30 March 1867: Russia sells Alaska to the United States

With the American Civil War out of the way, the United States agreed on a deal to buy Alaska from Russia, on this day in 1867.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The Russians had been exploring Alaska since 1725. But with the British and the Americans both pushing westwards in the 19th century, Russia began to fear for its American territory, which had become a financial burden anyway.

Still bruised from its defeat in the Crimean War, Russia asked the United States in 1859 if it would be interested in buying Alaska. The US said it would, but before the two countries could shake on it, the American Civil War broke out.

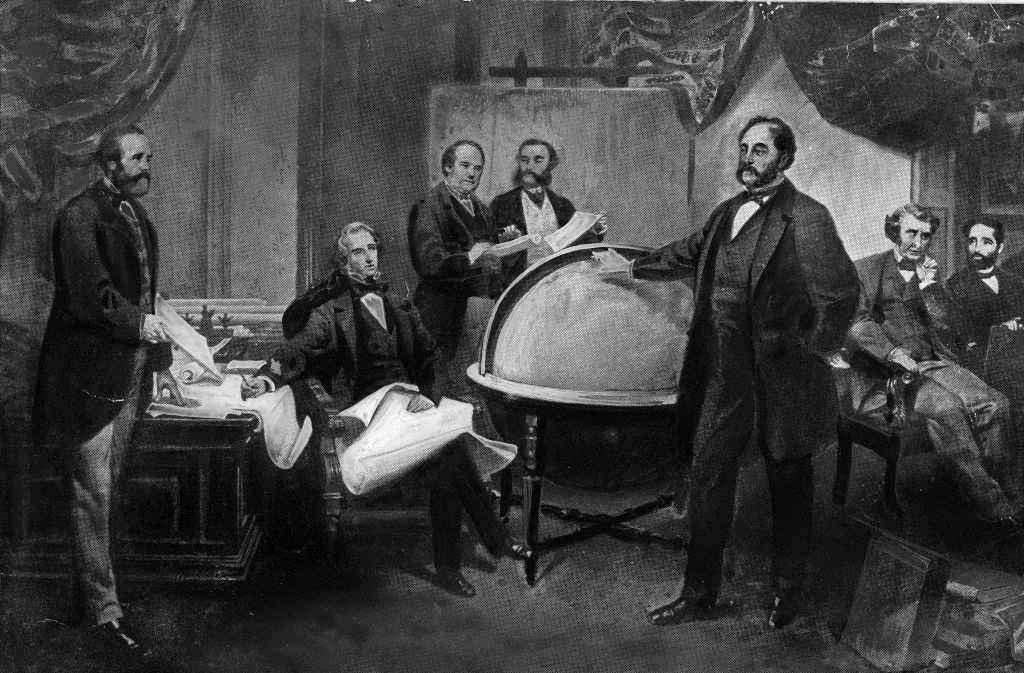

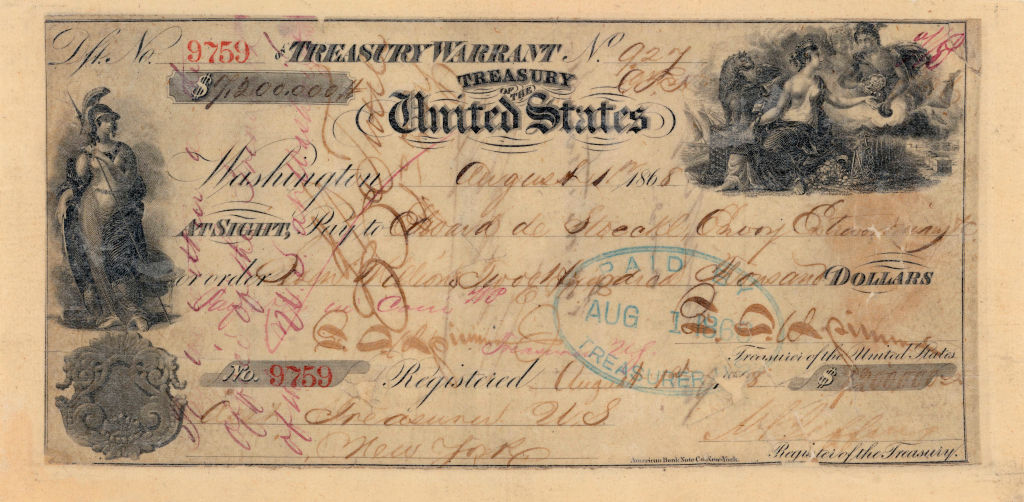

With the Union victory in the bag, in March 1867 Russia sent its minister to the United States, Edouard de Stoeckl, to try again. William Seward, the secretary of state, replied once more in the affirmative. By the end of the month, a sale price of $7.2 million had been agreed.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The purchase didn't go down well with everybody back in Washington. Critics in the press complained it was a lot to pay for ice and snow, calling it "Seward's Folly" and "Seward's icebox".

Others, however, were more enthusiastic, seeing it as another expression of Manifest Destiny' (the westwards expansion of the United States), as well as an opportunity to remove one more meddling European power from North America.

The senate lost no time in agreeing to the deal, and President Andrew Johnson put his name to the treaty in May. All that was left was for the United States to take formal possession of Alaska, which it did on 18 October that same year.

As for the nay-sayers, they were shortly to be silenced when, in 1896, gold was struck in the Klondike, leading to a gold rush that lasted until the end of the century.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

13 April 1960: the first satellite navigation system is launched

13 April 1960: the first satellite navigation system is launchedFeatures On this day in 1960, Nasa sent the Transit 1B satellite into orbit to provide positioning for the US Navy’s fleet of Polaris ballistic missile submarines.

-

9 April 1838: National Gallery opens in Trafalgar Square

9 April 1838: National Gallery opens in Trafalgar SquareFeatures On this day in 1838, William Wilkins’ new National Gallery building in Trafalgar Square opened to the public.

-

3 March 1962: British Antarctic Territory is created

Features On this day in 1962, Britain formed the British Antarctic Territory administered from the Falkland Islands.

-

10 March 2000: the dotcom bubble peaks

Features Tech mania fanned by the dawning of the internet age inflated the dotcom bubble to maximum extent, on this day in 2000.

-

9 March 1776: Adam Smith publishes 'The Wealth of Nations'

Features On this day in 1776, Adam Smith, the “father of modern economics”, published his hugely influential book The Wealth of Nations.

-

8 March 1817: the New York Stock Exchange is formed

8 March 1817: the New York Stock Exchange is formedFeatures On this day in 1817, a group of brokers moved out of a New York coffee house to form what would become the biggest stock exchange in the world.

-

7 March 1969: Queen Elizabeth II officially opens the Victoria Line

Features On this day in 1969, Queen Elizabeth II took only her second trip on the tube to officially open the underground’s newest line – the Victoria Line.

-

4 March 1519: Hernan Cortes arrives in Mexico

Features On this day in 1519, Hernan Cortes landed in Mexico before marching on the Aztec capital, Tenochtitlan.