Japan: Abe’s arrows hit home

Japan’s prime minister, Shinzo Abe, is trying to tackle the country's low economic growth with a package of reforms.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

In the late 1980s Japan's potential growth rate was estimated at around 4% by the Bank of Japan. These days the economy's speed limit is thought to be less than 1%.

That's for three main reasons: the working-age population is shrinking; companies have slashed investing after years of stagnation; and productivity has dwindled.

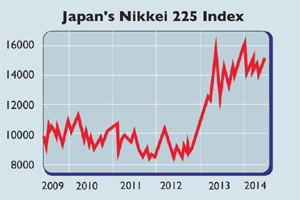

Japan's prime minister, Shinzo Abe, is now trying to tackle this with a package of reforms aimed at boosting productivity and, ultimately, growth. This is the so-called Third Arrow' of his programme to end years of deflation (the first two were money printing and more government spending).

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Some have criticised the reforms as too timid. But as one former US official told Reuters, it's unrealistic to expect an attempt to overcome all of the economy's vested interests in one go. "It isn't a Big Bang", but it is a lot better than previous reform packages that failed. The reforms are likely to produce "less than Abe hopes but more than sceptics expect", says David Pilling in the Financial Times.

Meanwhile, it is working on improving corporate governance via the new JPX-Nikkei 400 stock index, which government pension funds are being encouraged to invest in. The government also plans to expand a foreign trainee programme which may be a tentative first step to boosting immigration to offset the shrinking native workforce.

Much depends on whether the government delivers. But if it can, says JPMorgan's Jesper Koll, the economy's potential growth rate could rise from 0.8% a year now to 1.5% in the medium term. The Bank of Japan is also ready to print more money to reach its inflation target of 2%, which it currently looks like missing.

The economy is recovering from April's hike in the consumption tax, and companies look cheap. According to Morgan Stanley, the market's forward p/e hasn't been this low compared to its developed-market counterparts for 20 years. Japan remains a buy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement today (3 March). What can we expect in the speech?