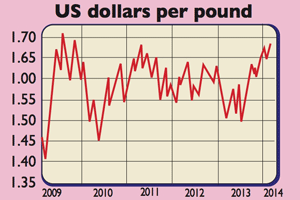

Recovery boosts the pound

A raft of good news has pushed the pound to a new five-year high against the dollar.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Inflation has fallen below the Bank of England's target rate of 2% for the first time since November 2009. Consumer Price Index (CPI) inflation dipped to an annual rate of 1.9% in January, down from 2% in December.

Meanwhile, jobless data continue to be positive. While the unemployment rate jumped from 7.1% to 7.2% in the three months to December, employment rose by 193,000, while the number of people out of work and claiming benefits slid by a hefty 27,600 in January.

The pound, buoyed by the recent run of good news, hit a five-year high against both the dollar and a basket of the currencies of Britain's major trading partners.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What the commentators said

Especially encouraging, said Deutsche Bank, is that the pace of full-time jobs growth is at its highest level since the early 1990s. The number of part-time jobs has also started to fall, suggesting that part-timers are migrating to full-time work.

In the meantime, the edge is coming off the cost of living crisis'. Earnings are still only growing at an annual rate of 1.1%.

Of course, that won't make the crisis suddenly disappear, as Patrick Collinson pointed out on Guardian.co.uk. It will take years for workers to recover their spending power. Real wages (ie, adjusted for inflation) are at 2004 levels. It's also worth noting that the old measure of inflation, which includes housing costs, ticked up to 2.8% in January.

Yet even though the recovery has yet to become fully entrenched, markets are pricing in an interest-rate rise in February next year. This may be too early, but other major central banks are "not yet even seriously considering" tightening monetary policy, said Lee Hardman of Bank of Tokyo-Mitsubishi UFJ. So the relative appeal of the pound, and hence its ascent, could continue.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.