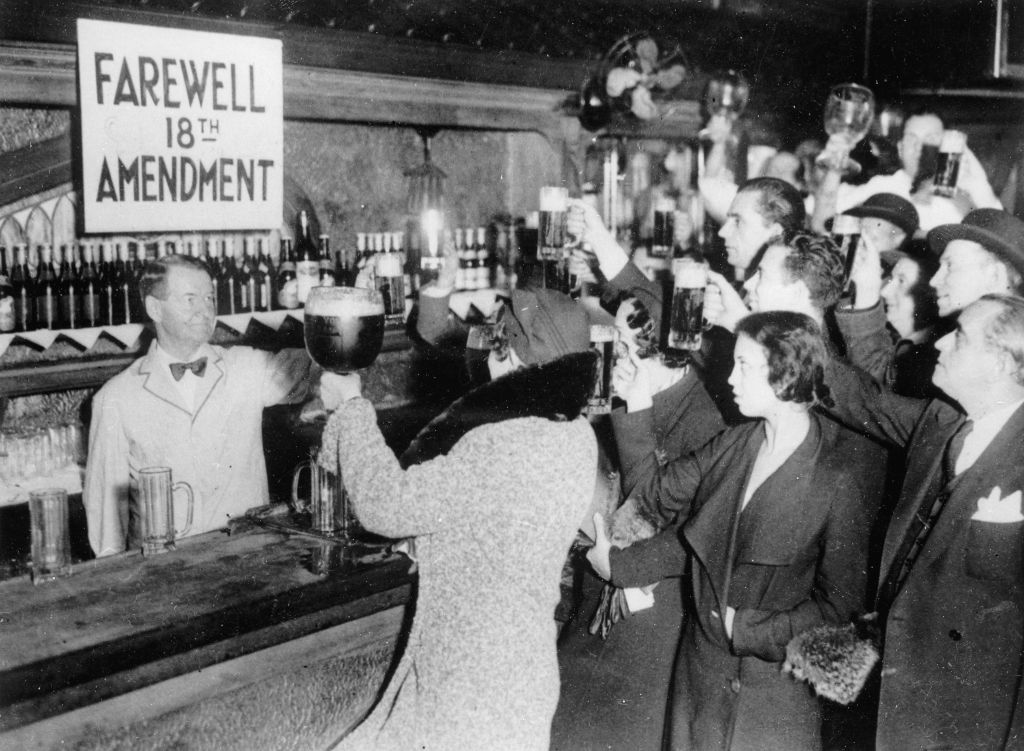

5 December 1933: prohibition ends in America

On this day in 1933, America finally gave up on its futile attempt at alcohol prohibition, which had begun with the passing of the 18th Amendment in 1919.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

From the late 19th century onwards, Temperance movements grew in popularity in the United States. They were primarily driven by a belief that easy availability of alcohol was responsible for poverty and crime (especially domestic violence).

Their dreams became reality in January 1919 when the 18th Amendment was formally ratified. This banned the sale, production and importation of "intoxicating liquor", defined as alcohol stronger than 0.5%. It would go into effect a year later.

From the start, enforcement proved futile. Organised crime and smugglers stepped in to supply a black market. The corruption that it spawned enabled many underworld figures, such as Al Capone in Chicago, to build vast fortunes. Policing was also hindered by loopholes, such as the fact that people were still allowed to make their own wine and hard cider at home. Whisky was also sold in limited quantities for "medicinal" purposes.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

By the late 1920s it was clear that the policy was a disaster. Not only did crime increase, with the homicide rate sharply up, but enforcement also proved to be expensive. While some historians have pointed out that rates of liver damage declined, recent studies have suggested that this was due to other factors, such as previous anti-alcohol policies and income.

By the 1932 election, both parties were committed to ending the experiment. In March 1933, legislation raised the minimum alcohol content to legalise low-alcohol beer. The 21st Amendment later that year repealed prohibition completely.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

Dario Amodei: The AI boss in a showdown with Trump

Dario Amodei: The AI boss in a showdown with TrumpAnthropic’s CEO Dario Amodei was on an extraordinary upward trajectory when he found himself on the wrong side of the American president. He is about to be severely tested.

-

31 August 1957: the Federation of Malaya declares independence from the UK

31 August 1957: the Federation of Malaya declares independence from the UKFeatures On this day in 1957, after ten years of preparation, the Federation of Malaya became an independent nation.

-

13 April 1960: the first satellite navigation system is launched

13 April 1960: the first satellite navigation system is launchedFeatures On this day in 1960, Nasa sent the Transit 1B satellite into orbit to provide positioning for the US Navy’s fleet of Polaris ballistic missile submarines.

-

9 April 1838: National Gallery opens in Trafalgar Square

9 April 1838: National Gallery opens in Trafalgar SquareFeatures On this day in 1838, William Wilkins’ new National Gallery building in Trafalgar Square opened to the public.

-

3 March 1962: British Antarctic Territory is created

Features On this day in 1962, Britain formed the British Antarctic Territory administered from the Falkland Islands.

-

10 March 2000: the dotcom bubble peaks

Features Tech mania fanned by the dawning of the internet age inflated the dotcom bubble to maximum extent, on this day in 2000.

-

9 March 1776: Adam Smith publishes 'The Wealth of Nations'

Features On this day in 1776, Adam Smith, the “father of modern economics”, published his hugely influential book The Wealth of Nations.

-

8 March 1817: the New York Stock Exchange is formed

8 March 1817: the New York Stock Exchange is formedFeatures On this day in 1817, a group of brokers moved out of a New York coffee house to form what would become the biggest stock exchange in the world.

-

7 March 1969: Queen Elizabeth II officially opens the Victoria Line

Features On this day in 1969, Queen Elizabeth II took only her second trip on the tube to officially open the underground’s newest line – the Victoria Line.