Big rewards for adventurous investors in frontier markets

There are big potential rewards for adventurers who head to frontier markets, says David C Stevenson. Here, he tips two funds for more cautious travellers, and four markets for the true Indiana Joneses.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

There are big potential rewards for adventurers who head to the frontier, says David C Stevenson. Here, he tips two funds for more cautious travellers, and four markets for the true Indiana Joneses.

The developing world seems to be going through another difficult' stage. Balance- of-payments challenges, tumbling local currencies, foreign investors running for the hills Turkey and South Africa have all of these problems, with the chance of worse to come.

Yet, these specific emerging markets are just part of a much bigger global developing-markets story. It's a mistake to avoid investing in the whole sector just because a few countries have serious problems.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Beyond the well-known Bric (Brazil, Russia, India and China) and Mint (Mexico, Indonesia, Nigeria and Turkey) countries lies a huge group of frontier markets'.

These are countries with relatively under-developed local stock markets, limited liquidity, and less developed economies. They range from gas-rich Qatar which from May will be reclassified as an emerging market to labour-rich Vietnam.

While the MSCI Emerging Market index dropped by 4% in 2013, the index tracking frontier markets actually rose by 23%.

Why the gap? Firstly, these countries tend to have young populations and are growing fast. Secondly, investors in these markets tend to focus on domestic issues so bigger picture' problems, such as China wobbling, don't always have a big impact.

Local businesses are also under-researched and under-invested in by Westerners. This all means most frontier markets have a fairly low correlation with their bigger emerging-market siblings and a much closer correlation to developed markets.

If you look at data on money flows from CrossBorder Capital, for example, you can see that, while credit creation and corporate liquidity have been growing slowly in China, in most frontier markets, business is booming and money supply plentiful.

While the 2013 rally means markets are no longer dirt cheap, there are still lots of opportunities. Bank of America Merrill Lynch notes that earnings estimates for 2014 have been raised for frontier markets, even as they've been cut for the fourth year in a row for emerging markets.

So, how do you invest? I have some specific countries I like, which I'll get to in a moment (see stories below). But I'll not pretend this is low-risk these markets can be very volatile. If you are likely to need your money at short notice, this isn't for you.

Probably the lowest-risk option is to invest in a range of markets. You can do this via two highly regarded London-listed funds: Advance Frontier Markets Fund (LSE: AFMF), run by Tunisia-born Dr Slim Feriani, and Blackrock's Frontiers Investment Trust (LSE: BRFI), run by Sam Vecht and Emily Fletcher.

The Blackrock trust has had a better run of late, beating the main benchmark indices and tapping institutional investors for money. It trades at a small premium to book value (around 4% in other words, you're paying more than the actual value of the underlying portfolio).

The Advance trust, on the other hand, still has a 7% discount. They are very different in style: Blackrock invests directly in locally listed business (including banks such as Nigerian Zenith bank and the Qatar National Bank). The longer-established Advance trust instead uses experienced local fund managers it's a fund of fund managers, effectively.

Each approach has its pros and cons, but I'd opt for either of these over any other fund in the sector, including exchange-traded funds tracking frontier markets (which I don't think are much help in this area).

NigeriaFor me, what makes a country attractive as an investment is not just its economic backdrop, but also its willingness to embrace reform: it has to be hospitable to outside investors.

A recent HSBC analysis of frontier states focuses on 'economic structure' how dense the economic relationships are between different players in society and the economy.The theory is that even a rapidly growing economy won't amount to anything unless a vast network of business, financial and political relationships develop in the background.

On this basis, I think Nigeria is interesting. Of course, there are lots of negatives: rampant corruption, a morally deficient political system and the Boko Haram Islamic insurgency in the north, for example.

Yet, Nigeria is a quintessential frontier market: it has high growth, a large, youthful population, and huge oil and gas reserves that are helping to drive a booming consumption story. It has an increasingly complex network of (frequently informal) institutions, all committed to rebuilding the country after decades of misrule.

And it has the money to pay for new economic and social infrastructure. Its ratio of government debt to GDP has slid from nearly 100% just over a decade ago, to roughly 20% today.

This dramatic improvement means the government can allocate resources to productive areas, such as education, healthcare and infrastructure, rather than repaying debt. That bodes well for the future.

GDP growth hit 6.8% year-on-year in the third quarter of 2013, after slowing to 6.2% in the second. HSBC economists now expect 7% growth for 2014. Meanwhile, inflation is firmly under control (by Nigerian standards), averaging 7.9% over the last three months.

It's worth looking for catalysts' for any country you invest in events likely to spark a revaluation. For Nigeria, its GDP numbers are set to be rebased shortly, boosting the size of the economy.

Best of all, stock market valuations are reasonable, especially if you're interested in the banks (some of which have Global Depositary Receipts (GDRs) listed in London). The banks crashed in value in the financial crisis, but now trade on single-digit price/earnings (p/e) ratios, with high dividend yields not uncommon.

What to buy

Accessing Nigeria isn't easy, either via individual stocks or funds. The most direct way into Nigerian equities is via London-listed shares of Nigerian-quoted banks. These GDRs can be tricky for UK investors to deal in, so check with your broker first.

Zenith Bank (LSE: ZENB), Guaranty Trust Bank (LSE: GRTB) and Diamond Bank (LSE: DBPA) all boast these UK GDRs and are reasonably priced.

Another way in is via personal-care products business PZ Cussons (LSE: PZC), which has a big Nigerian business selling all manner of cosmetic goodies to local consumers. But attractive as that may seem, the company is a global business only about a third of its turnover comes from Nigeria.

Alternatively, you can access Nigeria via a diversified African equities fund: my favourite is the UK-listed Africa Opportunity Fund (LSE: AOF).

It's well run and focuses on picking individual stocks and bonds. It's also about to issue new C-class shares, which should allow it to build up its portfolio of businesses.

The downside is that the fund is barely exposed at all to Nigeria, preferring Ghana (a great place to watch), and west African mobile-phone giant Sonatel.

So, Nigerian exposure might have to come via a US-listed ETF from Global X called the Nigeria Index ETF (US: NGE). Banks account for 45% of the ETF holdings, followed by local energy firms and brewers.

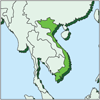

VietnamThe country has had a horrible few years, in both investment and economic terms. But it's set for a comeback. Inflation is a key issue for many frontier markets in Vietnam, it's pretty low at about 6% for 2013, the lowest annual figure for ten years.

The currency (the dong) is also relatively stable, helped by a big trade surplus (around $1bn in 2013), and record foreign-exchange reserves (more than $30bn). HSBC economist Trinh Nguyen expects the economy to grow by 5.6% in 2014, ahead of last year's 5.4%.

But what should really make a difference is that the ruling Communist Party is keen to reform the economy (echoing many of China's ideas) and is pushing initiatives such as stock market reform.

Foreign ownership limits (on non-bank stocks) look set to be raised from 49% to 60%. Another catalyst is worth watching: the country should soon sign the Trans-Pacific Partnership Agreement (TPP) between 12 nations across the Pacific Ocean.

This will create a free trade zone covering 40% of world GDP and 30% of global trade, according to HSBC. "Vietnam should emerge as a big winner, seeing higher demand for its textiles, apparel and footwear products. The agreement will also pave the way for pruning the role of state-owned enterprises (SOEs) in the Vietnamese economy one of the prime conditions mentioned in the TPP negotiations."

The local stock market rose by 20% in 2013. The average dividend yield is 3.9%, with an average p/e of about 13, and a book value of 1.8 times, which is in line with the broader frontier market indices.

What to buy

The London-listed PXP Vietnam Fund (LSE: VNF) is one of my favourite plays. It trades at the tightest discount of all such Vietnam closed-end funds.

But as Mark Ambrose of investment bank Jefferies notes, it has a good track record, both in the short term (+38.4% in 2013 versus 25.5% for the main stock index) and in the long term (111.4% versus 58.1% over five years).

There's no real way to access local markets directly, but you could look at Vietnam's next-door neighbour, Cambodia. Clearly, there are huge differences between the two but if Vietnam picks up in the next few years, there's every reason to think Cambodia will accelerate even faster.

That's good news for Naga Corporation (OTC: NGCRF). You'll need a specialist broker to trade it (it's on the pink sheets' in the US). It's a great business that owns the NagaWorld casino complex in Phnom Penh. It's hugely profitable and yields just under 5%.

QatarMiddle Eastern emirate Qatar is already familiar to many British people its ruling family has made huge investments in the UK, buying up just about all of prime central London. But a steady stream of money is starting to flow in the opposite direction as investors wake up to the potential of this tiny state and its vast hydrocarbon reserves.

Qatar's autocratic rulers want to turn it into a regional trading centre, with a media quarter (home to Al Jazeera) and a stock exchange.

There aren't many people in Qatar, but the economic potential from liquefying then exporting its natural gas is colossal. It has the world's third-largest natural-gas reserves after Russia and Iran. That should feed through in a fairly direct manner into the local banking sector (which is robust, as you'd expect) and then into the wider commercial sector.

Qatar is already one of the world's fastest-growing economies. Real (after inflation) GDP growth came in at a compounded annual rate of 19.3% between 2008 and 2012.

It's incredibly exciting not that you'd guess to look at the local stock market. Until recently, it's been decidedly boring. But 2013 changed all that the local market rose by around 23% and most of the specialists I talk to reckon the next few years could be even better.

Local shares remain very reasonably valued, despite last year's jump.The market is trading on a 2014 p/e of 10.4 times, compared with 16 times for UAE, 13.6 times for Saudi Arabia and 12.5 times for frontier markets in general. The dividend yield is a generous 5.5%, helped by healthy payouts from the Emirates' lowly valued local banks.

It might be a good idea to get in before the local market is reclassified as an emerging (rather than frontier) market in May. That means the shares will instantly be in demand from the huge range of emerging-market index-tracking funds.

What to buy

There is a widely followed, London-listed fund that invests almost exclusively in Qatar the Qatar Investment Fund (LSE: QIF). It was originally launched in mid-2007, but fell out of favour in the early years, with the fund at one point trading at a 40% discount to net asset value (NAV). But this has narrowed sharply to 12% as the management has worked to generate investor interest.

KazakhstanCentral Asia, notably Kazakhstan, and to a lesser degree Mongolia, is worth watching. The former Soviet state of Kazakhstan is blessed with huge natural resources, and the economy also continues to benefit from strong domestic consumption: HSBC expects private consumption to grow by 9.0% in 2014, only marginally slower than in 2013.

The country has been in the news this week after the central bank devalued the currency, the tenge. This was largely in reaction to the recent slide in the rouble Russia is one of Kazakhstan's key trading partners.

The devaluation will make Kazakhstan more competitive and the local stock market reacted positively to the news as did Kazakh-related stocks elsewhere, as we'll see in just a moment.

Where Kazakhstan falls short is in its local governance'. President Nursultan Nazarbayev has a curious view of democracy, probably not helped by the fact that he first got the job as boss of the local communist party back in 1989.

There's also the fact that his daughter is being groomed for power, and the odd news that he wants to change the name of the country and drop the stan' bit at the end.

That said, investors have to accept that investing in central Asia will always be a tad challenging. Kazakhstan is probably (Mongolia excluded) the best of a bad bunch Nazarbayev, for all his faults, is neither criminally insane nor a notorious despot, unlike some of his peers in the region.

The big positive for Kazakhstan is that it is a natural resources powerhouse, which should benefit from any improvement in the eurozone's growth rate.

Up until the devaluation, local stock markets have also been hammered by negative sentiment to all things commodity-related, which means local companies trade at low levels, despite paying huge dividends and having relatively strong balance sheets.

What to buy

Central Asia is quite easy to access. Copper miner Kazakhmys (LSE: KAZ) shot up on the news of the tenge devaluation, but even so, it still looks cheap, and yields just under 4%. Obviously, this a cyclical business (China buys most of the company's copper), but it seems a great contrarian bet if you believe the world economy is going to pick up.

In terms of funds it might be worth looking at a US ETF provided by Global X that is called the Central Asia and Mongolia ETF (NYSE: AZIA).

This tracker fund looks for businesses listed in the West that access the wider Central Asia region, with holdings that include Dragon Oil (which operates in Turkmenistan) and one of my personal favourites, Bank of Georgia (LSE: BGEO), as well as big Kazakh businesses and even the odd Mongolian firm.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how