Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Engineering is a cut-throat industry.It's very competitive and customers are always looking for cheaper prices and better-quality products. To prosper you have to be very good at what you do.

As I said a few weeks ago when I coveredIMI(LSE: IMI), Britain is home to some very good engineering companies ones that have carved out a profitable niche in markets that are growing. GKN(LSE: GKN) can be included in that list.

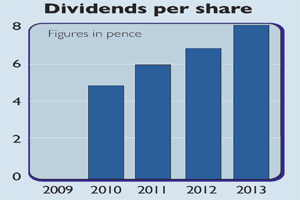

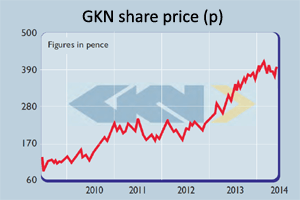

Like a lot of its peers, the maker ofparts that go into cars and planes suffered a lot during the last recession. It had to ask shareholders for more money and slashed costs to get itself back on track. During the last few years it has been doing well, with profits and dividends growing nicely. Its share price has followed suit. So is GKN still worth buying, or is it another example of a good company whose shares have become just a little bit too expensive?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The outlook

GKN is a world leader in what it does and seems to make good profits on the money it invests. But it probably can and should do better. Some investors are probably put off by the fact that nearly 60% of its sales come from the automotive industry a market where it has been notoriously hard consistently to make money. There's no shortage of choice when it comes to buying a car, which means competition is fierce. Even some of the best car makers, such as Volkswagen, have wafer-thin profit margins and so they squeeze their suppliers hard.

But a close look at GKN's dealings with the car makers makes for quite pleasant reading. GKN makes most of its money selling steering systems and metal powders that can be compressed and heated to make precision car parts. Profit margins are better than at most car makers, while return on investment is over 20%, which is pretty good. GKN stays ahead of the game by putting a lot of time and effort into technology so that it can move into new areas, such as all-wheel-drive cars.

GKN's automotive business manufactures all over the world and has been able to grow its sales and profits faster than the growth in the number of cars made worldwide. With the global car marketexpected to grow by around 4% a year for the next five years mainly in emerging markets and North America the outlook looks promising.

Diversifying out of cars

However, GKN's management wants to be less reliant on the car market. So it has been beefing up the aerospace business, which makes parts for planes, such as wings, fuselages (the main body section), engine structures and fuel tanks. A couple of years ago the company splashed out over £600m to buy Volvo's engine parts business, which has helped GKN diversify away from a weak military aircraft market. Seventy-three per cent of sales now come from commercial aircraft makers. There's a good chance that GKN will get its chequebook out again if it sees an opportunity to buy up good suppliers.

Commercial aviation looks like it's a good business to be in. According to the two big aircraft makers, Airbus and Boeing, growing demand for air travel will see a need for between 29,000 and 35,000 new aircraft over the next 20 years. There is already a production backlog on existing aircraft programmes, which should mean build rates will increase over the next few years. This should feed through into more orders for GKN.

Even better, GKN should also make money selling spare parts, as all these aircraft will need regular maintenance over a working life of 25 years or so. In short, more aerospace profits equals better-quality profits. This should lead to a higher rating by the stockmarket for GKN's shares.

Elsewhere, GKN also sells products for machinery used in agriculture, construction and mining. Here, life is quite hard. However, it is the company's smallest business, accounting for 12% of sales, and is not the main driver of profits or the share price.

Should you buy the shares?

All things considered, GKN looks to be in good shape and has sound finances.I think it can continue to grow its profits and dividends steadily over the next few years whilst improving its return on capital employed from the current 14% (based on my calculations).

However, the market seems a little downbeat on the company at the moment. Back in April, GKN said that growth would slow a little later in the year. It also said that the strength of the pound was becoming a problem. This would mean lower overseas profits when translated back into sterling and more expensive selling prices for stuff made in the UK.

Yet that's not necessarily a problem unless the pound keeps on getting stronger and stays that way. That's because GKN does not trade on some of the lofty valuations that some other UK engineers command. Trading on only 12.9 times expected earnings, its valuation looks quite modest given its longer-term growth prospects. Now is a decent buying opportunity.

Verdict: buy

The numbers

Directors' shareholdingsN Stein (CEO) 1,102,056A Walker (CFO) 65,000M Turner (Chair) 260,000

What the analysts say

Buy 14Hold 9Sell 1Target price 430p

Key facts

Stockmarket code LSE: GKNShare price 368pMarket cap £6.03bnNet assets (Dec 2013) £1.8bnNet debt (Dec 2013) £732mP/e (prospective) 12.9 timesYield (prospective) 2.3%Interest cover 8.1 timesROCE 14%Dividend cover 3.4 times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn