Buy into 'big data': the biggest upheaval since the industrial revolution

The collection of vast data pools is revolutionising everything from medicine to agriculture, and the firms at the forefront stand to profit, says David Thornton.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The collection of vast data pools is revolutionising everything from medicine to agriculture, and the firms at the forefront stand to profit, says David Thornton.

About ten years ago I found myself standing on a lawn with some of Britain's leading scientists. We had gathered at the Sanger Institute in Cambridge, where my wife was working, to celebrate the completion of the Human Genome Project. The mood was jubilant as we watched a spectacular fireworks display. It had been a long journey. The scientists had started out by decoding the genetic makeup of viruses. Even these simple entities can have more than 100,000 base pairs (the building blocks of the genome). A human being has rather more about three billion. To unravel a sequence on this scale within an acceptable margin of error took time, money and a completely new scale of computer-processing power. In all, it took 13 years and $3bn to complete the project.

So it's remarkable to me that today we can sequence an entire genome in just a few hours. And all of that information can be stored on a device the size of a USB key. With one of these devices, you can collect as much biological data in a day as my wife and her colleagues collected in a decade. That's extraordinary. As these devices find their way into hospitals and laboratories worldwide, it is creating a vast amount of raw information about the way diseases evolve and spread. That is potentially very useful, if it can be analysed.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A $47.8bn market by 2017

This is just one example of what has come to be known as big data' the collection and use of vast data pools to look at society on a scale that has never before been possible. It began with attempts to understand the genetic roots of major diseases. But as computer processing power has developed in the last decade, so has our ability to produce and collect vast torrents of data on just about anything.

Take your phone. From the moment you woke up this morning, you have left a trail of data behind you that has been collected and studied by strangers throughout the day. These strangers may know what news you read, what breakfast you bought, and the distance you travelled to work. We send emails, visit websites, place orders with Amazon and Tesco, and list items for sale on eBay. We post on Facebook and Twitter using phones and tablets that log our location wherever we go. Without us really appreciating it, our lives online are generating astounding volumes of data 90% of all the data in the world was produced in the last two years alone.

How useful is this information? Clearly, it varies. Until recently most of it would have just sat there in cyberspace, untapped and unused. But with today's massive computing power, companies are realising that they can harness this data to make smarter decisions that will enable them to stay ahead of the competition. That's why the likes of Amazon have been so eager to collect data on your spending habits.

"Firms are harnessing Big Data to stay ahead of the competition"

But it's not just retailers. Other industries are catching on. Agricultural giant Monsanto has paid $930m for The Climate Corporation. This is a big data start-up that specialises in monitoring weather patterns for crop farmers. The firm has collected 60 years' worth of crop-yield data and 14 terabytes of information on soil types for every two square miles of the US. (For perspective, a single terabyte hard drive can hold nearly 500 hours of broadcast-quality video.) Climate Corp matches that data with weather information and makes predictions about the impact on corn, soybean and wheat yields. It could be a huge leap forward for agriculture.

It's even catching on in sport. The Red Bull team was the first to adopt big datatechniques in Formula One it has dominated the sport ever since. And this season, most rugby clubs have dedicated themselves to recording their players' sleep patterns, immune systems and nutritional habits. Global positioning system (GPS) technology tracks players' movements in matches, with sensors even measuring the forces passing through their bodies from collisions and tackles. The speed with which this new technology is being adopted is remarkable. Technology sharing website Wikibon estimates the big datasector will grow in value by 33% a year between 2012 and 2017, from $11.4bn to $47.8bn. There are two areas in particular that look interesting from an investor's perspective.

Creating living maps

Geographic or spatial information is a huge part of the convenience of modern life. I'm sure you've used GPS to navigate unfamiliar cities. And you've no doubt used Google Maps to locate bars and restaurants closer to home. Compare this convenience to the ordinary paper map. When I hike in the countryside, I like to stick with tradition and use a trusty paper Ordnance Survey map. These are beautifully designed to indicate the most important geographic features as clearly as possible. But mountain rescue teams will tell you that this is still a poor substitute for a digital map.

Most mountain rescue helicopters are now equipped with a "Geographic Information System" (GIS) that has access to a big datadatabase holding information on thousands of past search and rescue missions. Say I got lost up a mountain in Snowdonia. As the rescue teams take off, the GIS could inform them that 66% of lost hikers in this region are found within two miles of the spot last seen. So they focus their efforts on this two-mile perimeter. Next, they would learn that 52% of lost hikers are found downhill and 32% up. So they would mark out an exclusion zone before checking the temperature, wind chill and exposure at that height. Then they could check the Twitter feeds of people who mentioned climbing that day, just as the system uses this information to narrow down my most probable location.

These digital maps are also being used by utilities to spot blackouts and to manage power, by insurers to assess flooding and hurricane risks, and even by police forces to assess crime risks. Broker N+1 Singer estimates that the geospatial market is currently around $5bn in size and is expected to double by 2015. One company in the sector looks particularly attractive. 1Spatial produces software that helps companies capture, manage, process and analyse large volumes of spatial data. These include national mapping agencies, utilities, defence agencies and government departments. The British Transport Police is a key customer. It uses 1Spatial software to respond rapidly to incidents on public transport, in a similar way to the rescue mission described above. This has reduced disruption to train services by creating an accurate location-based addressing system. The police can now locate an incident precisely and conclude their activity more rapidly within an average of 90 minutes from receiving a fatal incident report, according to IT consultant Bloor Research.

"The speed with which new technology is being adopted is remarkable"

The big prize, however, lies in applying geographic big data in the commercial sector. In the utilities sector the adoption of smart-grid' technologies to reduce or better manage electricity consumption is producing huge volumes of data on energy and resource consumption patterns. On the insurance side, monitoring demographic and geographic changes can reveal potential risks from natural disasters, theft and accidents, enabling better pricing of premiums. Monitoring claim patterns can also identify possible occurrences of fraud.

In healthcare, demographic analysis can also identify areas of demand for treatment across our major cities. Disease control can be managed by identifying the location of outbreaks and tracking them day-by-day to monitor the spread. Location information was a major part of the strategy the NHS used in response to the swine flu epidemic, ensuring a swift distribution of antiviral drugs to hospitals throughout the UK. That wasn't possible before.

Geospatial mapping is an immediate and exciting opportunity for investors. Below, I explain why I am very optimistic about 1Spatial's prospects over the next three years.

Driving the DNA boom

The second very real opportunity in big data is to buy the machines that are deciphering all of our biological information, or "bioinformatics". This is a story that has taken a long time to bear fruit for investors. The $3bn Genome Project began in 1990, the first draft of the human genome was published in 2000 and the project was declared complete in 2003. It represented a major international collaboration, spurred on by competition from the commercial sector. But there was little pay off for the companies involved.

The commercial element of all this has created controversy. Is it permissible, let alone ethical, to patent a gene sequence? Companies have tried to do this, but the law has tended to side against patenting naturally occurring genetic data. However, the good news is that this hasn't stopped work on genome technology. The cost of sequencing a genome has dropped to around $1,000 and looks set to fall as far as $100. This has freed researchers across the world to run gene association studies. That in turn is creating other commercial opportunities in the new treatments that are made possible, and in diagnostic tests that use gene sequencing. Genomics opens up the field of preventive medicine for example, if we can identify a genetic mutation in a specific person, associated with developing a particular cancer, then we can take pre-emptive action.

Actor Angelina Jolie raised awareness of this preventive approach when she revealed she had undergone a double mastectomy earlier this year. She had a family history of cancer and tests had revealed that she carried a defective gene, which gave her an 87% chance of developing breast cancer. If such tests are to be easily available to the wider population, they have to be simple and affordable. This is already happening.

Recently my colleague Tom Bulford took part in an experiment conducted by the Oxford BioBank. For a week, along with thousands of other men of a similar age, he wore a wristband that recorded his physical activity. He completed an online questionnaire about his general health, smoking, drinking and other habits. They also collected his DNA. The Oxford BioBank plans to use this data to study a number of different diseases and conditions, such as diabetes, obesity and heart disease.

Projects like this are happening worldwide as part of a movement that aims to cure the world's deadliest diseases. Below, Tom recommends one very exciting company that is central to these studies Qiagen. Qiagen provides devices that enable researchers and doctors to extract valuable molecular information from biological samples of blood, bone and tissue. Taking a small swab from the inside of your mouth, a doctor can feed the sample into a machine developed by Qiagen that extracts your DNA, sequences it in its entirety and looks for any mutations that might be associated with any type of cancer that runs in your family. Having spotted the mutations, the machine compares them with a vast database of known cancer cases and treatments, and prescribes the exact combination of drugs you should take. As Tom notes in his Biotech Alert letter, Qiagen has 500 core products that it sells to 500,000 customers in 80 countries.

The DNA sequencing company that most interests me, however, is Oxford Nanopore. I think this is one British company that could play an interesting role in opening up genome sequencing to the mass market. Its devices aim to be low cost, to work in real time and be portable. The company was founded in 2005 to commercialise nanopore technology developed in Oxford, Harvard and the University of California.

A nanopore is as the name suggests a very small hole. Very small in this context means a billionth of a metre in diameter, the size that allows single molecules to pass through. I'm going to get a bit technical here, but if you can ratchet a strand of DNA through an electrically charged nanopore, the current will be disrupted in such a way as to enable the identification of the nucleotide bases in sequence as they pass. The data can be read in real time, which allows analyses to be made immediately and the process to be stopped once the targeted information has been obtained. In other words, they've worked out how to sequence a genome a lot more efficiently and reliably than was previously possible.

Their new product is the MinION, introduced as a prototype last year. It is a single-use miniaturised device that ultimately will be not much bigger than a memory stick, and will also work by being plugged into a USB port in a laptop or PC. The target cost? Less than $1,000. The company now has a portfolio of over 300 patents and an exciting technology. It is now at that critical point where it has to make the transition from the research and development phase to the commercial world. I look at its prospects in more detail below.

The sixth revolution

Both spatial mapping and DNA sequencing offer great opportunities for investors. And I firmly believe that big data will have a huge impact on society as each industry wakes up to its promise.

However, big data is only a small part of a much bigger story. As devices proliferate across our economy, they will send back more and more information. That will allow us to control things that we've never controlled before. We've seen it happen to an extent already with utilities, which have used smart meters to improve the control of the electricity flow around the grid. That has reduced the threat of blackouts. And we will soon see it in healthcare as devices are used remotely to monitor patients with diabetes, heart disease, and hypertension in their homes.

As more and more of these devices are linked together, we will see the emergence of the 'internet of things' (one of the trends also identified by HSBC). This is a story that will play out over the next decade, and it's one that investors can't ignore. In Red Hot Penny Shares I've described it as a "sixth revolution". You can read more in my report here.

The three investments to buy into now

1Spatial (Aim: SPA) is your first great play on the big data story.Its expertise in the specialist field of geographic and spatial data is long-established, with high-profile customer relationships in place. These include national mapping agencies, utilities,defence agencies and government departments. The company's key product is its new 1Spatial Management Suite. This can be licensed by users as a complete suite, or separate modules can be taken from the seven that are available. The modules cover the entire mapping process: organising surveying jobs; entering data;editing and validating it; maintaining the database; and publishing maps to the users' requirements.

The company's flagship first customer is Ordnance Survey Ireland,which has just begun using virtually all the modules in this end-to-end mapping system. But in fact 17 out of the 37 largest national mapping organisations,covering every continent, are customers of 1Spatial. These national mapping agencies include those of Ireland, Great Britain, Brazil, Denmark, France, New Zealand,Mexico, South Africa and America. As a software company,1Spatial is operationally geared. As evidence of sales momentum builds over the year ahead, I expect the shares to do well. I rate this stock a buy' up to around 9p, with a target of 25p.

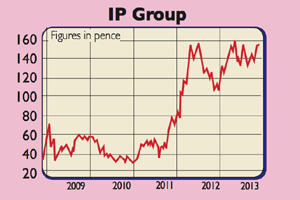

Then there is Oxford Nanopore. The company itself isn't quoted;but it is possible to get indirect exposure through main-market listed investment company IP Group (LSE: IPO), which owns a 20.3% stake, making it IP Group's biggest holding. This is a stock I own myself. IP Group uses its relationships with British universities to invest in intellectual property-based businesses that are spun out of academic research departments. It has formal agreements with 12 of our leading universities. IP Group has an extensive portfolio with holdings in 70 firms, and so far 15 of the businesses it has supported have gone on to list on the Alternative Investment Market (Aim). It would be wonderful to see Oxford Nano's MinION USB device in the marketplace. Although IPGroup has more than doubled in the last two years, it has tracked sideways for much of 2013. There should be more to come.

You should also look at Tom Bulford's favourite Big Data play Qiagen (Nasdaq: QGEN). As Tom notes in his Red Hot Biotech newsletter, "last year Qiagen, which is valued at $4.7bn, made sales of $1.25bn, recorded net income of $129m and had a free cash flow the financial acid test of $143m". Most of its money comes from selling consumable products. The steady income from this "allows it to invest in new instruments and tests that are devoted to one end automatically and cheaply to capture the vital molecular information that can help us beat disease".

Overall, says Tom, "Qiagen offers a way to invest in the broader long-term growth themes of genetic testing, biomarker identification and bioinformatics. While we cannot predict the therapies that may ultimately emerge out of this focus on diseases such as cancer, we can be certain that there will be an explosion of research as scientists use Next Generation Sequencing and other modern techniques to seek the root cause of cancer and other major diseases. With a 12-month target of $35,buy up to $25."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Thornton is a small cap share expert with over 30 years’ experience in the investment world. He was an equity fund manager at Henderson Global Investors for 17 years, and in 2006 he launched the Matrix New Europe Fund, investing in equities throughout Eastern Europe, Russia and Turkey.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.