How tax eats away at your investment returns

Tax combined with inflation can devastate your investment returns. Cris Sholto Heaton explains how you can minimise the damage.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

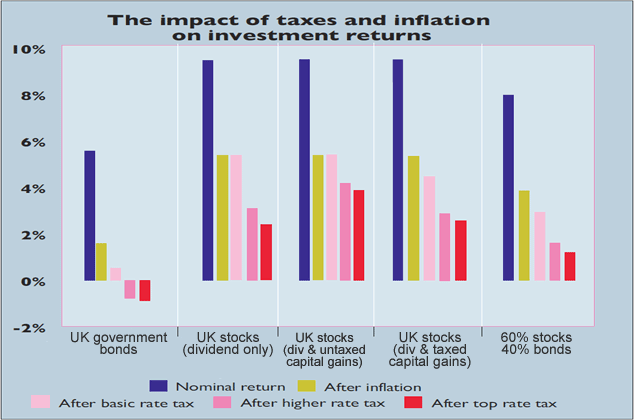

Most of us know that taxes are a drag on our investment returns, but it's easy to underestimate how big the impact is. That's because taxes are usually taken from nominal (before-inflation) returns, yet what really matters to our wealth is real (after-inflation) returns.

Once we account for the corrosive effect of taxes and inflation combined, the damage is far greater than the headline tax rate leads us to believe.

You can see this in the chart below. We've plotted investment returns under several different scenarios, using average long-term returns (since 1899) from the Credit Suisse Global Investment Returns Yearbook and UK tax rates for the 2014/15 tax year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There's a lot of information in the chart, so let's go through an example, starting with the first set of bars on the left.

The dark blue bar represents the nominal return on UK government bonds, which has averaged 5.5% per year. That falls to 1.54% after inflation is taken into account (the yellow bar). That's bad enough, but once we factor in tax, the picture becomes grim.

A basic-rate taxpayer (the light pink bar) would see their annualised real return cut to 0.48%, while higher-rate (dark pink) and top-rate taxpayers (red) would end up with -0.58% and -0.84% respectively (in other words, they lose money in inflation-adjusted terms).

The dividend tax break

If we assume that this entire return came from dividends (rather than capital gains), then the basic-rate taxpayer would pay no tax on this and earns the full 5.29% a year.The higher-rate and top-rate taxpayers earn 3.03% and 2.35%.

All taxpayers make money in real terms, but those in higher tax bands still end up with a good deal less than the headline return might suggest.

Of course, returns on stocks don't normally all come from dividends. For most of us, some will come from capital gains but the exact split will vary greatly. For simplicity, we'll assume that we make around half our profits from capital gains.

Estimating how much we lose to capital gains tax (CGT) is more complicated than with income tax, since we all have an annual CGT allowance that makes some of our capital gains tax-free. So, we'll consider two scenarios: one where all our gains are below the CGT allowance, and one where they're all above.

The pre-tax return is unchanged, but all of our taxpayers reduce their tax costs by making some of their profits from untaxed capital gains (the third set of bars in the chart). If we assume that the capital gains are all taxed (the fourth set), then our basic-rate and higher-rate taxpayers are worse off than if returns were all from dividends, but the top-rate taxpayer is in fact slightly lower better off than in the dividend-only scenario.

In the real world, our capital gains would be at least partly sheltered by the allowance, so the tax due would fall between these extremes.

The high cost of taxes

The nominal return on the portfolio is 7.85%, but the basic-rate taxpayer sees this cut to 2.85% after tax and inflation, while the higher-rate taxpayer earns 1.47% and the top-rate taxpayer makes just 1.16%.

It should be very clear to you by now that once both taxes and inflation take their toll, investment returns shrink alarmingly.

While basic-rate taxpayers tend to think that taxes are mostly a problem for those in higher tax bands, we can see that's not always the case: adding bonds to a portfolio or steadily running up some long-term capital gains can see them lose a significant part of their real returns to tax.

Three steps to minimise tax

Investments held in individual savings accounts (Isas) incur no income tax or capital gains, have no restrictions on accessing your money, and need not be any more costly than a standard dealing account. If you're happy to lock up your money until retirement, you can also consider a self-invested personal pension (Sipp).

Second, structure your portfolio to minimise overall tax. For example, if your Isa and Sipp allowances aren't sufficient to get your whole portfolio inside a tax shelter immediately, it's generally best to put bonds and real estate investment trusts (Reits) inside the wrapper first, since they suffer the highest income tax rates.

Lastly, for stocks held outside an Isa or Sipp, consider use your CGT allowance each year to take some profits tax-free.

You can even do this with investments you plan to hold for the long term as long as you wait more than 30 days between selling and repurchasing the investment, it's treated as a different transaction for tax purposes. This can be a very effective way to avoid building up an unrealised CGT liability.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

The most single-friendly areas to buy a property

The most single-friendly areas to buy a propertyThere can be a single premium when it comes to getting on the property ladder but Zoopla has identified parts of the UK that remain affordable if you aren’t coupled-up

-

RICS: UK housing market showing signs of 'tentative recovery'

RICS: UK housing market showing signs of 'tentative recovery'RICS members are becoming less negative about property sales and house prices. What does the latest data mean for the property market?