Shares in focus: Should you hitch a ride with the AA?

Shares in the AA are trading on the open market below their issue price. Is this a chance to grab a bargain or should you steer clear? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The iconic motoring group looks cheap, but it's struggling and mired in debt, says Phil Oakley.

Private investors are not short of new share issues to buy these days. However, they weren't invited to subscribe for any shares in the recent AA flotation. So with the shares now on the open market and trading below their issue price, is it a good time to snap some of them up?

The outlook

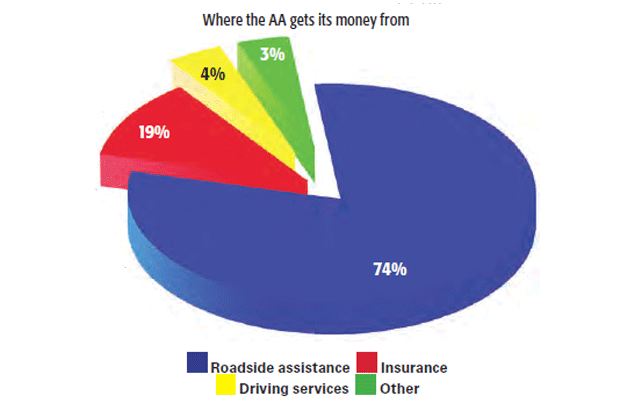

The AA is the largest roadside assistance provider in the UK. With four million private and nine million business customers, it has a 40% share of a £1.5bn market. It has also branched out into home and travel insurance, as well as plumbing and boiler maintenance, and is the biggest driving school in the UK.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The AA's customers are very loyal, with around eight out of ten of them dutifully renewing their policies every year. This makes for a business with very stable and predictable cash flows.

It also passes the test of being a profitable business with an excellent return on capital employed (ROCE) of 35%. Private-equity investors love these type of businesses and it's no surprise that the AA has been owned by a private-equity firm for the last ten years.

Good cash flows and high returns on investment are all well and good, but what people really want to know is whether this business can grow. To buy shares in the AA you have to believe that it can sell more products to its existing customers or cross-selling' as it's known.

So customers with breakdown cover are going to have to buy things like home insurance and boiler cover as well.

This sounds great in theory, but it's by no means a done deal. It's worth remembering that Centrica the owner of British Gas bought the AA in 1999in order to cross-sell products, butthe strategy never really succeeded. Centrica sold the company in 2004.

Lots of debt, but not much growth

The number of insurance policies sold has gone up, but revenues have hardly changed. That's because insurance is fiercely competitive, with providers often having to offer lower prices to stop customers going elsewhere. That probably isn't going to change. Most of the recent profit growth has come from cutting costs and this can't go on forever.

If the lack of growth isn't bad enough,the finances leave a lot to be desired too. In fact, they look quite typical of a business that has been under private-equity ownership for some time, as the AA was for ten years.

By this I mean that the business has been loaded up with debt. Last year the AA borrowed a lot of money and then used it to pay out a £2.5bn dividend to its private-equity owners. Very little of the money raised from floating the business on the stock exchange less than £200m will be used to pay off the debt. This leaves the AA with net debt (debt less cash) of around £3bn, which is morethan twice the company's market value.

What's more, the AA now has an interest bill that is barely covered twice by its trading profits. The insurance premiums from customers may be quite resilient, but all this debt turns the AA into quite a risky proposition.

The AA has so much debt that all of its surplus cash flows over the next few years will be channelled into paying it down. In fact, the resulting lower interest bills will probably be the main and perhaps only driver of profits growth.

The new shareholders appear to have signed up to a leveraged buyout on a public stock exchange. But unlike private owners, they may not be able to sell out at a big price to make it all worthwhile.

What about dividend payments? Well, it looks like they are a long way off.In fact, it would not be surprising if the AA had to ask shareholders for more money sometime in the future to lighten its debt load. That's because the surplus cash flows will only reduce the burden quite slowly.

Are the shares fairly priced?

| Ticker: | LSE: AA |

| Share price: | 248p |

| Market capitalisation: | £1.37bn |

| Net assets (April 2014): | -£2.2bn |

| Net debt (April 2014): | £2.96bn |

| P/e (Historic): | 8.9 times |

| Dividend yield: | N/A |

| Interest cover: | 2.1 times |

| ROCE: | 35% |

The interest on that debt has to be paid before shareholders get a penny. If trading profits take a hit, shareholders' share of the pie shrinks significantly. This is known as financial gearing the AA arguably has too much of it for comfort.

Debt shrinks p/e ratios and makes companies look cheaper than they actually are.

Fortunately, you can get a betteridea of a company's fair value by calculating what is known as the enterprise price/earnings ratio. This adds net debt to the market value of the shares, which givesyou the enterprise value.

Then you compare that figure to thepost-tax trading profits that are used to pay the shareholders and lenders.On that basis, the AA shares trade on a debt-adjusted p/e ratio of 15. That looks very punchy for a company that is struggling to grow. It's a good reason to steer clear of the shares.

Verdict: avoid

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?