Russian stocks are 'screamingly cheap'

Russian stocks were already cheap before the crisis in Crimea. Now, they are an absolute bargain. Investors should snap up these two funds to profit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investors underestimated the risks of an escalation in Ukraine, said David Thebault of Global Equities, a Paris-based asset manager. This week, they got "a wake-up call" as Russia's grip on Ukraine's Crimean peninsula tightened ominously.

Many Western markets slid by around 1% on Monday alone, while gold jumped to a four-month high as rattled investors sought out the traditional safe haven.

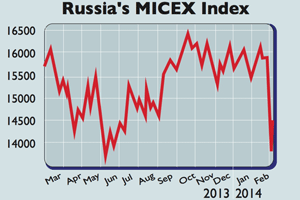

Russia bore the brunt of the sell-off amid talk of Western sanctions hitting the economy. Russian stocks fell by 12% on Monday and the rouble slid to yet another record low against the dollar and the euro.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Market heavyweight Gazprom, the gas giant that supplies Europe through Ukraine, slumped by 17%. The Russian central bank raised interest rates by 1.5%, the biggest hike since the debt crisis of 1998, to stem the slide in the rouble.

The impact on Russia

"Everything Russia's elites hold dear is now locked up in European properties and bank accounts." Europe has repeatedly balked at passing anything similar to America's Magnitsky Act, which bars a few Russian officials from entering America.

Sanctions that target the economy rather than oligarchs look even less likely. "Europe needs Russia," says Allister Heath in City AM. A full 36% of Germany's gas, 23% of France's and 27% of Italy's is Russian. "Putin could inflict immense damage."

The West also needs Russia to prop up near-bankrupt Ukraine.More than half of Ukraine's gas consumption is imported from Russia.

Also, Russia has amassed almost $500bn of foreign-exchange reserves, says Capital Economics "a substantial buffer" to ride out a period of capital outflows. Unlike in Ukraine, a balance of payments crisis "is not a threat" right now.

Structural weaknesses

A consumption boom is petering out, and to raise the economy's speed limit now, investment in production capacity will have to rise. Russia invests just 21% of its GDP, well below the emerging-market average of 30%.

A shrinking work force and poor productivity, a legacy of communism, are further problems. Endemic corruption and weak property rights companies cannot be confident that their assets won't be seized by the state are the main obstacles to boosting investment.

Meanwhile, the current account is slipping into deficit, a sign of falling competitiveness. Overall public debt is low at 15% of GDP but due to rising public spending over the past few years, the energy-dependent economy now needs an oil price of $110 a barrel just to balance the budget.

Time to buy

The MSCI Russia index is on a price-to-book-value ratio of 0.7, virtually the same as after the Lehman Brothers crisis. The cyclically-adjusted price-earnings (Cape) ratio is below seven, cheaper than any of the world's stock markets except Greece.

If Russia one day gets its act together, investors buying now should be handsomely rewarded. You can buy in via JPMorgan Russia Securities trust (LSE: JRS) or the iShares MSCI Russia Capped ETF (NYSE: ERUS).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how