Want to profit from 'joyflation'? Remortgage now

Inflation is at a record low and ‘bad’ deflation is off the cards, so make the most of ‘joyflation’ – remortgage at a cheap rate, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Inflation in the UK is at a record low. Annual inflation, as measured by the consumer prices index, fell to just 0.5% in December well below the Bank of England's 2% target. And it's set to get even lower. When the Bank's boss, Mark Carney, writes to George Osborne, the chancellor, next month to explain why he is obliged to do this when inflation falls below 1% he'll have to admit that it's likely to be the first of several. In fact, Carney has even said that, with the oil price still collapsing, prices might even start falling in other words, we might end up with deflation.

Deflation is the modern central banker's biggest bogeyman mere mention of it conjures up images of Japan's lost decades. So should we be worried?

We're not known for being overly optimistic here at MoneyWeek. But for now at least, it's hard to argue that Britain is at risk of bad deflation. It's certainly an issue elsewhere and there's every possibility that in the longer run it could become a global issue. But for now as Channel 4's Paul Mason puts it in a spoof letter from Carney to Osborne "You face a unique situation in modern British history: low inflation and high growth. And an election. Enjoy."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What's holding back inflation?

Let's look at the inflation figure in a little more detail. Prices rose by 0.5% in December, a lot lower than the 0.7% expected. But the key is to look at what's driving this slowdown. Bad deflation is what you get when companies are cutting back, people are being laid off, and demand is tumbling, which in turn hits corporate profits and leads to more layoffs in a vicious cycle that's what you've got in Europe.

But in Britain, the main thing holding back inflation is the recent plunge in oil prices. As the Financial Times notes: "almost all the drop in December was because of falling fuel prices and household gas and electricity bills remaining stable, rather than rising". Meanwhile, with supermarkets now realising that the only way to tackle discount stores is with full-blown price wars, prices in the shops are likely to get lower too. This is not a bad-news scenario not for consumers at least and it's not the sort of thing that triggers a deflationary spiral. As Rob Wood of Berenberg Bank puts it in the FT, "no one is likely to delay buying a television because they found it cheaper to fill up the car with petrol and the store was offering cheaper credit".

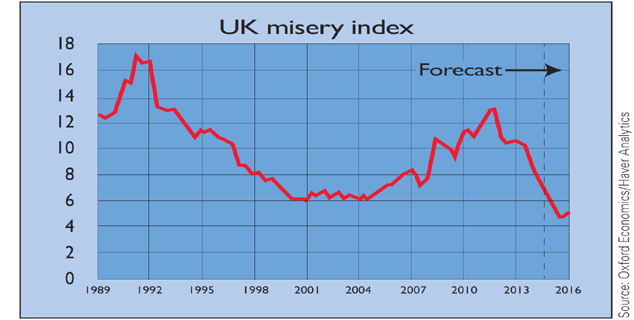

Researchers at Oxford Economics called it "joyflation" more and more people are in work, but their key living costs are either falling or not rising very quickly. The chart below shows what they mean. The "misery index'" dreamt up in the 1970s by US economist Arthur Okun when inflation and oil prices were soaring, along with the jobless rate adds the unemployment rate and inflation rate together to give a view of how grim life is for the population. Currently, it's at its lowest level in the UK since at least 1989. You might not feel like jumping for joy, but it certainly makes talk of a cost-of-living crisis look out of touch.

Need further proof that this isn't a looming deflationary crash? Just look at the inflation measure we all used to prefer right up until 2003 the retail prices index (RPI). In the crisis years of 2008 and 2009, while CPI remained well above the 0% mark, RPI spent much of the time below -1% firmly in deflation territory. That was a proper crisis. But if you look at RPI today, it's sitting at 1.6%. Equally, if you look at core inflation which strips out volatile things like fuel and food prices (and which central bankers have often used in the past to justify keeping rates low when inflation is above target) then it actually rose in December, from 1.2% to 1.3%. That's lower than normal, but it's not into spiral territory.

The best ways to benefit

What does this mean? For a start, it means that Carney is under absolutely no pressure to raise interest rates before the May election (as many had expected last year). Indeed, the City now expects that we won't see a UK rate hike until 2016 at the earliest. In the immediate term that's not good news for savers you might finally be getting a real return on your money, but there's no imminent prospect of better rates being available. You might even be tempted to lock your money up in a long-term savings bond.However, we'd be wary of acting too quickly. The long-term rates on offer are generally poor, and if this really is just a disinflationary blip, you might regret locking up your savings for a long time. As Vicky Redwood of Capital Economics points out, there's a possibility that an interest-rate rise might even still happen this year. If consumers have more money in their pockets and the employment outlook remains positive, then this would boost the economy, and thus the medium-term inflation outlook. So "a brief period of falling prices in the short term could in theory make a rate rise more likely". Of course, we suspect that Carney would rather use the excuse of a low headline number to keep interest rates low, then worry about rising inflation later.

"There's one group of people for whom this is very good news those with lots of debt."

That's one reason why we're hanging on to a nice chunk of gold in our portfolios. And it's another good reason not to lock up your cash for too long. Indeed, if Carney decides that he isn't going to "look through" the oil-price drop and ignores the threat of medium-term inflation, then when he finally does act, rates might have to rise a lot more quickly and a lot further than they otherwise would have.

So what's the best way to benefit? There's one group of people for whom this is very good news those with lots of debt. Debt is a bad thing to hold during genuine deflation (the cost of servicing your debt goes up while your wages are static or under threat). But with key living costs falling and wages (according to the Office for National Statistics) still rising ahead of inflation, that's not where we are at the moment. But with markets worldwide now not expecting much by the way of rate rises in the near future, the cost of debt remains very low in fact, for some products, it's the lowest ever.

So while we're not desperately keen on the UK property market (and London in particular) as an investment, if you are buying a property or you already own one, now is looking a very good time to remortgage and lock in a nice, low, long-term rate. See below for more.

The cheapest mortgages ever

Looking for the deal of the decade? The mortgage market might be the place to start your hunt, writes Merryn Somerset Webb. The Bank of England put out figures this week showing that mortgage rates ended last year at their lowest levels for at least 20 years (detailed records only began in 1995). Given that the bank rate is at its lowest level ever, it seems safe to say that these might be the cheapest mortgage rates on record too.

The average two-year fix can now be had for a mere 2.08%. The average two-year variable rate comes in at 1.63%. And the average five-year fix (assuming a 25% deposit) will now only cost you 3.21%. HSBC has one of the cheapest on the market if you have a 40% deposit they'll lend you money at 2.48%, and First Direct has an offer at 2.39%.

But if you think that's cheap, consider this: HSBC has just come up with a two-year fix at 1.29% (with a 40% deposit), while Barclays has just launched a ten-year fixed-rate mortgage with the "lowest-ever interest rate" for such a product, says Lisa Bachelor in The Guardian. If you have a 60% deposit (or equity to the value of 60% of your house), you can now borrow at a rate of 2.99% for ten years (down from a previous rate of 3.45%). That is a genuinely cheap deal and it's a direct result of there being some real competition in the ten-year mortgage market for the first time in the UK. A year ago, there were only eight ten-year offers in the market. Today, says Sylvia Waycot of Moneyfacts, there are 77. In the past the main reason to avoid ten-year mortgages has been FOMO fear of missing out if rates fall lower. But at the moment, while rates can of course go lower than they are in a very low-inflation environment (a 2% interest rate can halve pretty quickly), the scale of the risk is clearly lower than in the past.

However, before you jump on any cheap deals, do bear in mind that the mortgage market hasn't abandoned its profiteering tricks just because interest rates are so low. Far from it. The First Direct five-year fix mentioned above comes with an unnecessarily high fee of £1,450 and the Barclays ten-year fix comes with one of £999. There are also some nasty bits and bobs in the small print of the latter: if you want to exit the deal in the first seven years, you will pay a fee of 6% of the value of the outstanding loan. And don't think that you can avoid that by taking the mortgage with you if you move within ten years (as most people do!) there is no guarantee that the lender will agree to port the loan to your new house. TSB offers a ten-year deal you might want to look at instead: the rate is higher (3.44%), but there are only redemption fees for the first five years and there is no up-front fee.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.