Stocks take a stumble

Expensive markets have shown themselves to be vulnerable to bad news.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

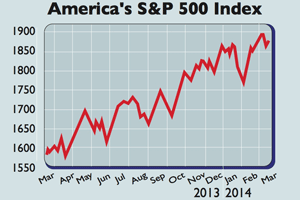

Stocks have had another bout of vertigo. America's S&P 500 fell by 2% last week. Britain's FTSE 100 lost almost 3%, its worst week in nine months. Traditional safe havens, such as government bonds and gold, strengthened. The latter has hit a six-month high above $1,380 an ounce.

Concerns for rattled investors include China's slowdown, the Crimean stand-off and the prospect of tighter US monetary policy. The main problem, however, is that markets look expensive, which makes them vulnerable to any sort of bad news.

After a five-year bull run, America's S&P 500, which sets the tone for the world, is looking overheated. According to Richard Fisher, president of the Federal Reserve Bank of Dallas, various stock-market metrics "are at eye-popping levels not seen since the dotcom boom of the late 1990s".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The S&P's forward price/earnings (p/e) ratio is 15.4, far above the ten-year average of 13.8. One of the most reliable long-term valuation measures, the cyclically-adjusted p/e ratio (Cape), sits at 25.1, 52% above the average for the past century. It hit 26 in early 2007, the highest since it peaked above 40 in 2000.

We have also been seeing the same sort of "outrageously expensive" technology stock valuations we saw back then, adds James Mackintosh in the Financial Times. The p/es on some small tech names are in the high hundreds. Twitter's price-to-sales ratiohas exceeded 30.

Earnings still show little sign of shooting up. Indeed, 85% of the S&P 500 firms that have reported on their first-quarter performance have guided expectations downwards.

All this means that US stocks, and even more attractively valued Japanese and European equities, are likely to have trouble shrugging off big-picture jitters. And it's not just stocks, notes Klarman. Investors "would have to be blind not to see bubbles inflating in junk-bond issuance, credit quality and yields".

Markets priced for perfection, and a shaky economic and geopolitical backdrop, are not a healthy mix.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how