Is this a new tech bubble?

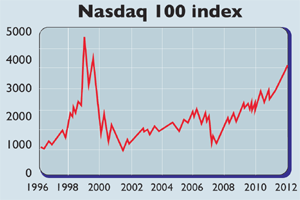

After a decade in the doldrums, the Nasdaq 100 indexis rapidly closing in on its post-millennium peak. Paul Amery asks if history is repeating itself.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The tech stock boom and bust of 1998-2002 was one of the greatest ever market bubbles, taking its place in the history books alongside Amsterdam's 17th-century tulip mania, the UK's South Sea fiasco of 1720 and the Wall Street craze of the 1920s.

Not quite. First, the index isn't the same as it was during the overheated months of the tech bubble. An index is just a shopping basket of stocks. Handily, you can buy it in a single purchase via an exchange-traded fund (ETF). But indices, especially those that weight their constituents by their market size (capitalisation), can change their constituents quite dramatically over time.

And, name apart, today's Nasdaq 100 bears little resemblance to the one that peaked in early 2000. Only one of the top five stocks by market capitalisation in the 2000 version of the index is still there Microsoft. The other members of the 2000 top five Cisco, Intel, Oracle and Ericsson have all either been demoted or have dropped out of the index altogether. Instead, new tech giants like Apple, Google, Amazon and Facebook are now the Nasdaq 100's leading stocks.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

More importantly, though, the extreme valuations of the 2000 bubble are far from being repeated.Of the two largest companies in the index, Apple (with a 12% weighting) has a price/earnings ratio of 13 and Google (with 8%) trades at 33 times last year's earnings. Overall, the Nasdaq 100 trades at a multiple of 21 times earnings certainly not cheap, but hardly stratospheric. Remember that at the peak of the market in 2000, Microsoft traded at 64 times earnings, Intel at 63, Oracle at 124, Cisco at nearly 200 and semiconductor firm Qualcomm at 235.

You can buy London-listed Nasdaq 100 ETFs from iShares, Lyxor and Amundi (with annual expense ratios of 0.33%, 0.3% and 0.23%, respectively). Alternatively (since the Nasdaq 100 selects from all non-financial stocks, not just tech companies), Source's Technology S&P US Select Sector UCITS ETF, which charges 0.3% a year, gives you purer exposure to the sector.

Paul Amery, formerly a fund manager and trader, is now a freelance journalist. Disclosure: He has recently done contracting work for Lyxor.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul is a multi-award-winning journalist, currently an editor at New Money Review. He has contributed an array of money titles such as MoneyWeek, Financial Times, Financial News, The Times, Investment and Thomson Reuters. Paul is certified in investment management by CFA UK and he can speak more than five languages including English, French, Russian and Ukrainian. On MoneyWeek, Paul writes about funds such as ETFs and the stock market.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.