Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

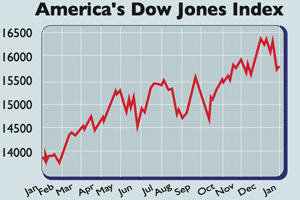

The US stock market hasn't seen a correction' of 10% or more since the summer of 2011. Now, having gained 50% since then, it seems to be taking a breather.

Last week, the Dow Jones index slid by 3.5%, its worst week since November 2011. The pan-European FTSE Eurofirst 300 index lost 3.25%, falling by 2.4% on Friday alone, the steepest one-day fall in seven months. Japan's Nikkei has hit a three-month low.

The turbulence stems from emerging markets, which have run into trouble because money is flowing out of risky assets as US monetary policy tightens.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Some emerging markets look especially vulnerable to money being pulled out, while there are several other problems afflicting various regions. There is even talk of another crisis.

That casts doubt on the outlook for global growth and developed-market profits, especially as the profits of large companies in many of the world's most important stock markets are now increasingly dependent on the world economy.

Firms in the FTSE 100 and Germany's Dax, for instance, make around 70% of their sales abroad. German exports to Brazil, Russia, India and China grew fivefold between 2000 and 2011. The slowdown in emerging markets helps to explain why profit warnings from FTSE 350 firms hit their highest level since 2008 last quarter.

On Wall Street, which sets the tone for world equities, the cyclically adjusted price-to-earnings ratio is over 25, a level that implies poor long-term returns.

Profits rose by just 8% last year, while the S&P gained 29%. Profit forecasts have fallen recently. "Earnings continue to disappoint," says Money.cnn.com. Profit growth has been reasonable "as opposed to spectacular". The trouble is that investors had priced in the latter.

For now at least, the wobble looks more like a repeat of the turbulence seen in summer 2012 than the start of something nastier. If it does escalate, the Federal Reserve, America's central bank, could always prop up markets by putting tapering on hold, giving easy-money-addicted markets another hit.

But having got a long way ahead of themselves last year, markets could face a bumpy 2014.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?