US dollar is the horse to back

Having struggled against other major currencies for the last few years, the US dollar is due a rise.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

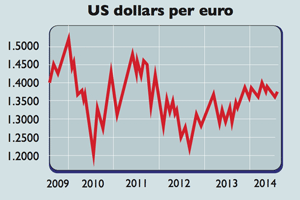

In the past few years, the US dollar has struggled against the other major currencies. The dollar index, which tracks its performance against that of its key trading partners' currencies, has been treading water for three years.Against the pound, the dollar has slid to a six-year low. It is not far off a three-year low against the euro.

A currency's strength usually boils down to expectations for growth and interest rate changes, says Ben Levisohn in Barron's. Solid growth implies higher interest rates. That raises the yield on a currency, making it more appealing.

On this view, the dollar should be doing better than its rivals. The US economy may have shrunk at an annual pace of 2.9% in the first quarter, but that was down to the unusually cold winter.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Deutsche Bank expects American growth of around 3% for the rest of 2014, and the backdrop is promising. Consumer confidence is at its highest level since before the credit crisis. Manufacturing and service-sector activity is strong.

Government spending cuts and tax rises, which have squeezed growth in recent years, are easing up. Even business investment so far the missing link in this recovery should start to rise soon, reckons Deutsche Bank.

Meanwhile, the European recovery remains tepid and the European Central Bank is far more likely to start printing money than to raise rates. The Bank of Japan is also ready to do more quantitative easing (money printing) to weaken the yen and beat deflation.

Only sterling is in a similar position to the dollar in terms of interest rate and growth expectations. But in the pound's case, a lot of the good news is already priced in, says Morgan Stanley this is clear from its recent upswings.

All this means that the US dollar is now the horse to back in the currency markets. Morgan Stanley sees the euro-dollar rate easing from $1.37 to the euro to $1.27 by the end of March 2015, and Bank of America Merrill Lynch takes a similar view.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.