Buy small stocks – you have a big advantage

Ed Bowsher explains why small-cap stocks can give you a big advantage over City investors, and picks two of the best ways to buy in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

I love investing in smaller companies.

I enjoy finding out about businesses that most people aren't aware of.

I like the excitement of investing in a stock that might just might give me a 1,000% profit.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And I really like the fact that private investors are playing on a pretty much level playing field when it comes to small-cap investing. In other words, the City doesn't have an advantage over the likes of you and me.

So when I see that investors are selling out of small-caps, I get excited. It could be time to pick up some bargains.

Why small-cap stocks are a private investor's best friend

Small stocks are one area where private investors often have an advantage over the professionals or at least, they are at less of a disadvantage.

The problem with larger companies especially FTSE 100 companies is that they're followed by loads of City analysts and fund managers. Every day, people are analysing these companies and watching how they perform.

Sure, the markets sometimes misprice these larger stocks the City was far too bullish about Tesco, for example. But most of the time, the City is broadly on the right track, and, as a result, larger companies' share prices fairly reflect their current performance and future prospects.

Small companies, on the other hand, have a much smaller following. As a result, more of them are mispriced there's information available on them that the market isn't taking into account and that makes it easier for private investors to find bargains.

Private investors also benefit from investing with relatively small stakes. If you're putting £5,000 into a company with a £50m market value, you're not going to move the share price much when you buy. But if you manage a £500m fund, you have to buy a much bigger stake even at £5m, the holding will still only account for 1% of your portfolio. But by buying such a large stake (10% of the company, in this case), you would inevitably move the share price a lot, and then your investment won't be as profitable.

Small-cap stocks also tend to beat larger companies over the longer term. For example, over the 16-year period between March 1998 and March 2014, the FTSE 100 index delivered a 99.48% total return (so including dividends). The FTSE small-cap index did much better it generated a 178.4% total return over the same period.

Now looks a good time to buy as everyone else sells

But why invest now? The panicky market is currently fleeing risky-looking assets.

Well, I'd argue that the best time to buy is when others are selling. You tend to get things cheaper that way.

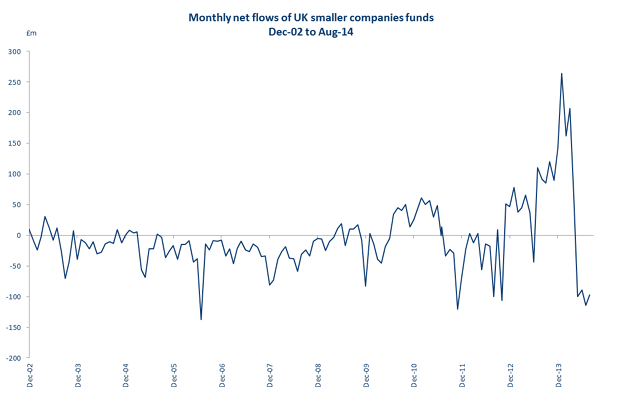

Look at the chart below. It shows the monthly net flows into investment funds that focus on smaller companies. It goes back to around 2002.

Earlier this year, the monthly net inflow for these funds reached approximately £250m. In other words, when you compared the amount that was invested in these funds with the amount that was withdrawn, investors put a total of around £250m into these funds.

But in recent months, there has been a net outflow of over £100m in other words, they've been pulling it back out again.

Source: GVO Investment Management

Given this backdrop, it's no surprise that the FTSE small-cap index has fallen from over 4,600 in February to 4,180 on Friday, a 9% fall. The index as a whole yields 2.76%, which I think is a pretty decent payout, given that a lot of the firms won't be paying any dividend at all, as they focus on investing for future growth.

The best ways to buy small-cap stocks

So how can you invest in small-cap stocks?

One option is to go for a fund that invests in smaller companies. My current favourite is the Strategic Equity Capital investment trust (LSE: SEC). There are 14 investment trusts in this sector, and the Strategic Equity trust is the top performer over the last year, as well as the last three and five years.

One reason for its success is that the fund manager, Stuart Widdowson, uses some of the techniques used by private equity investors when he picks stocks. So he looks to see if a company has assets that might be coveted by other businesses (and so very valuable). He also uses models that focus on how much shareholders would gain if the debt levels of a company were reduced.

I also like the fact that the trust is only invested in 18 companies in other words, it's highly focused. Most investment funds have a much broader investment portfolio, which arguably reduces risk for investors. But I prefer to back a manager who isn't afraid to back his judgement and invest big in potential winners. What's more, Widdowson is relatively young, so there's a good chance that he'll carry on managing this trust for ten years or longer, and may well continue to outperform over this period.

Another plus is that the trust only has a £93m market cap, unlike some of its peers which are much larger. This means that investments in relatively small companies can make a significant difference to the performance of the fund.

This issue of fund size really matters at this end of the market. Some of the popular small-cap trusts in fact have a lot of money in FTSE 250 companies, which are hard to describe as true small-caps. For example, analysts at Numis reckon around 73% of the Henderson Small Companies trust was invested in the FTSE 250 back in February, compared with just 5% for the Strategic Equity trust.

I also like the Elite Webb Smaller Companies Income & Growth fund which is the top-performing smaller companies unit trust or Oeic over the last year. Its manager, Peter Webb, was very successful in the 90s and early noughties. He didn't do so well in the run-up to 2008, and left fund management at that point before making a comeback two years ago.

Don't get me wrong. I'm not suggesting that investing in small-caps is a one-way bet. There's plenty of risk in this sector, and if the stock market as a whole falls, small-cap shares will fall too. But if you're prepared to invest for the long term, I think now looks a pretty good time to buy in, and you could do a lot worse than the Strategic Equity Capital trust.

And if you like the idea of picking your own potential small-cap dynamos, then you should read this report from my colleague David Thornton David reckons he's spotted a couple of great stocks in a sector he's very bullish on.

Our recommended articles for today

Ebola isn't going away what does it mean for stocks?

Ebola's spread around the world is making itself felt in the economy. Bengt Saelensminde looks at what it means for the stockmarkets.

Tax cuts are great but they don't always make sense

There's no doubt taxes in Britain are too high. But cutting the wrong ones might do more harm than good, says Merryn Somerset Webb.

On this day in history

13 October 1884: Greenwich adopted as the prime meridian

On this day in 1884, Greenwich was chosen as the prime meridian of longitude, settling the matter of time once and for all.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Somero: trading this overlooked bargain

Somero: trading this overlooked bargainFeatures Mechanical-screed maker Somero dominates its niche and is attractively valued. Matthew Partridge picks the best way to trade it.

-

How to find big profits in small companies

How to find big profits in small companiesCover Story The small- and micro-cap sectors are risky and volatile. But with careful research and patience, investors could make huge gains. Matthew Partridge explains how to find the market’s top tiddlers.

-

The hidden gems on Aim, London's junior market

The hidden gems on Aim, London's junior marketFeatures Aim, London’s junior market, is risky – but you can find solid stocks at low prices. Scott Longley reports.

-

Is Aim finally coming of age?

Is Aim finally coming of age?Features The Aim market of mostly smaller companies has traditionally been seen as a bit of a backwater. Is it time to change that view? Matthew Partridge talks to Paul Latham and Richard Power of fund management company Octopus.

-

Three Aim-listed firms that will thrive in a post-Brexit world

Opinion Matt Tonge and Victoria Stevens of the Liontrust UK Smaller Companies Fund pick three Aim-listed firms that will survive Brexit turmoil.

-

Fetch! The Chinese small-cap stocks to buy in the Year of the Dog

Opinion Each week, a professional investor tells us where she’d put her money. This week: Tiffany Hsiao of Matthews Asia selects three Chinese small-cap stocks with exciting potential.

-

Small and mid-cap stocks with big potential

Opinion Professional investor Guy Anderson of the Mercantile Investment Trust selects three small and medium-sized firms with promising prospects that the market has missed.

-

Get cheap, reliable growth from smaller companies

Get cheap, reliable growth from smaller companiesFeatures One of the most reliable long-term investment trends is the long-term outperformance of smaller companies over blue chips. Max King picks some of the best ways to buy into this growth.