Redemptive tale of Wall Street excess

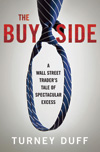

Book review: The Buy Side, by Turney DuffThis introspective tale banking excess is a cut above the average Wall-Street tell-all, says Matthew Partridge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Published by Constable (£12.99)

Wall Street memoirs are an established publishing niche the public may despise bankers, but there's still plenty of interest in the more salacious side of the job.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

As the title suggests, The Buy Side: A Wall Street Trader's Tale of Spectacular Excess, by Turney Duff, is such a memoir, focusing firmly on the nightlife with Turney progressing from after-work drinks in hotels as a lowly sales assistant at Morgan Stanley, to cocaine-fuelled orgies with escorts as a successful Wall Street trader.

Initially he throws himself into the debauchery with relish, splurging millions on drugs, designer clothes and an exclusive apartment. But this takes its toll, damaging his career and poisoning his relationships.

Despite several attempts to clean up his act, driven partly by the birth of his daughter, the stress of collapsing markets and his crumbling finances proves too much. He ends upburned out, virtually bankrupt and divorced in his early 30s.

It's not all about drugs and prostitutes. One of the firms that Duff worked for, albeit at a relatively junior level, is the notorious Galleon Group Hedge Fund.

While the firm was hugely successful, growing to have over $7bn in assets under management at its peak, it was eventually shut down by regulators, and founder Raj Rajaratnam received a record 11-year sentence for insider trading.

Duff's time there accounts for only a small portion of his book, and he is understandably circumspect about what went on. But he makes it clear that much of Galleon's edge' came via illegal access to insider information. It also benefited from an elaborate (but legal) form of bribery, whereby it would use its generous commission budget to get privileged access to public offerings of shares.

In a similar vein, Duff's book paints a picture of a world that is far from the meritocracy it's painted to be connections still play an important role. The only reason Duff gets his first job is because his uncle pulls some strings.

Similarly, he joins Galleon after a long stint on the bottom rung of the career ladder, because his manager at Morgan Stanley takes pity on him and puts him in touch with a key contact.

Although a shrewd trader, he makes business decisions on the basis of which broker provides the best entertainment.

Duff's style may be a little introspective for many, especially compared to the frenetic rush of Jordan Belfort's (The Wolf of Wall Street) memoirs. But it is certainly a cut above the average Wall-Street tell-all. As The Independent's Farah Nayeri notes, he "casts a lucid look on his past and delivers a redemptive tale that makes the reader feel less like a voyeur".

The Buy Side: A Wall Street Trader's Tale of Spectacular Excess by Turney Duff. Published by Constable (£12.99).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.