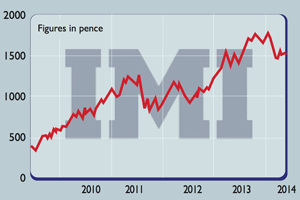

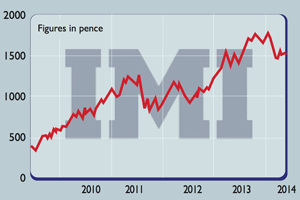

Shares in focus: Should you buy this specialist engineer?

British engineering firm IMI is a great business. Phil Oakley looks to see if now is a good time for investors to buy in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

IMI is a great business, but it's a bit pricey for now, says Phil Oakley.

Back in 2000, you could have been forgiven for thinking that IMI was just another bland medium-sized company. It made money by selling copper tubes and plastic pipes to builders, among other things. Its market value was just under £900m.

But over the next 13 years, under CEO Martin Lamb, the company set about reinventing itself as a specialist engineering business.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Today, it calls itself a specialist flow control business. It designs and makes products such as valves and actuators that control the movement of fluids so that its customers can work more efficiently, safely and cleanly. It's been very successful. IMI's market value is now £4.3bn, placing it comfortably in the FTSE 100 index.

Last year, Lamb decided he needed a new challenge and left IMI. Is this another case of a CEO getting out at the top, or can the new CEO take IMI to fresh heights?

The outlook

On the face of things, there's no reason why not. IMI has positioned itself to tackle problems arising from long-term trends such as climate change, dwindling energy resources, energy efficiency and the growth in urban living. However, a look under the bonnet makes me think the company is not firing on all cylinders.

Of IMI's three core businesses, Severe Service looks the most promising.It sells products that can cope with high temperatures and high pressure to companies in growth sectors, such as the oil and gas, petrochemicals and nuclear power industries. This business should be capable of decent profit growth in the years ahead.

Its next business, the Fluid Power unit, sees decent demand from the trucking sector, where IMI's products help to cut exhaust emissions and boost fuel efficiency. But elsewhere things have been a bit sluggish.

The Indoor Climate division is the smallest of IMI's businesses. It specialises in heating and cooling systems and has struggled to grow sales. It has pulled out of a number of emerging markets and it's hard to see this business making a big difference to future growth.

All eyes are on the new boss, Mark Selway. He has an impressive track record and lots of experience of running engineering companies. He is best known for having been the CEO of Glasgow-based Weir Group, where, during his eight years in charge, profits grew rapidly and shareholders did very well.

However,Weir was an underperforming business when he took over, and also enjoyed a boost from a commodities boom. The same cannot be said of IMI a lot of improvements have already been made.

Selway is currently reviewing IMI's strategy and will tell investors about his plans in August. He has already said that he thinks the company can become more efficient and get better by sharing best practices across all its businesses.

But to take IMI to the next level, Selway will need to grow its sales, as there's a limit to what cost cutting and efficiency gains can achieve. If IMI can develop more new products, there's every chance that its shares can still be a good investment.

Could IMI go on a buying spree?

There's also lots of competition for them from private equity companies flush with cash. If IMI does go on a buying spree, then there's a danger it will overpay, which could make shareholders worse rather than better off.

Moreover,growing profits by buying companiescan be a dangerous game. Companies that do so should not be rated as highly as those who sell more with what they already have.

I'm not saying that IMI isn't a good company. It has high profit margins, which helped it make a return on capital employed (ROCE) of 26% last year the hallmark of a good company.

It also generates lots of surplus cash flow, which supports a growing dividend and extra investment in the business. Its finances are in great shape with low levels of debt and a pension fund deficit that is being dealt with.

But when it comes to any investment, the price you pay for it determines the returns you will get. And as good a company as IMI is, its shares just look a bit too expensive right now.

Earnings are expected to grow by around 12% over the next year (although the strength of the pound means they could grow by less), but with the shares trading on over 18 times those earnings, this is priced in to the shares.

With some uncertainty regarding future strategy and sales growth, there may be a better time to buy.

Verdict: one for the watch list

IMI (LSE: IMI)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?