Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Before the industrial revolution, time was a fairly local thing. When the sun was at its peak, it was around midday. Everybody was happy.

But the arrival of the railways changed things. Even in Britain, the difference in time between the most easterly and westerly points is around 30 minutes. For large places, it could be hours. This played havoc with timetables. In the USA, for example, each railway company worked to its own clock, set at the location of its head office. Nobody knew which train was due when. Clearly, this could not go on.

Time was also crucial for navigation. Latitude was easy enough to reckon, but working out your longitude meant you had to know the exact time both at the place you happened to be, and at a fixed spot somewhere else.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

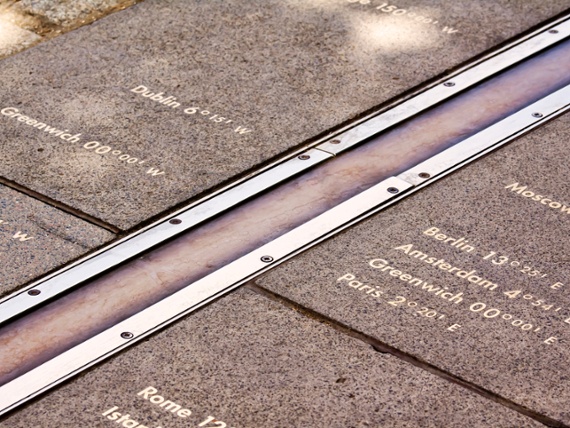

One problem was that nobody could quite agree where somewhere else should be. Britain used Greenwich. France used Paris. Others used Cadiz or St Petersburg. People had been trying to standardise time for years, but nobody could agree. And so, to settle the subject once and for all, in 1884 a conference was called by the president of the USA, Chester Arthur.

On 13 October 1884, the International Meridian Conference resolved by 22 votes to one, and two abstentions (one of which was France, obviously), that Greenwich would be the prime meridian of longitude. It was, after all, the most practical solution. Around 65% of the world's ships already used it; America used it; the British Empire used it. All of those people were hardly going to start using Paris, now, were they?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

31 August 1957: the Federation of Malaya declares independence from the UK

31 August 1957: the Federation of Malaya declares independence from the UKFeatures On this day in 1957, after ten years of preparation, the Federation of Malaya became an independent nation.

-

13 April 1960: the first satellite navigation system is launched

13 April 1960: the first satellite navigation system is launchedFeatures On this day in 1960, Nasa sent the Transit 1B satellite into orbit to provide positioning for the US Navy’s fleet of Polaris ballistic missile submarines.

-

9 April 1838: National Gallery opens in Trafalgar Square

9 April 1838: National Gallery opens in Trafalgar SquareFeatures On this day in 1838, William Wilkins’ new National Gallery building in Trafalgar Square opened to the public.

-

3 March 1962: British Antarctic Territory is created

Features On this day in 1962, Britain formed the British Antarctic Territory administered from the Falkland Islands.

-

10 March 2000: the dotcom bubble peaks

Features Tech mania fanned by the dawning of the internet age inflated the dotcom bubble to maximum extent, on this day in 2000.

-

9 March 1776: Adam Smith publishes 'The Wealth of Nations'

Features On this day in 1776, Adam Smith, the “father of modern economics”, published his hugely influential book The Wealth of Nations.

-

8 March 1817: the New York Stock Exchange is formed

8 March 1817: the New York Stock Exchange is formedFeatures On this day in 1817, a group of brokers moved out of a New York coffee house to form what would become the biggest stock exchange in the world.

-

7 March 1969: Queen Elizabeth II officially opens the Victoria Line

Features On this day in 1969, Queen Elizabeth II took only her second trip on the tube to officially open the underground’s newest line – the Victoria Line.