Gamble of the week: A car dealer with growth potential

Much of the easy money has already been made in car dealers, says Phil Oakley. But this is no ordinary car dealer.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Britain's car market is booming.New car registrations grew by more than 8% in April the 26th consecutive month of growth. New car sales are forecast to top the pre-recession peak of 2.4 million this year.

That's good news for the likes of this Aim-listed company, the sixth biggest car dealer in the UK. But how long can the good times last?The market for new cars in Britain looks increasingly like a debt-fuelled boom, with nearly four out of five cars bought on credit.

Economies across Europe have been weak and this means that car makers have to find a home for their output to keep their factories busy.UK consumers have snapped up the tempting cheap finance deals they are offering. In fact, it seems that many of them are renting cars for three years rather than buying them outright.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This has been good for the car dealers. But what happens when interest rates rise and car finance becomes more expensive? Also there's a risk that the price of used cars could fall, which could be a problem when there are lots of three-year-old ones to sell.

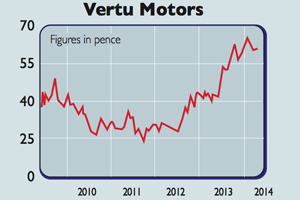

Surely the easy money has been made in the shares of car dealers? Maybe, but the investment case for Vertu Motors (Aim: VTU)isn't just linked to selling more cars. Selling new cars isn't very profitable. You have to sell lots to cover all the costs.

There's a lot more profit to be made after the car has been sold, from servicing and spare parts. This accounts for less than 10% of Vertu's sales at the moment, but has scope to increase given the growth in the number of new cars out there.

Afterstarting out with the big volumebrands, such as Ford and Vauxhall, itis now moving more upmarket withVolkswagen, Land Rover and Jaguardealerships. By building up scale withthe manufacturers, it can buy better andmake more money.

Vertu has said that it will keep on buyingdealerships. With many of the onesalready bought yet to fully mature,this should continue to be a goodsource of profit growth. And with £31mof cash on its balance sheet, it is notshort of money, so it is perfectly able todo this.

Combine this with more aftermarketsales and there is scope for Vertu'swafer-thin profit margins of just over1% to increase. The shares are quiterisky, given the dependence of new saleson debt; but trading on just over 12 timesearnings, they look worth a punt.

Verdict: buy at 57p

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.