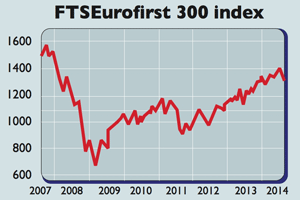

Europe’s recovery stalls

The European Central Bank is expected to resort to money printing to kickstart growth.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

"Investors are losing faith in Europe," says Manish Kabra, of Bank of America Merill Lynch. Germany's DAX index has lost 10% from its recent high. Italy's main market is down 9%; the French CAC 40, down 15%.

Worries over Ukraine have been one factor.But the key problem isan old one: Europe "produces no growth",says Didier Saint-Georgesof fund group Carmignac.

The eurozone's recovery seems to have ground to a halt. After growing by 0.7% in the first quarter of 2014, GDP was flat in the second. For once, it wasn't the troubled periphery' causing the most worry. Portugal and Spain grew by an annualised 2.6%. "Even Greece seemsto be on the road back from Hades,"says Hugo Dixon on Reuters.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But in France, where manufacturing and services activity is falling, output was stagnant. In Italy, a renewed slide in GDP in the second quarter was depressing but not surprising, as we noted last week. But the eurozone powerhouse, Germany, which accounts for 25% of the zone's GDP, also saw output fall.

One problem is the strength of the euro, which is hampering European exports. Italy and France are dragging their feet on economic reforms designed to boost growth, while nervousness over the crisis in Ukraine is starting to dent business confidence, notably in Germany.

Falling prices and negligible growth "are a potentially lethal combination for countries weighed down by debt",says The Economist's Graphic Detail blog.

The real value of debt rises,making the burden heavier and further denting confidence, investment and borrowing, raising the spectre of aJapan-style slump.

Given all this, the European Central Bank (ECB) is expected to have to resort to quantitative easing (QE money printing) to ward off deflation and weaken the currency.

QE's impact on growth may be questionable, but it does give stocks a lift as the printed cash finds its way into markets. This suggests that eurozone stocks remain worth buying. The Greek market remains among the world's cheapest, on a cyclically adjusted price/earnings ratio of just four.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement today (3 March). What can we expect in the speech?