Share buyback boom subsides

The bull market in stocks looks set to lose one of its drivers as companies buy back fewer shares.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

US company profits beat expectations in the second quarter of 2014. Companies in the S&P 500 index grew earnings per share (EPS) by 8.4% on average the best quarterly showing in three years.

But dig a bit deeper and the profit picture isn't as robust as it looks. And this is true not just of the recent quarter, but of the entire post-crisis profit rebound.

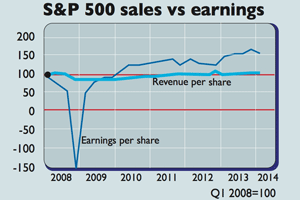

For a start, healthy earnings growth doesn't reflect the underlying economy. Sales (revenue) growth has been very weak, as the chart shows. Instead, the boost to earnings has come partly from historically high profit margins, which in turn have been helped greatly by sluggish wage growth.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, firms have also exploited another way to boost EPS they have been buying back their own shares. Buybacks raise EPS by reducing the number of outstanding shares.

Buybacks can boost share prices, as some investors see them as a sign that a stock is cheap why would management buy the stock otherwise? As Michael Mackenzie notes in the Financial Times, since the start of 2013, a US exchange-traded fund (ETF) that tracks firms doing buybacks has beaten the S&P by a third.

But "a less charitable view" is that management is out of ideas for investing to grow the business. There's also the fact that buybacks can boost managers' bonus payments by giving EPS a key performance measure an artificial lift.

The first quarter of 2014 marked the peak of the buyback wave, with $160bn announced, compared to $120bn in the second quarter.

Why is the momentum ebbing? Many companies have taken advantage of record-low interest rates, fuelled by quantitative easing (QE), to borrow money to fund buybacks. But QE ends in October, while net debt in the American corporate sector now stands at a record $2.3trn, up 14% in the past year.

So, there seems little scope for the buyback boom to keep going. "When it finally sputters, be prepared for it to weigh on forward earnings expectations," says Chris Versace on Foxbusiness.com. The bull market, in short, looks set to lose one of its drivers.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how