The bull-market in the dollar has legs

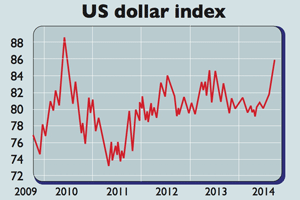

The dollar index, which tracks the greenback against a basket of major trading partners’ currencies, has leapt to a four-year high.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The dollar index, which tracks the greenback against a basket of major trading partners' currencies, has leapt to a four-year high. It has gained over 7% in the third quarter of 2014 alone, and it looks like the bullish trend will endure.

The latest rise has continued for 11 weeks on the trot, a record performance in the era of floating currencies that began in the early 1970s, notes Simon Smith of Fxpro.co.uk. The dollar has also strengthened against the euro, and it's at a six-year high against the yen.

Looking forward, remember that the main influences on exchange rates are economic growth and interest-rate expectations. Growth is certainly picking up in the US, with the latest figures confirming that American GDP grewby an annualised 4.6% in the second quarter of 2014. So that's one support for a rising dollar.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

As for interest rates, one member of the Federal Reserve's Open Markets Committee has said that the first US interest-rate increase could come "sooner rather than later". Any such rise will follow the end of the Fed's quantitative easing (QE), or money printing, programme, which is widely expected to cease this month.

An improving trade balance is another boost for the dollar. Until recently, the US currency was weighed down by a huge current-account deficit in other words imports were much higher than exports. (If a country has a big trade deficit, a cheaper currency can help shrink it.)

However, the US trade deficit is now only 2.3% of GDP, down from 5% ten years ago. This improving trade position should serve to help keep the dollar high.

Japan, too, looks likely to loosen monetary policy further. So the outlook for the yen and the euro is bearish.

Also, some previously high-yielding currencies are no longer so attractive as their interest rates have declined in the past few years. Australia is a good example.

Overall, the dollar should continue flexing its muscles in the forex markets. Morgan Stanley is pencilling in further gains against the euro in particular. It expects the euro, now worth $1.27, to buy only $1.15 by the end of next year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.