Gamble of the week: struggling newspaper group

Buying shares in struggling companies that can recover is a good investment strategy. And this newspaper group fits the bill nicely, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Buying shares in struggling companies that can recover is a good investment strategy. That's because not many people feel comfortable buying them. This is explained by people's natural tendency to extrapolate the recent past into the future. So what's been bad, will stay bad. When things improve, the shares can go up a lot.

This week's gamble fits into this camp quite well. It has been struggling for years, and has been hammered by changes in the way people access the news.

Printed newspapers have seen their circulation plummet as more people have turned to the internet to find out what's going on in the world. This means that advertising revenue the lifeblood of publishing companies has followed them. The financial crisis and recession that followed only made this worse.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

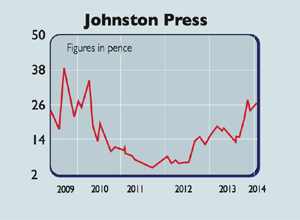

Johnston Press (LSE: JPR), publisher of newspapers such as The Scotsman and Yorkshire Post along with a host of regional and local titles,has arguably been a bit slow off the mark in embracing the shift to digital media. It has also made life difficult for itself by going on a buying spree in recent years and loading its balance sheet up with debt way too much of it. It's not really surprising that its shares have fallen a lot.

This means that the shares look very unloved. However, there are signs that the company is turning itself around. If this can continue, then the shares could be an interesting punt.

The company posted its first growth in operating profit in 2013, after seven years of continuous falls. Costs have

been slashed and the business is becoming more efficient. The rate of decline in print advertising is also slowing.

Cost cutting can only take a business so far. To be a decent investment, Johnston Press needs to grow its revenues. Increasing the cover prices of its newspapers has probably had its day.

The key to getting more income into the business is with digital content. Here, news is encouraging. Digital revenues are growing. Advertising revenues are being boosted by a buoyant property market, while an improving economy should also help other key titles, to do with jobs and motors.

The company is also placing a lot of emphasis on bringing in advertising income from small and medium sized companies in local markets. That said, digital revenues still only account for 8% of total revenues so this strategy will take a while to pay off.

But Johnston Press's share price is implying a pessimistic outcome. The shares trade on just 7.3 times forecast earnings (8.9x if adjusted for debt). With debt coming down and a good track record of cash generation, the rights issue may have paved the way for a decent profit recovery.

Verdict: buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn