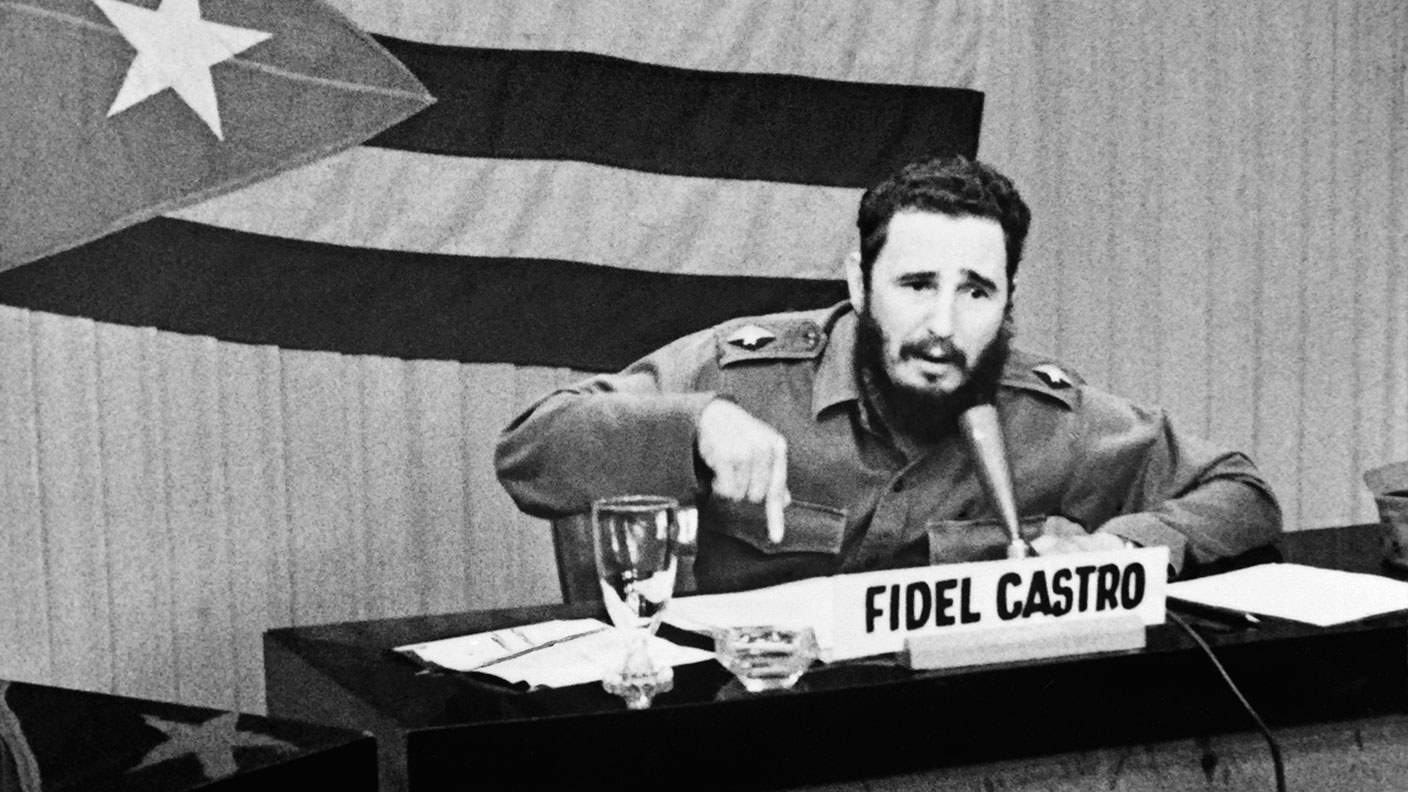

After its revolution in 1959, Cuba began trading sugar for oil with the Soviet Union. The US, which imported some 3.5 million tons of Cuban sugar every year, was deep in the throes of the Cold War, and wasn't too keen on this development.

Che Guevara (at the time the head of the National Bank of Cuba) ordered the three foreign companies who operated refineries there – Esso, Texaco and Shell – to refine the Soviet oil. After the US State Department advised them not to, they refused. So Cuba nationalised their assets without compensation. In retaliation, the US cut Cuban sugar imports and Cuba seized all American property and businesses.

And so, on this day in 1960, the US got serious. President Eisenhower banned American companies from exporting anything but food and medicine to Cuba, and placed foreign ships which traded with Cuba on a blacklist. President Kennedy extended the embargo in 1962 to forbid imports of all goods from Cuba, and prohibited aid to countries that provided assistance to Cuba. (The day before he signed the order, he is said to have sent his press secretary to buy 1,200 Cuban cigars.)

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Far from softening its stance after the fall of the Soviet Union, the US extended the embargo in the 1990s to penalise any company that did business with Cuba. But despite America's stance, much of the world has continued to do business with Cuba. The Netherlands and Canada are among its biggest trading partners, and Europeans have been holidaying there for many a long year.

On 17 December 2014, US president at the time, Barack Obama and Cuban president Raul Castro announced that work would begin to “normalise” relations between their two countries, with the eventual aim of re-establishing full relations and lifting the economic blockade that has been in place for so many years.

Cuba claims the embargo has cost it £1.1 trillion since it was imposed. The damage to the US economy is estimated at anything between $1.2bn and $4.8bn a year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

31 August 1957: the Federation of Malaya declares independence from the UK

31 August 1957: the Federation of Malaya declares independence from the UKFeatures On this day in 1957, after ten years of preparation, the Federation of Malaya became an independent nation.

-

13 April 1960: the first satellite navigation system is launched

13 April 1960: the first satellite navigation system is launchedFeatures On this day in 1960, Nasa sent the Transit 1B satellite into orbit to provide positioning for the US Navy’s fleet of Polaris ballistic missile submarines.

-

9 April 1838: National Gallery opens in Trafalgar Square

9 April 1838: National Gallery opens in Trafalgar SquareFeatures On this day in 1838, William Wilkins’ new National Gallery building in Trafalgar Square opened to the public.

-

3 March 1962: British Antarctic Territory is created

Features On this day in 1962, Britain formed the British Antarctic Territory administered from the Falkland Islands.

-

10 March 2000: the dotcom bubble peaks

Features Tech mania fanned by the dawning of the internet age inflated the dotcom bubble to maximum extent, on this day in 2000.

-

9 March 1776: Adam Smith publishes 'The Wealth of Nations'

Features On this day in 1776, Adam Smith, the “father of modern economics”, published his hugely influential book The Wealth of Nations.

-

8 March 1817: the New York Stock Exchange is formed

8 March 1817: the New York Stock Exchange is formedFeatures On this day in 1817, a group of brokers moved out of a New York coffee house to form what would become the biggest stock exchange in the world.

-

7 March 1969: Queen Elizabeth II officially opens the Victoria Line

Features On this day in 1969, Queen Elizabeth II took only her second trip on the tube to officially open the underground’s newest line – the Victoria Line.