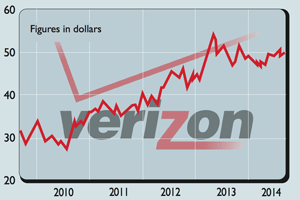

Shares in focus: Can the good times last for Verizon?

The American telecoms giants is making healthy profits, says Phil Oakley. But buying the shares isn't without risk.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Profits are healthy and the dividend is safe, so snap up a few shares, says Phil Oakley.

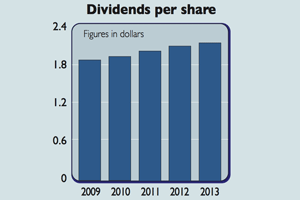

Buying shares that pay out regular chunky dividends is a popular investing strategy. Not only are these shares a good source of income, but they also tend to be a lot less volatile and risky than companies with lower yields. Investors often buy shares in telecoms for this reason. That said, blindly buying shares on the basis of yield alone can be a dangerous road to go down.

To make money from high-yielding shares, the dividend has to be safe and capableof growing.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Vodafone shareholders will be familiar with the company's US peer, Verizon Communications (Verizon), as it bought Vodafone's 45% stake in Verizon Wireless earlier this year.

While Vodafone is having to battle against weak European economies and fierce competition, Verizon seems to be having an easier time. But can the good times last and can the dividend keep on growing?

The outlook

First and foremost, Verizon has been good at looking after its customers. The quality of its service has been better than its competitors. Only AT&T really gives it a run for its money.Secondly, the US wireless (mobile) market can best be described as a cosy oligopoly.

Verizon and AT&T dominate the market. Rivals, such as T-Mobile and Sprint, are a long way behind. The relative lack of competition compared with Europe allows Verizon to earn much higherprofit margins.

Unlike Vodafone, where profits are under pressure, Verizon's are still very healthy and are growing. The company is winning new wireless customers and has been very successful at hanging on to its existing ones, as evidenced by low churn rates (the percentage of customers that leave each year).

Good-quality packages offering smartphones and tablet computers have proved to be very popular. As a result, wireless revenues grew by more than 5% during the first six months of 2014. When combined with cost-cutting and efficiency gains, that means higher profit margins.

Verizon is not resting on its laurels and is investing in its services. It's already the largest fourth-generation mobile operator in America and is adding more network capacity across the country. This allows it to offer its customers more premium services, such as faster mobile internet browsing and video streaming. These services should help Verizon maintain its competitive edge.

Like BT in the UK, Verizon is investing heavily in fibre-optic broadband services for households and businesses. Customer numbers and revenues here are growing strongly. As more customers shift from the old copper network to the fibre-optic one, Verizon should make more money from them.

It will also save money on maintenance, as the fibre-optic infrastructure is much tougher and needs fewer repairs.

It's also looking to make more money from business customers by offering cloud-based storage, network security and technology services across the world.

Should you buy the shares?

Some people think that Americans pay too much for mobile-data services and broadband and that Verizon's profits might not be sustainable. Verizon has also come in for some criticism for slow wireless data speeds.

So far, however, Verizon has escaped a big hit to its profits, and the short-term outlook looks fairly good. Revenues and profit margins should keep on growing for a while yet. A key attraction for potential buyers of Verizon shares is the strength of its cash flow and the quality of its profits.

Verizon's free cash flow per share has been consistently higher than its earnings per share (EPS) in recent years. In 2013 it generated $7.50 of free cash flow per share, compared with EPS of $4 almost twice as much. Compared with a dividend payout of $2.08 per share, you can see that Verizon's healthy free cash flow makes the dividend very safe.

Going forward, it looks like the outlook for free cash flow could be even better. Capital expenditure as a percentage of revenues will fall this year, which should mean that free cash flow will increase again. Given this, the prospects for further dividend increases are good.

Verizon shares currently trade on14 times 2014 forecast EPS. That doesn't look particularly cheap. However,when you compare the share price with last year's free cash flow per share, a multiple of 6.6 times looks a lot more attractive. Perhaps this is what has tempted Warren Buffett's Berkshire Hathaway to buy quite a few Verizon shares this year.

So if you are looking to diversify your share portfolio into a cheap overseas company that pays a good dividend, you could do a lot worse than snap up a few Verizon shares.

Verdict: buy

Verizon (NYSE: VZ)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how