Shares in focus: Do shopping centres have a future?

It’s tough on the high street, but Hammerson’s smart strategy could pay off. Should you buy the shares? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's tough on the high street, but Hammerson's smart strategy could pay off, says Phil Oakley.

The British love shopping, but making money out of selling stuff to them has always been very hard work. The country's high streets are being decimated by the change in people's shopping habits and the pressure on household budgets.

For many it's much more convenient and cheaper to stay at home and buy things with a click of a mouse rather than go through the rigmarole of heading out to the shops.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The plight of high-street retailers that have gone bust because of this seem to be constantly in the news. What's not mentioned as much, though, are the problems faced by landlords who have to try to fill empty shops and get the rental income coming in again.

Given this backdrop, why on earth would you want to consider investing in a company like Hammerson? It owns 20 shopping centres and 22 retail parks, which are currently valued at £5.7bn.

Like most of its peers, it was hit hard by the financial crisis but is now doing much better. But this is a company that has staked its future on the health of retailing in Britain and France two economies that are struggling to grow.

Is Hammerson just throwing good money after bad? Or will it succeed in carving out a profitable niche in a difficult market?

What to do with the shares now

While people are going out to the shops less than they used to and footfall on the high street and in shopping centres is going down, it seems that when people do venture out, many of them are prepared to spend. This trend has had big implications for the business models of retailers and property companies alike.

Retailers are focusing their investments on the shopping destinations people want to go to. These are the big, modern shopping centres and out-of-town retail parks that offer lots of high-quality shops, easy parking and other facilities, such as restaurants and cinemas. Consequently, tatty, tired shopping centres in secondary towns and cities are losing out.

This is good for companies such as Hammerson, which has invested in prominent shopping centres such as the Bullring in Birmingham and Brent Cross in London. It has also put money into designer retail villages elsewhere in Britain and France.

Hammerson has been very good at getting top-quality retailers to rent its shops over the last few years and this has consistently kept its occupancy rates above 97%. This has meant that the failure of other retailers has not caused it big problems.

As a result, Hammerson has been able to increase the rental income that it has been getting from the same space every year since 2009.

The company has big plans to keep on growing. A large shopping complex in Marseilles is nearly complete, while there are also plans for new destination shopping centres in Leeds and Croydon, and extra investment at Brent Cross. On top of this, other retail parks are being refurbished.

Hammerson's 22% stake in Value Retail, a provider of high-quality designer outlet villages in major European cities, has been good for shareholders so far and looks well placed to deliver more value to them in the future.

With a fair wind behind it, Hammerson looks well placed to meet its objective of growing its earnings by at least inflation plus 3% over the medium term.

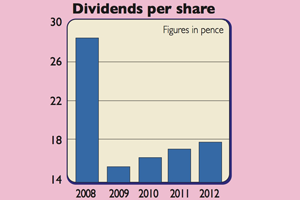

Given that the company is set up as a real estate investment trust (Reit), most of these profits will be paid out to shareholders to provide them with a growing income stream.

The shares aren't without risk, though. A downturn in the French and British economies would hit the company hard, as would a further big shift towards internet shopping. Rising interest rates would also be unwelcome.

This would probably lead to a reduction of the company's property portfolio as investors would ask for higher rental yields, while it may cause Hammerson's interest bill to increase a lot, given that it has some big chunks of debt to refinance over the next two to three years.

That said, the company's finances are not a cause for concern at the moment as its loans only account for 38% of the value of its properties. Paying the interest bill should not be too difficult either.

Assuming no big upwards surge in interest rates, I think the outlook for Hammerson appears quite reasonable. As long as it can keep on bringing the rents in, the shares are good value at current levels. A yield based on this year's expected dividend of 3.75% looks set to grow and is worth having.

On top of this, the shares trade at a discount to its current net asset value (NAV) per share of 551p. A recovering UK economy could see better times for the country's retailers and their landlords, which would mean that this discount would look increasingly unwarranted. New investments will see Hammerson's NAV continue to grow as well.

Retail property investing is not for the nervous, but buying Hammerson today could pay off over the next couple of years.

Verdict: buy

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how