Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

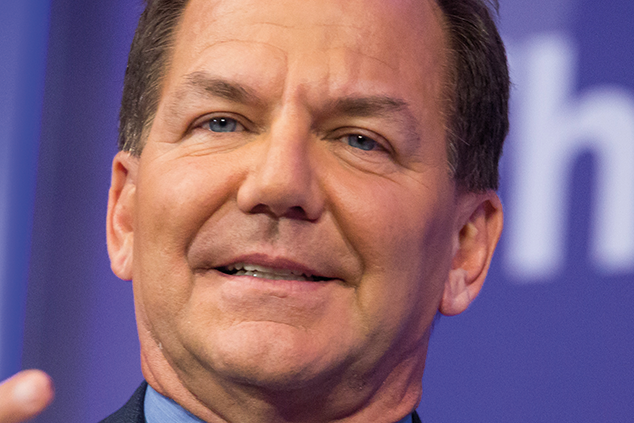

Lex Van Dam the former Goldman Sachs trader turned hedge-fund manager turned reality TV impresario "is not one to mince his words, says the FT. He paints the City as little more than a rip-off racket and decries "bogus" investment courses peddling "snake oil". Strong stuff.

Especially since Van Dam is hoping to profit from the public's appetite for "teach me how to get rich quick" courses he's just launched his online Trading Academy (at Lexvandam.com).

So is this urbane 42-year-old Dutchman setting himself up for a spectacular fall? Maybe not. Two things differentiate him from those he disparages. Firstly, he isn't promising to make people a fortune: the intention is to give them a drilling in the rules of trading (see below). Second, he has already shown he is prepared to put his money where his mouth is.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

As creator of BBC2's series Million Dollar Traders, he allowed eight novice traders to gamble with £500,000 of his own money for two months. That was after just a fortnight's training, in a kind of high-finance version of The Apprentice. His aim was to demystify the City and smash the myth that trading is only for the select few.

The one small problem with Van Dam's "otherwise valiant plan" was the global financial meltdown, says The Times.

He unleashed his guinea pigs including a former vet, a corner-shop owner, a single mother and an ex-soldier onto the market just as the world was caving in during the late summer of 2008. "It was the financial equivalent of giving a blind man the controls of a jumbo jet during extreme turbulence and telling him to land without damaging the plane." The mistakes were painful to watch. It was "difficult not to scream at the TV" when one contestant decided to plough money into Bradford & Bingley. And it was impossible not to sympathise with the panicking novices as they coped with

the meltdown of US mortgage giants Fannie Mae and Freddie Mac. Nonetheless, they vindicated Van Dam's theory by losing just 2% of the capital at stake. Over the same period the professionals lost over 4%.

Van Dam's own professional credentials are impeccable: educated in Holland, he holds a Masters degree in investment theory and econometrics. After arriving in Britain in 1992, he put in a ten-year stint as a trader with Goldman Sachs, before joining the hedge fund GLG Partners. These days, he runs his own fund, Hampstead Capital, from offices in Covent Garden. He also pursues a sideline in publishing his book How to Make Money Trading is a bestseller. Earnest, eager "and without that gloss of supreme self-confidence" you tend to see in City types, Van Dam is a model reformer, says The Daily Telegraph. Trading, he concludes, "is an extremely psychological business and most of the time it's more of a battle with yourself rather than with the market". His mission now is to spread "the right kind of Dutch courage".

Van Dam's five-step road to success

Call it the battle of the TV trading mentors, says The Sunday Telegraph. Van Dam's decision to set up a trading academy to empower the ordinary punter comes hot on the heels of another venture that of his erstwhile Goldman Sachs colleague and fellow TV star, Anton Kreil. In August he launched his own Institute of Trading and Portfolio Management.

So, "have the million dollar traders fallen out"?

They've certainly caught the zeitgeist, says Emma Wall in The Daily Telegraph. The move coincides with a rash of new funds notably, City stalwart Terry Smith's Fundsmith which purport to heal the "broken" fund management industry with a new low-fees philosophy and a greater emphasis on simpler investments. Smith compares his fund (which will invest in just 30 stocks held for the long-term, Warren Buffett-style) to Ryanair, the low-cost airline that revolutionised air travel.

And his manifesto is "a simple joy to read", says Alistair Blair in Investors Chronicle. "No performance fees. No initial fees. No redemption fees. No overtrading. No Leverage. No hedging. No derivatives."

Van Dam advocates that the educated investor should cut out the middle man altogether. "The UK stockmarket has done nothing for ten years. Yet those in the City pay themselves record bonuses... The City invents more and more complicated products. The one certainty is that you will not get the pension you expected," he told the FT. So what exactly will you get if you cough up £249 for his online material (with the offer of "follow up seminars" for those who stay the course)? It boils down to a five-step plan of idea generation, company and chart analysis, trading psychology and risk management. "There are three kinds of people," he says. "Those who let it happen, those who make it happen, and those who wonder what happened. My course will get you into the second category."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Paul Tudor Jones: stockmarket could go "crazy"

Paul Tudor Jones: stockmarket could go "crazy"Features Hedge fund manager Paul Tudor Jones, who predicted the October 1987 crash, believes the stockmarket will rally later this year, even in the face of tightening monetary policy.

-

Robert Rubin: The 'Teflon Don' of Wall Street

Profiles Robert Rubin was widely feted for America's impressive economic expansion during the Clinton years. But did the former US Treasury Secretary sow the seeds of the financial crisis?