Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

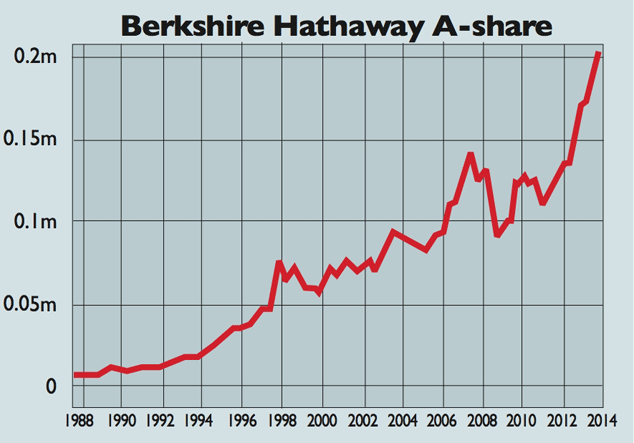

Shares in Berkshire Hathaway, Warren Buffett's holding company, are now worth over $200,000 each. Berkshire, which invests in businesses from insurance to rail freight, could be bought for under $10 in the early 1960s.

It is so expensive because it has never undergone a stock split. A pricey stock is harder to buy or sell, but Buffett says that weeds out short-term speculators and encourages the kind of long-term investor he wants.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

The Stella Show is still on the road – can Stella Li keep it that way?

The Stella Show is still on the road – can Stella Li keep it that way?Stella Li is the globe-trotting ambassador for Chinese electric-car company BYD, which has grown into a world leader. Can she keep the motor running?

-

Investing in the energy sector – is the reward worth the risks?

Investing in the energy sector – is the reward worth the risks?The energy sector used to offer predictable returns, but now you need to tread carefully. Is the risk worth it?

-

Power your portfolio with the profits of China’s electric-vehicle makers

Power your portfolio with the profits of China’s electric-vehicle makersOpinion A professional investor tells us where he’d put his money. This week: Ewan Markson-Brown of the CRUX Asia ex-Japan Fund highlights three favourites.

-

Buy stocks with wide moats to protect your profits

Buy stocks with wide moats to protect your profitsTips Companies with wide "moats" – attributes that give them an enduring competitive advantage – tend to thrive over the long term. Dr Mike Tubbs explains how to identify them and how to invest in them.

-

Three high quality companies that can generate real value

Three high quality companies that can generate real valueTips Professional investor Christopher Rossbach of J. Stern & Co picks three high-quality companies trading at very attractive prices.

-

The nifty nine: a portfolio of stocks to buy and hold forever

The nifty nine: a portfolio of stocks to buy and hold foreverCover Story A diverse range of stocks you can buy and keep forever should be a core part of any equity portfolio, says Dr Mike Tubbs. He selects his nine favourites from sectors ranging from agriculture to scientific instruments.

-

Warren Buffett is buying Exxon – but should you follow his lead?

Warren Buffett is buying Exxon – but should you follow his lead?Features Warren Buffett, one of the world’s most successful investors, has bought $3.45bn worth of shares in oil giant Exxon Mobil. Should you follow his lead? Ed Bowsher investigates.