What to expect from emerging markets

The last decade yielded mixed results for investors in emerging markets. Cris Sholto Heaton looks at what investors can expect in the years ahead.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The last decade has been a mixed blessing for investors in emerging markets. Taken over the whole ten years, to June 2014, emerging markets have comfortably beaten developed markets: the MSCI Emerging Markets index had an annualised total return including reinvested dividends of 12.3%, in US dollar terms, compared with 7.84% for the MSCI World index of developed markets.

But gains in the second half of that period were very disappointing compared to what had gone before. During the last five years, annualised returns of 9.58% for emerging markets lagged a long way behind the 15.62% managed by developed economies. So which half of the decade was normal and what can we expect for emerging markets in the future?

A look at the long term

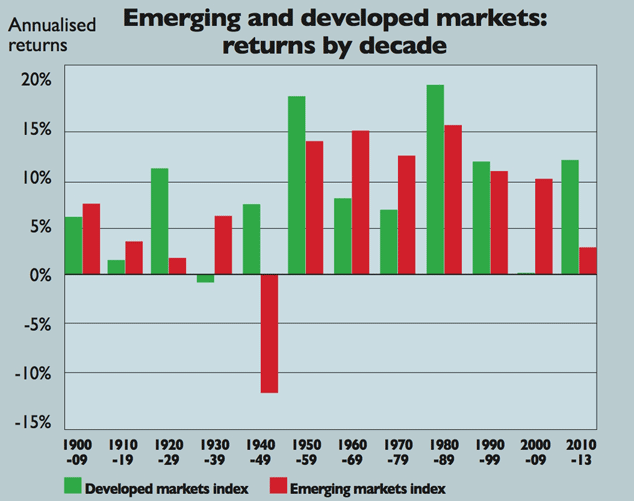

According to this index, the annualised return from emerging markets between 1900 and 2013 would have been 7.4% in US dollar terms, versus 8.3% for developed markets. In other words, contrary to what most investors believe, developed markets appear to have beaten emerging markets over the very long term.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This makes the case for investing in emerging markets look very weak. But does it reflect what we can expect from emerging markets in the future? Probably not. Their poor performance largely reflects events in the first half of the 20th century, when revolution and war meant that investors in many emerging economies, such as pre-revolutionary China and Russia, lost everything.

In the more stable conditions that prevailed from 1950 to 2013, emerging markets did rather better, returning 12.5% versus 10.8% for developed markets.

However, as the chart above shows, emerging markets still lagged behind developed marketsin half the decades since 1950. And their outperformance since 2000 was unprecedented by historical standards. This clearly shows the importance of taking a longer-term view and having realistic assumptions about the returns emerging markets are likely to deliver.

Diverging markets

For example, the MSCI Philippines index had an annualised total return of 24.49% in US dollar terms over the last five years, comfortably outperforming both the MSCI Emerging Markets and the MSCI World.

Other southeast Asian markets such as Thailand (19.89%), Malaysia (16.34%) and Indonesia (15.53%) have also seen strong returns. Conversely,other emerging economies such asBrazil (2.47%) and Chile (3.85%) have lagged far behind.

The same is also true at the stock and sector level. Many emerging-market consumer stocks have performed well even while the broader indices have fallen behind.

For example, the MSCI Emerging Market Consumer Staples Index had an annualised return of 17.88%, in US dollar terms, over the past five years. So even during a very weak spell for emerging markets, there have been opportunities to earn good returns.

The importance of value

Indeed, one reason that emerging-market returns sometimes disappoint is that people get carried away by exciting growth stories and end up overpaying for them.

Many investors are surprised to discover that focusing on value is as useful in emerging markets as it is in the developed world. A recent paper by Matthias Hanauer and Martin Linhart, of Technische Universitt Mnchen, found that value stocks outperformed growth ones in emerging markets by an average of 0.93 percentage points per month over the period from 1996 to 2012.

At a country level, Dimson, Marsh and Staunton found that countries with the highest trailing dividend yield outperformed the lowest yielders by 19 percentage points per year on average, over the period from 1976 to 2013.

They also found that investing in countries with the highest growth over the past five years as investors will often do if they give too much weight to the recent past delivered worst returns, whilethose with lower historic growth substantially outperformed.

The good news is that many emerging markets look relatively cheap. The MSCI Emerging Markets index trades on a price/earnings ratio of 13, compared to 18 for the MSCI World. That implies that emerging markets could well be set to outperform developed markets over the medium term. But investors should be aware that the exceptional returns of the early 2000s are unlikely to be repeated.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King