Britian's manufacturing is rebounding fast

Britain's manufacturing recovery has gathered pace, making an interest rate hike this year more likely.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The industrial recovery is gaining momentum. A survey of the manufacturing sector, the CIPS/Markit report, pointed to quarterly growth of around 2% between April and June, the fastest pace in 20 years.

In June, activity was just shy of November's 34-month high. A sub-index measuring job creation in the sector reached its highest level in over three years. Export orders hit a six-month high.

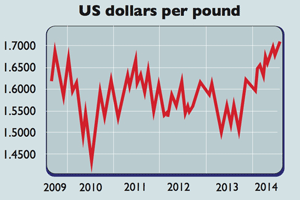

The manufacturing data implies overall GDP growth of almost 1% per quarter, according to Alan Clarke of Scotiabank, making an interest-rate hike before Christmas more likely.The pound rose to a six-year high ofaround 1.72 US dollars.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What the commentators said

It hardly helps matters that businesses on the other side of the channel don't sound nearly as optimistic as their British counterparts. There are indications that the weak recovery in Europe, which accounts for about half of UK trade, is petering out, which will undermine exports.

So while manufacturing is now powering ahead, talk of rebalancing the economy away from consumption and towards "George Osborne's feted makers'" is overblown, said Aldrick.

If manufacturing were to grow its share of national income, it would have to grow faster than the overall economy for several years. That implies an annual growth rate of around 4%. The best it could do between 1997 and 2007was 2%.

Still, at least the economy isn't as skewed towards consumption as it was pre-crisis. Ed Conway, also in The Times, pointedout that business investment has been rising for five successive quarters.And households' debt-to-income ratio has fallen to a ten-year low of 140%.Six years after the crisis hit, therepair job is making slow but steady progress.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

The UK regions with the highest proportion of homes above the inheritance tax threshold

The UK regions with the highest proportion of homes above the inheritance tax thresholdHigh house prices are pushing more families into the inheritance tax trap across the country

-

Are money problems driving the mental health crisis? MoneyWeek Talks

Are money problems driving the mental health crisis? MoneyWeek TalksPodcast Clare Francis, savings and investments director at Barclays, speaks about money and mental health, why you should start investing, and how to build long-term financial resilience.