Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Central banks these days are all-powerful behemoths, pulling the strings of the world's economies. But they didn't start out like that.

The world's first central bank was Sweden's Riksbank, famous these days for being among the first to bring in negative interest rates after the 2008 financial crisis. That was established in 1668. Then, 26 years later, came the Bank of England.

As with income tax, the Bank was born out of war with, inevitably, France. Uncharacteristically, the French had secured victory against an English and Dutch fleet in the Battle of Beachy Head. England spent a fortune rebuilding its navy and was (again) running out of money. Something had to be done.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And so, with £1.2m having been raised from investors and loaned to the government at a fairly profitable 8% rate of interest, King William III (star of the Glorious Revolution), sealed a Royal Charter on this day in 1694, creating the Bank of England.

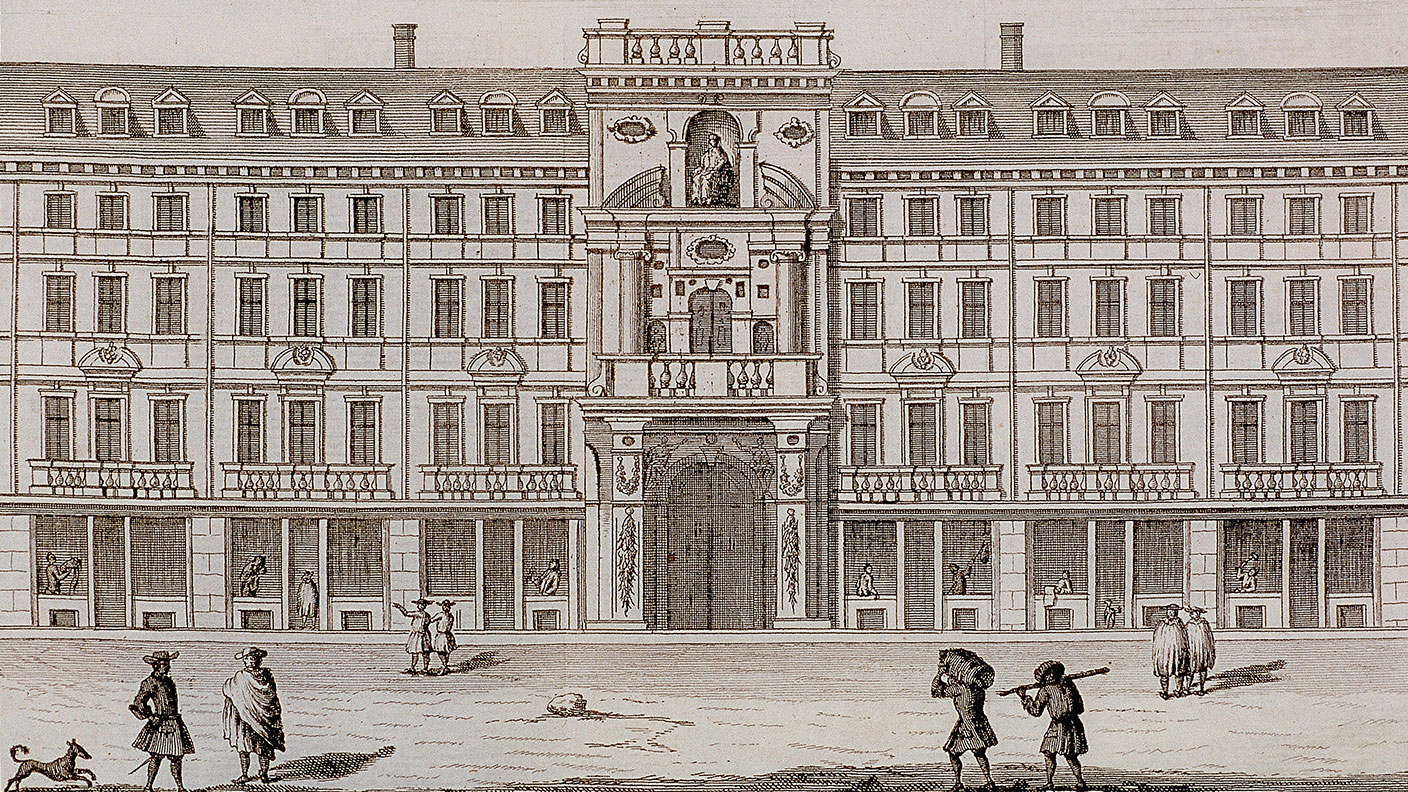

The charter gave the Governor and Company of the Bank of England a banking monopoly over the kingdom. It opened for business a few days later in Mercers' Hall, Cheapside, soon moving to the Grocers' Hall, then in 1734, to Threadneedle Street.

As well as acting as the government's banker and debt manager, it carried out normal retail banking taking deposits, making loans, and issuing coins. It rode out the South Sea Bubble in the 1720s when so many others went to the wall, and became the lender of last resort.

In 1797, it issued its first pound note (again as a result of war with France). And in 1844, it was granted a monopoly to print banknotes in England and Wales.

It was nationalised in 1946 by the government of Clement Attlee, and in 1997, it was given responsibility for monetary policy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

31 August 1957: the Federation of Malaya declares independence from the UK

31 August 1957: the Federation of Malaya declares independence from the UKFeatures On this day in 1957, after ten years of preparation, the Federation of Malaya became an independent nation.

-

13 April 1960: the first satellite navigation system is launched

13 April 1960: the first satellite navigation system is launchedFeatures On this day in 1960, Nasa sent the Transit 1B satellite into orbit to provide positioning for the US Navy’s fleet of Polaris ballistic missile submarines.

-

9 April 1838: National Gallery opens in Trafalgar Square

9 April 1838: National Gallery opens in Trafalgar SquareFeatures On this day in 1838, William Wilkins’ new National Gallery building in Trafalgar Square opened to the public.

-

3 March 1962: British Antarctic Territory is created

Features On this day in 1962, Britain formed the British Antarctic Territory administered from the Falkland Islands.

-

10 March 2000: the dotcom bubble peaks

Features Tech mania fanned by the dawning of the internet age inflated the dotcom bubble to maximum extent, on this day in 2000.

-

9 March 1776: Adam Smith publishes 'The Wealth of Nations'

Features On this day in 1776, Adam Smith, the “father of modern economics”, published his hugely influential book The Wealth of Nations.

-

8 March 1817: the New York Stock Exchange is formed

8 March 1817: the New York Stock Exchange is formedFeatures On this day in 1817, a group of brokers moved out of a New York coffee house to form what would become the biggest stock exchange in the world.

-

7 March 1969: Queen Elizabeth II officially opens the Victoria Line

Features On this day in 1969, Queen Elizabeth II took only her second trip on the tube to officially open the underground’s newest line – the Victoria Line.