Is merger mania back?

It’s the busiest first half-year for mergers and acquisitions since the height of the credit bubble in 2007.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

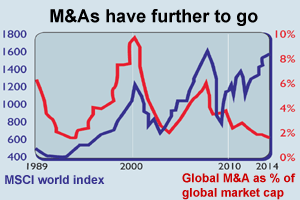

Deals worth $1.83trn were agreed worldwide in the first half of 2014. That's up 41% on the same time last year, and it's the busiest first half for mergers and acquisitions (M&A) seen since the height of the credit bubble in 2007.

There are several reasons for the M&A comeback. As the slow, but steady economic recovery has taken hold, firms have become more confident. They have plenty of cash with which to scoop up rivals and expand their exposure to promising markets: about $7.5trn, according to Thomson Reuters. Rising share prices mean that buyers who pay for mergers with stock (rather than cash) also have "a stronger currency", says John Authers in the Financial Times. And as for debt financing, it has never been this cheap to borrow money. In short, "it really is a bit of a perfect storm when it comes to dealmaking", says Frank Aquila of Sullivan & Cromwell LLP.

The boom looks set to continue. There are pockets of irrational exuberance' drugmaker Merck offered to buy a biotech firm last month at 240% above its market value, for instance but the market doesn't look especially frothy yet. Alistair Gunn of Jupiter Asset Management notes that companiesaren't overextending themselves asthey were at the top of the marketin 2007.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Back then, companiestypically borrowed too much cashand spent it on their targets. Today,they tend to use their own stock, or a mixture of stock and cash. Meanwhile, M&A represents only a small proportion of the total value of global stocks, compared to previous peaks, says Andrew Milligan of Standard Life. At the tops in 2000 and 2007, M&A comprised 10% and 6% of the combined value of global stocks respectively. Now the figure is under 2%.

The ongoing revival will reinforce, and be reinforced by, rising markets, says Authers in the FT. "Bid speculation helps raise the price of potential targets, whilethe aura of excitement and success around the acquirers helps ensure that their prices do not suffer as a result."Of course, in the long run, M&A is "a great process for creating fees for bankers, and for destroying the valueheld by shareholders". But expect the boom to continue for now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how