Gamble of the week: An insurer for your new Isa

If you're wondering what to put in your new Isa, this specialist insurer could be worth a look, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This stock is an insurance company that specialises in certain areas of the insurance market, such as property, accidents, shipping and energy.It also makes money selling reinsurance (insuring other companies' insurance policies).

At first glance, these companies can be rather off-putting to the private investor. Their accounts are full of jargon that could have you reaching for the dictionary every five minutes.

However, as with lots of things, a little goes a long way. In essence, this stock is just like any other insurance company. It makes money if the insurance premiums it takes in are more than it pays out in claims. On top of that it has a large chunk of money set aside in an investment portfolio that produces an income stream.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Underwriting insurance risks is a very skilled job. Knowing which risks to take on and which to avoid is not always easy. Charging customers the right price is vital too.Charge too much and people go elsewhere charge too little and you run the risk of losing money.

Then there's always a possibility that a big disaster will come along and blow a large hole in an insurer's finances.

It would seem that Brit (LSE: BRIT) is quite good at underwriting, compared to some ofits peers. Its combined ratio (its claims and expenses as a percentage of the money it takes in from premiums) was just over 85% last year, meaning there was a tidy profit left over. This was boosted by a modest investment return on top.

The key measure of how good an insurance company is is how much profit it makes on the money shareholders have invested. Last year its return on equity was a very creditable 24.5%, but can the good times continue?

Some are using them to cutprices on certain lines of insurance,which means that for companies such asBrit, it's going to be quite hard to growprofits in the years ahead.

Brit is trying to get round this by beingsmarter with its underwriting andconcentrating on areas where pricesare firmer, or increasing a little. It isalso expanding into new areas, such asaviation, fine art and high-value houses.

Even though profit growth may be hardto come by, it would seem that thiscloud may have a silver lining. As Brithas more money on hand than it hasprofitable insurance opportunities, it ishighly likely that shareholders will be inline for some bumper dividend payouts.

Over the next couple of years most ofBrit's profits will probably be paid out,which would give the shares a dividendyield of more than 10%. Its price-to-bookvalue a key valuation measure is a relatively undemanding 1.2 times.

If you are looking for a share for yournew Isa allowance, then Brit could beworth a look. You might want to considerreinvesting any dividend income too andcompound the value of any investment.

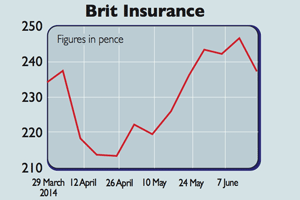

Verdict: buy at 244p

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

The downfall of Peter Mandelson

The downfall of Peter MandelsonPeter Mandelson is used to penning resignation statements, but his latest might well be his last. He might even face time in prison.

-

Default pension funds: what’s in your workplace pension?

Default pension funds: what’s in your workplace pension?Default pension funds will often not be the best option for young savers or experienced investors